Let's get straight to it. The real difference between a W2 employee and a 1099 contractor comes down to one simple concept: control. Who directs the work, and who carries the responsibility for taxes and benefits?

W2 vs. 1099: A Quick Breakdown

Deciding whether to bring someone on as a W2 employee or a 1099 contractor is a huge decision for any business. This choice goes way beyond just which tax form to use—it defines the entire working relationship and has major consequences for your finances, legal standing, and day-to-day operations.

A W2 employee is part of your team, plain and simple. You set their hours, give them the tools they need, and manage how they get the job done. In exchange, you handle all the payroll taxes, pony up for Social Security and Medicare, and usually offer benefits like health insurance and paid vacation. It’s a trade-off: you get more control, and they get stability.

On the flip side, a 1099 contractor is essentially their own business. They’re an independent expert you hire for a specific project or task. They use their own equipment, set their own methods, and are judged on the final result, not the process. This gives businesses incredible flexibility and access to specialized talent without the overhead costs. But the contractor is on the hook for their own self-employment taxes and benefits.

It's never about which option is "better." It's about which one legally and accurately describes the relationship. Getting this wrong and misclassifying a worker can bring the IRS down on you with some serious penalties, so you have to get it right from the start.

To help you see the differences clearly, let's break it down side-by-side.

Key Differences Between W2 Employees and 1099 Contractors

This table offers a clear, side-by-side view of the most important distinctions between W2 and 1099 worker classifications.

| Attribute | W2 Employee | 1099 Independent Contractor |

|---|---|---|

| Tax Withholding | The company withholds federal, state, and payroll (FICA) taxes from each paycheck. | The worker is responsible for paying their own self-employment taxes (both employee and employer portions of FICA). |

| Benefits | Typically eligible for company-sponsored health insurance, retirement plans (like a 401k), and paid time off. | Not eligible for company benefits. They have to find and fund their own insurance and retirement plans. |

| Control & Autonomy | The company dictates how, when, and where the work gets done. | The worker has significant control over their schedule, methods, and work location. |

| Tools & Equipment | The company provides the necessary tools, computer, software, and supplies. | The worker uses their own tools, equipment, and software to complete the job. |

| Payment Structure | Receives a consistent salary or hourly wage through the company's payroll system. | Submits invoices for work performed and gets paid per project, milestone, or on an hourly basis. |

As you can see, the lines are pretty distinct. One is an integrated team member, while the other is an external business partner. Understanding these core differences is the first step in making the right classification decision.

The Real Cost of Hiring: A Look at Taxes and Financials

Looking at a salary figure or an hourly rate only tells you part of the story. The true financial gap between a W-2 employee and a 1099 contractor is buried in the hidden costs—namely, taxes and benefits. What a business actually pays and what a worker actually takes home can be worlds apart depending on that classification.

For businesses, bringing on a W-2 employee means paying for more than just their salary. This is often called the "fully loaded" cost. It includes mandatory employer contributions that stack a significant percentage on top of the worker's gross pay.

On the flip side, when you hire a 1099 contractor, what you see is what you get, at least from the business's perspective. The agreed-upon rate is the full cost. For the contractor, though, that gross income is just the starting line before they have to deal with a hefty tax bill.

The Employer's Financial Burden

When a company hires a W-2 employee, they’re legally on the hook for several payroll taxes. These aren't just pulled from the employee's paycheck; they are an extra expense for the business.

These costs typically include:

- FICA Taxes: The employer has to pay 7.65% for Social Security and Medicare, which perfectly matches the amount withheld from the employee's check.

- Unemployment Taxes: Both federal (FUTA) and state (SUTA) unemployment taxes are paid by the employer. This is what funds the safety net for laid-off workers.

- Workers' Compensation Insurance: This is insurance, paid for by the employer, that covers employees if they get sick or injured on the job.

All told, these extra costs can easily tack on 25-30% to an employee's base salary. So, a $60,000 employee might really cost the business between $75,000 and $78,000 a year once you factor in these mandatory expenses.

The Contractor's Tax Reality

For a 1099 contractor, the financial situation is completely reversed. The business pays them their gross earnings, no deductions taken. This can look like a bigger paycheck at first glance, but the contractor is now responsible for the entire tax burden that an employer and employee would normally split.

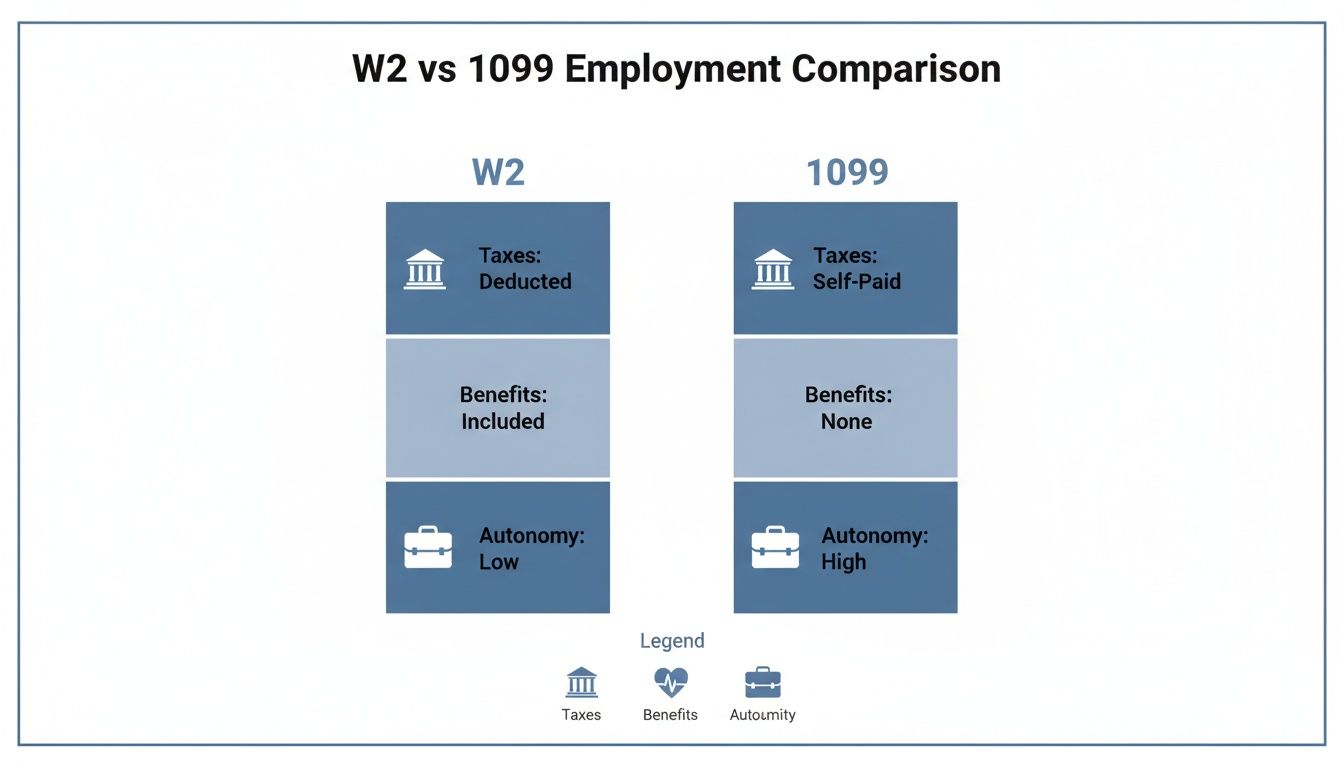

This chart breaks down some of the fundamental differences in taxes, benefits, and the freedom you have in your work.

As you can see, the tax situation and access to benefits are the biggest financial game-changers between the two.

The primary tax is the self-employment tax, which covers both the employer and employee shares of Social Security and Medicare. This is a massive dividing line: 1099 contractors are responsible for the full 15.3% on their net earnings, while W-2 workers only pay 7.65%, with their employer covering the rest.

This means a freelancer earning $100,000 gross has to set aside around $15,300 just for Social Security and Medicare, before even thinking about income taxes. It's why most experts recommend stashing away 25-30% of every single payment for quarterly estimated taxes using Form 1040-ES to stay out of trouble with the IRS.

A Side-by-Side Financial Scenario

Let's run the numbers to see how this all shakes out in the real world. We'll compare the total costs for a worker earning a base of $60,000 a year, using some basic estimates for things like unemployment insurance.

Cost Analysis Worker Earning $60,000 Annually

| Cost/Tax Item | Business Cost (W2) | Worker Cost (W2) | Business Cost (1099) | Worker Cost (1099) |

|---|---|---|---|---|

| Gross Pay / Contract Fee | $60,000 | N/A | $60,000 | N/A |

| Employer FICA Taxes (7.65%) | $4,590 | N/A | $0 | N/A |

| Unemployment/Workers Comp (Est.) | $1,800 | N/A | $0 | N/A |

| Self-Employment Tax (15.3%) | N/A | Withheld (7.65% or $4,590) | N/A | Paid (15.3% or ~$8,477)* |

| Total Business Cost | $66,390 | $60,000 | ||

| Worker's FICA/SE Tax | $4,590 | ~$8,477* |

Note: The 1099 worker can deduct one-half of their self-employment tax, which slightly reduces their taxable income. The figure here is a simplified estimate for comparison.

This table lays out the core financial trade-off perfectly. The business saves over $6,000 by classifying the worker as a 1099 contractor. But that same worker now has to shoulder nearly $4,000 in extra self-employment tax, not to mention the full cost of their own health insurance, retirement savings, and paid time off.

This is exactly why experienced 1099 contractors have to charge higher rates—they need to cover all those extra costs just to end up with a net income that’s on par with their W-2 counterparts.

Autonomy vs. Integration: Who Controls the Work?

Forget the balance sheets and tax forms for a second. The real heart of the W-2 vs. 1099 debate boils down to one simple question: who's in charge? The IRS cares a lot about this because the answer dictates how a worker is legally classified. It’s not about job titles or what your contract says; it’s about the reality of your day-to-day working relationship.

To cut through the confusion, the IRS uses a three-part framework to figure out how much control and independence a worker actually has. These categories—Behavioral Control, Financial Control, and the Relationship of the Parties—are the go-to tests for getting worker classification right. And trust me, this isn't just about good bookkeeping; it's a legal must.

Behavioral Control: The How and When

This test is all about whether the business has the right to direct how the worker does their job. We're not just talking about the final deliverable but the step-by-step process to get there.

You have to ask yourself:

- Instructions: Is the company giving detailed instructions on when, where, and how to work? A W-2 employee is generally told how to perform their duties, while a 1099 contractor brings their own methods to the table.

- Training: Does the company train the worker to do the job in a specific way? If a business is investing in training you on its particular methodology, that's a huge sign of an employer-employee relationship.

Think about a marketing agency that makes a writer attend daily stand-up meetings, use specific project management software, and follow a rigid style guide. That's a classic case of behavioral control and points straight to a W-2 classification.

Financial Control: The Business Side of Things

Financial control gets into the money side of the relationship. Who holds the purse strings? Who shoulders the financial risk? The IRS wants to know if the business directs the economic aspects of the worker's job.

Key factors here include:

- Investment: Does the worker have a significant investment in their own equipment? A 1099 contractor typically uses their own laptop, software, and tools. A W-2 employee is usually given everything they need.

- Expenses: Are business expenses reimbursed? Employees often get reimbursed for things like travel or office supplies. Contractors, on the other hand, usually just build those costs into their overall rate.

- Market Availability: Is the worker free to find other clients? A hallmark of a 1099 contractor is their ability to work for multiple companies at the same time.

A graphic designer who pays for their own Adobe Creative Cloud subscription, uses their own powerful computer, and actively markets their services to several different clients is showing clear financial independence. That’s a 1099 relationship through and through.

Relationship of the Parties: The Intent Behind It All

Finally, this part looks at how both the worker and the business see their relationship. Written contracts and the expected duration of the work often tell the story here. At the end of the day, control and autonomy are the defining elements. W-2 employees often get specific training and have their schedules dictated for roles core to the business. In contrast, 1099s typically call the shots on their own methods for project-based work, operating more like a business-to-business service. You can get more insights on the IRS tests for worker status.

This includes things like:

- Contracts: Is there a written contract? While not the final word, a contract stating it's an independent contractor relationship helps—but only if the actual work arrangement backs it up.

- Benefits: Does the worker get perks like health insurance, paid time off, or a retirement plan? Offering benefits is one of the strongest indicators of a W-2 employment relationship.

- Permanence: Is the work expected to be ongoing, with no end date in sight? Permanent roles lean toward an employee classification, whereas a relationship tied to a specific project deadline suggests a contractor.

Ultimately, no single factor decides it. The IRS looks at the whole picture, weighing all these elements to determine if someone is truly an integrated part of the business or an independent operator.

Weighing the Tradeoffs for Workers and Businesses

Deciding between hiring a W-2 employee and a 1099 contractor isn't about which is "better." It’s a strategic choice that hinges on your specific goals, the nature of the work, and the resources you have. Both setups come with their own set of pros and cons, and getting a handle on them is crucial for both the person doing the work and the business paying for it.

For individuals, it often comes down to the age-old tug-of-war: security versus freedom. The W-2 route is a well-paved road with a steady paycheck and a built-in safety net. On the flip side, the 1099 path is for the entrepreneur at heart—it offers incredible autonomy and earning potential, but you’re the one steering the ship and weathering the storms.

For a business, the calculation is just as nuanced. You're balancing the need for control and long-term team building against the desire for flexibility and leaner costs. The right answer depends entirely on whether a role is fundamental to your company's mission or if it's a job for a specialist on a specific project.

The Worker's Perspective: Stability vs. Flexibility

Let's be honest, the biggest draw of a W-2 job is predictability. There's a certain peace of mind that comes with knowing a paycheck will hit your bank account on the same day every month, with taxes already sorted out. Plus, employer-sponsored benefits—health insurance, 401(k) matching, paid time off—are huge financial perks that are a real headache (and expense) to set up on your own.

This kind of setup is perfect for anyone who values long-term security, enjoys being part of a team, and would rather focus on their actual job than on the nitty-gritty of running a business. A W-2 role gives you a clear path for advancement and access to company-funded training to grow your skills.

The 1099 lifestyle, on the other hand, is all about freedom. Independent contractors are their own bosses. They pick their projects, set their hours, and decide where and how they work. This level of autonomy is a massive incentive for seasoned experts who can charge top dollar for their skills. And while they give up the employer safety net, they unlock some serious tax advantages.

As a business owner, a 1099 contractor can deduct a wide range of business expenses—from a home office and software subscriptions to health insurance premiums—potentially lowering their overall tax burden. This is a critical financial lever unavailable to W2 employees.

The tradeoff is crystal clear. As a W-2 employee, you get security but trade some control and potential upside. As a 1099 contractor, you get freedom and tax perks but take on all the risk, pay for your own benefits, and are always on the hunt for the next gig.

The Business's Perspective: Control vs. Agility

From the company's point of view, the W-2 model is about building a core team for the long haul. When you hire an employee, you can immerse them in your company culture, train them on your specific systems, and keep valuable institutional knowledge in-house. That level of control is non-negotiable for essential business functions that need deep integration and ongoing commitment.

Yes, the true cost of a W-2 employee is significantly higher. Once you factor in payroll taxes, unemployment insurance, and benefits, you can easily add 25-30% on top of their base salary. But that investment often yields dividends in the form of loyalty, reliability, and a team that’s fully aligned with your business goals.

Hiring a 1099 contractor, however, gives you incredible agility and immediate cost savings. You can bring in highly specialized talent for a specific project without the long-term financial weight of a full-time hire. Need a website redesigned, a short-term marketing blitz, or an expert to fix a tricky IT problem? A contractor is perfect for that.

The financial upside is straightforward: you pay a set fee for a finished product, sidestepping all the overhead of payroll taxes, benefits, and equipment. This "plug-and-play" approach lets you scale your team up or down on a dime, reacting quickly to whatever the market throws at you.

Ultimately, the W-2 vs. 1099 decision comes down to the function of the role. If you need someone to handle a core, ongoing responsibility under your direct supervision, W-2 is the only way to go. If you need a specific expert to deliver a well-defined outcome with minimal hand-holding, a 1099 contractor is the smarter, more strategic choice.

The High Cost of Getting It Wrong

Choosing between a W-2 employee and a 1099 contractor might feel like just another box to check, but getting it wrong is one of the most dangerous financial mistakes a business can make. We’re not talking about a simple slap on the wrist. The consequences are a brutal cascade of penalties from the IRS, the Department of Labor, and state agencies that can put a company's future in serious jeopardy.

This isn't a gray area where you can just take your chances.

The IRS is actively cracking down on businesses that control a worker's schedule and workflow but pay them like a freelancer. With over 36% of the U.S. workforce freelancing in 2023, you can bet regulators are paying close attention. An audit can slam you with penalties of up to 40% of unpaid tax amounts, not to mention the back taxes and interest. You can dig deeper into these employee classification dynamics to see just how nuanced this gets.

The Financial Fallout of an Audit

When a business gets flagged for misclassification, the financial pain is immediate and deep. Regulators don't just ask you to fix the paperwork for the future; they hold you liable for everything you should have paid from day one.

Here’s what that looks like:

- Back Taxes: You’re suddenly on the hook for the employer's share of FICA taxes (7.65%) on every single dollar you paid that worker, potentially going back years.

- Withholding Liability: In some cases, you could even be held responsible for the employee's share of FICA and federal income taxes that were never withheld in the first place.

- Steep Penalties: The IRS has a whole menu of fines for failure to pay taxes, and they add up fast.

- Interest Payments: On top of all that, you'll be charged interest on the entire unpaid balance, which just pours salt in the wound.

A misclassification ruling isn't just about paying what you should have paid. It's about paying that amount plus a mountain of penalties and interest that can turn a cost-saving attempt into a massive, unplanned liability.

Beyond the IRS: Legal and Benefit Risks

And the pain doesn't stop with tax authorities. A misclassification ruling opens you up to a whole new world of legal trouble from the workers themselves, who were denied critical protections and benefits they were entitled to.

This legal exposure often leads to:

- Overtime Lawsuits: Misclassified workers can sue for unpaid overtime under the Fair Labor Standards Act (FLSA). If that person worked more than 40 hours a week, this can get incredibly expensive.

- Benefit Reimbursement: You might be forced to reimburse the worker for things like health insurance premiums or retirement plan contributions they missed out on.

- State-Level Penalties: States like New York and California have their own aggressive rules and pile on their own penalties, creating another layer of financial risk.

Let’s play this out. Imagine a small tech company pays a developer $90,000 a year as a 1099 contractor for two years. An audit reveals they were really an employee. Suddenly, that company could owe over $13,000 in back FICA taxes alone, plus thousands more in penalties, interest, and legal fees if the developer decides to sue.

What seemed like a savvy business move has now become a devastating financial blow. It’s a harsh lesson that correct classification isn't just a best practice—it's essential for survival.

A Simple Framework for Making Your Decision

Getting the W-2 vs. 1099 decision right is all about confidence. To make a choice that will stand up to scrutiny, you need to go beyond a basic pro/con list and really dig into how the IRS and state agencies see things. This framework will help you do just that—it’s a way to self-assess the situation and know when it’s time to call in a pro.

The best place to start is by asking the same kinds of questions an auditor would. The answers will reveal the true nature of the working relationship, which is all that really matters.

A Self-Assessment Checklist

Be honest as you run through these questions. The job title doesn't matter; it's the reality of the work that counts.

- Behavioral Control: Who's really calling the shots on how the work gets done? If the business provides detailed instructions, step-by-step processes, or specific methods, you're leaning heavily toward W-2.

- Financial Control: Who's paying for the essential tools, software, and equipment needed to do the job? If the business is supplying them, that’s a big checkmark in the W-2 column.

- Relationship Permanence: Is this a core, ongoing role with no defined end date? If the work is central to what the business does every day, that points straight to an employee classification.

- Training: Is the business training the worker on how to perform the job? Providing job-specific training is a classic sign of an employer-employee relationship.

Answering these gives you a solid gut check on how an agency would classify the role.

Think about it this way: A startup bringing on specialized coders for a six-month project is a perfect use case for 1099 contractors. But if a company hires a full-time marketing manager to run their daily campaigns, that person needs to be a W-2 employee to comply with labor laws and protect the company.

Situational Advice for Common Scenarios

Context is absolutely everything here. For a new startup, using 1099 contractors can be a lifesaver. It lets you tap into specialized skills without the heavy overhead of payroll taxes and benefits, giving you the flexibility to manage cash flow while you grow.

On the other hand, an established company filling a key operational role should almost always default to a W-2 employee. When a position is vital to your day-to-day business, the control, integration, and stability of a true employee relationship are non-negotiable. It’s the safest path to avoid misclassification risks and build a committed team.

At the end of the day, this framework is your starting point for navigating the w2 contractor vs 1099 contractor debate. If you go through this and still feel like you’re in a gray area, that’s your cue to get professional advice. At Blue Sage Tax & Accounting, we can give you the clarity you need to make the right call, every time.

Frequently Asked Questions

Digging into the W-2 vs. 1099 debate always brings up some practical, real-world questions. Let's tackle a few of the most common ones that businesses and workers run into.

Can You Switch a Worker From 1099 to W2?

Absolutely. In fact, it's a pretty common and often necessary move. A relationship might start out as a simple project-based gig, but as the company starts directing more of the contractor's work, that line gets blurry. At that point, making the switch to a W-2 employee isn't just an option—it's a legal requirement.

Making the change is more than just a little paperwork; it fundamentally alters the legal relationship. You'll need the worker to fill out a Form W-4 for their tax withholding and a Form I-9 to verify their employment eligibility. From there, you add them to your payroll, start withholding taxes, and stop paying them via 1099 invoices. Picking a clear, official transition date is crucial to make sure all tax, payroll, and benefits obligations are handled correctly from day one.

What Are the Key Tax Forms for Each Worker?

The paperwork is one of the biggest differences between the two, and knowing which form to use is the first step to staying compliant.

- For W-2 Employees: It all starts with the Form W-4, which they fill out when hired to tell you how much income tax to withhold. Every January, you'll give them a Form W-2 showing their total earnings and all taxes paid for the year. As the employer, you're responsible for filing Form 941 every quarter to report and pay your share of payroll taxes.

- For 1099 Contractors: When you bring them on, they'll give you a completed Form W-9. If you pay them $600 or more in a calendar year, you have to send them a Form 1099-NEC by the end of January. That form is what they'll use to report their income, and they are on the hook for making their own quarterly estimated tax payments using Form 1040-ES.

What Business Expenses Can a 1099 Contractor Deduct?

This is where being a 1099 contractor really shines. When you're a contractor, you're technically a business owner, which opens the door to a whole world of tax deductions that W-2 employees simply can't claim. These write-offs directly lower your taxable income, which is one of the biggest financial perks of self-employment.

The golden rule here is that any expense considered "ordinary and necessary" for your business is fair game for a deduction. This is a massive advantage for reducing what you owe the IRS, but it demands that you keep flawless records.

Some of the most common write-offs include:

- The home office deduction

- Business mileage (every single trip counts!)

- Software, subscriptions, and tools needed for your work

- Courses, certifications, and other professional development

- Health insurance premiums

Contractors tally up all their income and expenses on a Schedule C (Form 1040), which gets filed with their personal tax return. I can't stress this enough: tracking every single expense meticulously isn't just a good idea—it's essential for getting the most out of these benefits and backing yourself up if the IRS ever comes knocking.

The details of worker classification can feel overwhelming, but getting it right is fundamental to your financial health. If you need an expert to look at your specific situation, the team at Blue Sage Tax & Accounting Inc. is here to offer clear, strategic advice. You can explore our accounting and tax services to learn more.