Think of your general accountant as the person who keeps your financial books in order. They’re essential for day-to-day operations. But a real estate tax accountant? They’re the architect of your financial future. This isn't just about filing taxes; it's about building a strategic framework to grow your wealth, using the complex real estate tax code as a blueprint.

Their entire purpose is to navigate the maze of property-specific regulations to actively lower your tax liability, manage risk, and ultimately, help your portfolio grow faster. They turn confusing tax laws into tangible financial gains.

Why a Specialist Real EState Tax Accountant Is Your Best Investment

You wouldn't ask a general contractor to engineer the foundation for a skyscraper, right? The stakes are too high. The physics are too complex. The same logic applies directly to your real estate portfolio, especially in a fiercely competitive market like New York City.

A general accountant can certainly handle your basic bookkeeping and file your annual returns. But they simply don't have the deep, niche expertise to build a tax strategy that can withstand the pressures and capitalize on the opportunities unique to real estate. That's where the specialist comes in. They are the structural engineers for your investments, with a profound understanding of everything from advanced depreciation strategies to the maddening complexities of state and local tax (SALT) laws.

General Accountant vs Real Estate Tax Specialist

To really understand the difference, it helps to see it side-by-side. The gap between a generalist and a specialist isn't just a small detail; it represents a fundamental difference in strategy, execution, and financial outcome.

| Area of Focus | General Accountant | Real Estate Tax Accountant | Impact on Your Portfolio |

|---|---|---|---|

| Service Scope | Broad financial reporting, payroll, basic tax filing for various industries. | Deep focus on property transactions, cost segregation, 1031 exchanges, and passive activity loss rules. | A specialist uncovers savings and opportunities a generalist would miss. |

| Tax Strategy | Primarily focused on compliance and historical reporting. | Proactive and forward-looking, structuring deals to minimize future tax hits. | Moves you from a defensive, reactive tax position to an offensive, strategic one. |

| Entity Structuring | Basic advice on LLCs or S-Corps. | In-depth analysis of partnership agreements, waterfall distributions, and asset protection. | Optimizes your structure for both tax efficiency and long-term liability protection. |

| Market Knowledge | General understanding of business tax law. | Expert knowledge of real estate market cycles, local tax incentives, and investor-specific regulations. | Aligns your tax strategy with real-world market conditions for better returns. |

Ultimately, a generalist helps you report what happened last year. A specialist helps you shape what will happen over the next decade.

The Specialist Advantage in Action

This isn't just a theoretical distinction—it has a real, measurable impact on your bottom line. A dedicated real estate CPA does more than just keep you compliant. They’re constantly hunting for opportunities that are invisible to anyone without their specific training.

Their entire practice is built around the unique challenges property investors face:

- Strategic Entity Selection: They’ll guide you to the right structure—whether it's an LLC, S-Corp, or a complex partnership—to shield your assets and slash your tax exposure right from the start.

- Advanced Depreciation Tactics: They use powerful tools like cost segregation studies to accelerate depreciation, which can significantly boost your cash flow in the early years of an investment.

- Capital Gains Deferral: They expertly structure 1031 exchanges, allowing you to roll gains from one property into another without getting hit with a massive tax bill, letting your capital compound and grow.

- Proactive Risk Mitigation: They ensure every deal is buttoned up, structured to defend against audits and protect you from unexpected financial traps.

A specialist doesn't just record history; they help you write it. Their role is to transform the tax code from a burden into a strategic tool for wealth creation, ensuring your financial foundation is strong enough to support your ambitions.

The accounting industry is vast, and with tax laws constantly shifting, specialization has never been more important. A focused real estate tax accountant can often cut an investor's tax burden by 15-30% annually through sophisticated strategies that simply aren't in a generalist's playbook. You can get a sense of the industry's scale from recent industry analyses.

When you hire an expert, you’re not just paying for a service. You’re making a smart, calculated investment in the long-term health and profitability of your portfolio.

The Core Services That Build and Protect Your Wealth

Real wealth in real estate isn’t just about the properties you buy; it's about how you manage the entire financial ecosystem around them. A specialist real estate tax accountant goes far beyond just filing your taxes at the end of the year. They offer a core set of services designed to actively grow your portfolio and shield your net worth. Think of these services less as a simple checklist and more as a connected toolkit for smart financial growth.

This proactive approach is what separates investors who just happen to own property from those who are truly building lasting wealth. It’s the difference between reacting to a surprise tax bill and architecting a financial structure that minimizes your tax burden from day one.

Strategic Entity Selection

One of the very first decisions you’ll make—and one of the most critical—is how to legally hold your properties. This single choice sends ripples through your financial life for years, affecting everything from your tax bill to your personal liability. A specialist accountant brings the foresight needed to get this right from the start. It’s far more involved than just picking "LLC" from an online menu.

The right structure acts as both a financial firewall and a tax-optimization engine.

- Limited Liability Company (LLC): This is the go-to for many investors. It offers a powerful shield for your personal assets and gives you flexibility in how your income is taxed.

- S-Corporation (S-Corp): If you have significant portfolio income, an S-Corp can unlock potential savings on self-employment taxes. It does come with more formal operating rules, but the savings can be substantial.

- Partnerships: Absolutely essential for joint ventures. These demand carefully written agreements that spell out how profits, losses, and cash distributions are handled to ensure tax efficiency and keep all partners on the same page.

Getting this wrong can lead to huge, unnecessary tax bills and leave your personal wealth exposed to business risks. A real estate tax accountant dives into your portfolio size, your tolerance for risk, and your long-term ambitions to map out the ideal structure for you.

Advanced Depreciation Strategies

Depreciation is hands-down one of the most powerful tax benefits available to real estate investors. It allows you to deduct a portion of your property's cost each year, but the standard approach barely scratches the surface. Advanced strategies can unlock far more value and give your cash flow a serious boost.

Cost Segregation Study: This is where the real magic happens. It’s an engineering-based analysis that breaks a property down into its individual components. Instead of depreciating the entire building over a slow 27.5 or 39 years, you can reclassify things like carpeting, light fixtures, and landscaping into much shorter depreciation schedules—think 5, 7, or 15 years.

This strategy front-loads your tax deductions, putting a lot more money back into your pocket right now. And with tax laws constantly changing bonus depreciation rules, having an expert who can maximize these benefits in real-time is a massive advantage. A solid cost segregation study can often increase your near-term cash flow by 5-10% of the building's total cost.

Tax-Deferred 1031 Exchanges

As your portfolio matures, selling a successful property can trigger a painful capital gains tax bill, eating away at the equity you’ve worked so hard to build. The Section 1031 exchange is the cornerstone strategy we use to defer those taxes, potentially forever. It allows you to sell an investment property and roll all of the proceeds into a new "like-kind" property, kicking the tax can down the road.

Imagine you sell a multi-family in Brooklyn for a big profit. Instead of writing a huge check to the IRS, a 1031 exchange lets you take that entire sale amount and use it to buy a commercial building in Queens or even a whole portfolio of rental homes.

This tool is incredibly powerful because it lets your capital compound without being chipped away by taxes after every transaction. The catch? The rules are notoriously strict. You have just 45 days to identify a replacement property and only 180 days to close the deal. An experienced accountant is your guide through this minefield, making sure you navigate the process flawlessly and keep every dollar working for you.

Diving Deeper: Advanced Real Estate Tax Strategies

Once you’ve got your entity structure and depreciation schedules dialed in, you’re ready for the next level. This is where the game really changes for serious real estate investors. We're moving beyond the fundamentals into more complex, high-impact strategies that can dramatically accelerate wealth creation and preservation.

These aren't boilerplate tactics you can pull from a textbook. They require a deep understanding of the tax code's nuances and, frankly, a bit of creative thinking. This is precisely where a specialist real estate tax accountant proves their worth, turning dense regulations into powerful financial levers.

Turning "Paper Losses" into Real-World Tax Savings

One of the biggest frustrations for real estate investors is seeing huge "paper losses" from depreciation that they can't actually use. The IRS generally classifies rental income as "passive." This means any losses from your rental properties can typically only offset other passive income. If you don't have other passive gains, those valuable deductions are effectively stuck in limbo.

This is where we get strategic with the Passive Activity Loss (PAL) rules.

The ultimate goal here is to reclassify your real estate work from "passive" to "active" in the eyes of the IRS. If you can pull this off, you can use your real estate losses to offset your active income—like your salary from a day job or profits from an operating business. The savings can be staggering.

To unlock this powerful advantage, you need to qualify for Real Estate Professional Status. This isn't just a fancy title; it's a specific tax designation with very strict hurdles. Proving you meet the criteria is all about documentation, and an experienced accountant is your guide.

- The 50% Test: You have to prove that more than half of your total working hours are spent in real property trades or businesses.

- The 750-Hour Test: You must spend more than 750 hours a year working in real estate activities where you "materially participate."

Meticulous, real-time record-keeping is non-negotiable. We work with clients to build a defensible case from day one, helping them structure their time and maintain the contemporaneous logs needed to stand up to any IRS scrutiny.

Taming the Multi-State Tax Beast

As your portfolio grows, you'll likely start buying properties across state lines. Suddenly, you're not just dealing with the IRS. An investor with assets in New York, New Jersey, and Florida now has to navigate three completely different sets of tax laws, filing requirements, and deadlines. It’s a massive compliance headache waiting to happen.

Making matters worse is the federal State and Local Tax (SALT) deduction cap. This rule limits your deduction for all state and local taxes—property, income, sales—to a paltry $10,000 per year. For investors in high-tax states like New York, this cap can feel like a direct hit to the bottom line.

A sharp real estate accountant doesn’t just accept this. We use specific entity structures and elections—like the Pass-Through Entity Tax (PTET)—to work around the individual SALT cap. This allows the business entity to pay the state tax, creating a federal deduction that isn't subject to the $10,000 limit. It’s a sophisticated maneuver, but it’s incredibly effective.

The Art of Partnership Tax Structures

For developers, syndicators, and anyone pooling capital for a large project, the partnership is king. But the tax engineering inside that partnership agreement is where fortunes are made or lost. Two areas that demand true expertise are carried interest and special allocations.

- Carried Interest: Think of this as the sponsor's performance bonus—their share of the deal's profits. For years, the major advantage was having this "carry" taxed at lower long-term capital gains rates instead of much higher ordinary income rates. Preserving this benefit now requires careful planning around holding periods and fund structure.

- Special Allocations: A well-drafted partnership agreement is a thing of beauty. It can be designed to send specific tax benefits to the partners who can use them most. For instance, we might allocate the lion's share of depreciation deductions to a high-income partner, while another partner who needs cash flow gets a preferred return.

These arrangements aren't a free-for-all; they must have what the IRS calls "substantial economic effect." This is a complex test to ensure the tax benefits match the real-world economics of the deal. Structuring these agreements to be both tax-efficient and audit-proof is one of the highest forms of the craft. It's what separates a good tax preparer from a great real estate tax advisor.

What's the Real ROI of a Specialist Accountant?

It's easy to talk about theoretical benefits, but when you're considering a top-tier real estate tax accountant, it all boils down to one simple question: what’s my return on this investment? The answer isn't just about staying compliant; it's about seeing measurable increases in your cash flow, net worth, and the speed at which your portfolio grows. A true specialist stops being a line-item expense and becomes a profit center for your business.

The financial impact isn't trivial. Expert real estate accounting can deliver powerful returns, with leading firms often cutting their clients' annual tax bills by 15-30%. A single, focused strategy like a cost segregation study can generate a 5-15x return on its fee just by accelerating depreciation. For operators with serious portfolios, investing in a dedicated tax partner frequently yields returns of 3-5x through a combination of direct tax savings and smarter, data-driven financial decisions. You can explore a deeper analysis of the ROI of specialized accounting on MadrasAccountancy.com.

A New York City Case Vignette

Let's make this real. Consider a common scenario for a successful NYC real estate investor we'll call Alex.

Alex owns a portfolio of five multi-family properties across Brooklyn and Queens, worth about $25 million. For years, he’d used a general accountant who was great at filing on time. But Alex couldn't shake the feeling that his tax bills were eating him alive. His cash flow was perpetually tight, which put a hard ceiling on his ability to acquire new properties. He was playing defense, not offense.

The Situation Before an Expert Stepped In:

- Crushing Tax Bills: Alex was getting hammered by a combination of federal, state, and city taxes, with the SALT cap adding insult to injury.

- Painfully Slow Depreciation: His properties were all on the standard 27.5-year depreciation schedule, offering minimal tax relief each year.

- Inefficient Debt: His mortgages were structured for the bank's benefit, not his. He wasn't getting the most out of his interest deductions.

The Strategic Shift and the Results

Once Alex brought in a real estate tax specialist, the conversation immediately changed from "Did we file?" to "How do we build wealth?" The new firm got to work, implementing a few key strategies designed to restructure his finances and unlock the value trapped inside his portfolio.

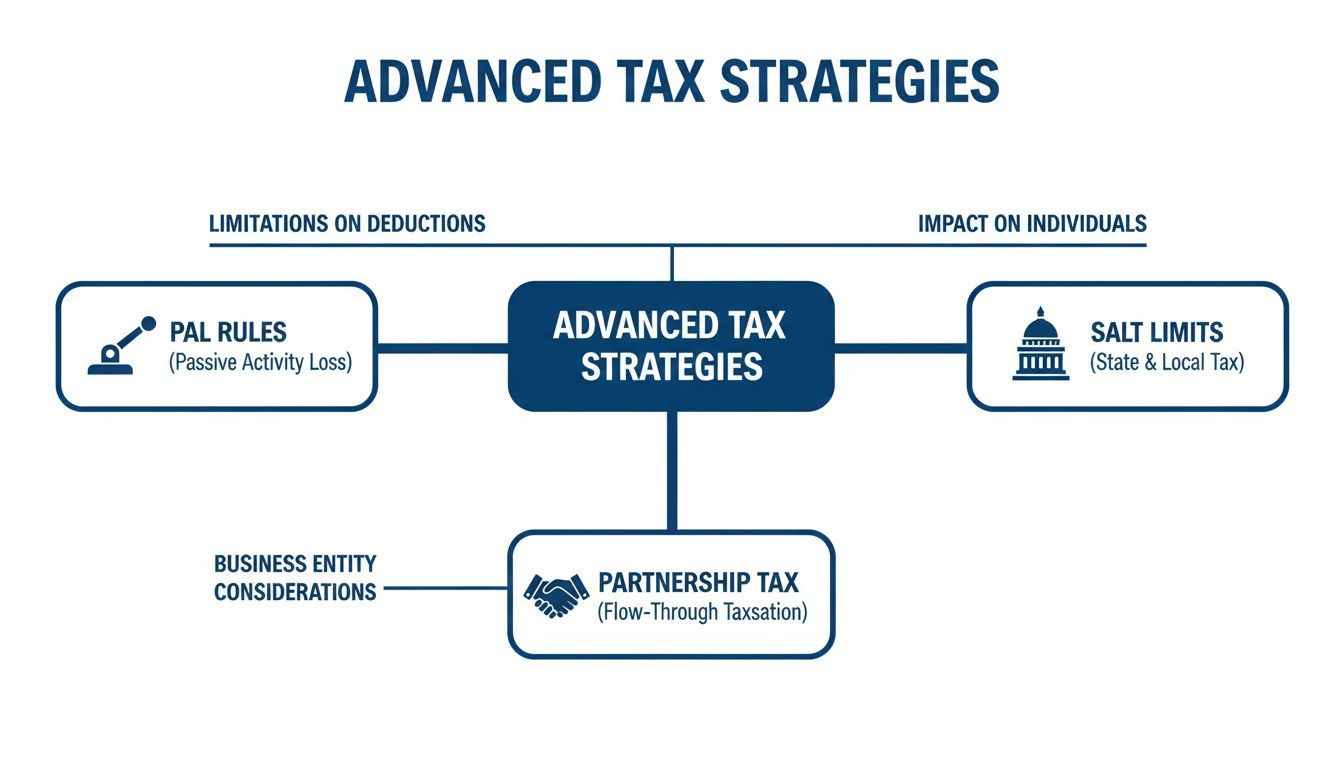

The diagram below gives you a glimpse into the kind of advanced thinking that specialists bring to the table.

This isn't just about plugging numbers into a form. It’s about navigating the tricky waters of Passive Activity Loss (PAL) rules, finding clever ways around the State and Local Tax (SALT) limits, and mastering complex partnership structures to drive better financial outcomes.

For Alex, the turnaround was both dramatic and immediate.

- Cost Segregation Study: The team performed a study on two of his largest properties, which allowed them to reclassify $2.5 million of assets into much shorter five and seven-year depreciation schedules.

- Entity Restructuring: By making a simple Pass-Through Entity Tax (PTET) election, they sidestepped the $10,000 SALT deduction cap, instantly creating a huge federal deduction.

- Strategic Refinancing: The accountant worked directly with Alex's lender to refinance two buildings. This pulled out tax-free equity for his next acquisition and restructured the debt to maximize his interest deductions.

The bottom line? In the very first year, Alex saved over $275,000 in taxes. This wasn't just found money; it was a game-changer. The savings covered the accountant's fees many times over and provided the down payment for his next property, directly fueling his growth. Alex's story makes it clear: the right accountant isn't an expense—they're an investment that pays for itself.

How to Select the Right Financial Partner

Choosing a real estate tax accountant isn't just about hiring someone to file paperwork. Think of it more like bringing on a long-term business partner. This decision will directly shape your portfolio’s growth and financial health for years to come.

The right professional doesn't just record history; they help you write a more profitable future. They do this by turning the dense, complex tax code into a clear, actionable strategy. That’s why your selection process needs to be thoughtful and focused. Look past generic accounting credentials and find a partner with a deep, proven specialization in the real estate world. Their expertise should be obvious, not just another bullet point on a long list of industries they serve.

Key Vetting Criteria

When you’re vetting a potential real estate tax accountant, your focus should boil down to three things: specialized expertise, local market fluency, and their tech stack. These pillars ensure the advice you get is not only technically sound but actually relevant to what you’re doing on the ground.

A firm that truly gets real estate will have dedicated teams for it and can point to a string of successes with clients just like you.

Proven Industry Specialization: Do they live and breathe real estate tax? Ask for real-world examples of how they've helped investors with cost segregation studies, tricky 1031 exchanges, or navigating the Passive Activity Loss rules. Their answers should be specific and show a real command of the subject.

Deep Local Market Knowledge: Real estate is an intensely local game. An accountant who knows the New York City regulatory landscape inside and out will understand the nuances of local property taxes, transfer taxes, and specific city-level incentives that a generalist would almost certainly miss.

Technological Proficiency: Modern accounting runs on efficiency. Your accountant should be using advanced software for tax modeling, projections, and secure client communication. This frees them from getting bogged down in manual tasks so they can focus on high-value strategic advice.

It’s a bigger deal than you might think. In commercial real estate, a staggering 43% of firms say manual admin work is their biggest headache, with teams wasting nearly 14 hours a month on data entry. An accountant who embraces technology automates these tasks, making sure their time is spent on your strategy, not on clerical work. You can dig into the data in the latest commercial real estate accounting reports.

Powerful Interview Questions to Ask

Once you have a shortlist, it’s time to dig in. Get past the surface-level stuff and start posing scenarios that really test their proactive and strategic thinking. How they respond will tell you everything you need to know about their depth of expertise.

Here are a few questions designed to separate a true advisor from a simple tax preparer:

- "Looking at my portfolio of NYC multi-family properties, what are the top three tax planning strategies you'd want us to explore in the first 90 days?"

- "Walk me through a complex 1031 exchange you handled that hit a snag. How did you get it back on track to a successful outcome for your client?"

- "How do you help clients stay ahead of their tax liability during the year, instead of just scrambling when the deadline is near?"

- "What’s your process for helping an investor figure out if they qualify for Real Estate Professional Status to unlock those loss deductions?"

Listen for answers that are detailed, confident, and feel like they’re being tailored to you on the spot. If you get vague or canned responses, that’s a major red flag.

Understanding Common Fee Structures

Finally, let's talk about money. It's crucial to understand how you’ll be billed, and transparency here is the mark of a trustworthy partner. Most specialized firms use one of three main models, and each has its pros and cons for real estate investors.

Choosing a fee structure is about aligning incentives. The right model ensures your accountant is rewarded for delivering value and proactive advice, not just for the hours they spend on your account.

Hourly Billing: This one is straightforward—you pay for the time they spend on your work. The downside is that it can sometimes discourage you from picking up the phone with a quick question for fear of "running up the clock."

Fixed-Fee Engagements: You get a set price for a clearly defined scope of work, like your annual tax prep and compliance filings. This gives you cost certainty and makes budgeting a breeze.

Value-Based Pricing: Here, the fee is based on the value and financial outcomes the accountant delivers. This model really fosters a true partnership, because their success is directly tied to yours.

Make sure to discuss these options openly. A quality firm will take the time to help you choose the structure that makes the most sense for your portfolio and your long-term goals.

Where Do You Go From Here?

It’s one thing to acquire properties, but it’s another thing entirely to build a durable financial engine that powers long-term growth. We’ve covered a lot of ground in this guide, but the central takeaway is this: a specialist real estate tax accountant isn't just another expense. They are a high-return investment in your portfolio's future, shifting you from defense to offense.

This is about moving away from the frantic, year-end scramble to file taxes. Instead, you adopt a proactive, year-round strategy. The right partner isn't just looking in the rearview mirror at what you earned last year; they're looking ahead, helping you structure the next deal, optimize your cash flow, and plan for a tax-efficient exit down the road.

A Partner, Not Just a Preparer

A modern advisory relationship is built on precision. Using sophisticated modeling and projection tools, a good accountant can map out the tax implications of a decision before you ever make it. This gives you the clarity to act with confidence, turning tax planning from a chore into a powerful strategic advantage.

The core idea is simple: Your tax strategy should actively serve your investment goals. It should be a living plan that adapts to new opportunities, market shifts, and changes in the tax code, making sure your capital is always working for you.

This forward-looking approach is what separates a portfolio that just gets by from one that generates exceptional, legacy-building wealth.

Building Your Strategic Roadmap

Ready to put this all into practice? The next step is moving from theory to a personalized action plan. A focused consultation can uncover immediate opportunities for tax savings within your current portfolio and create a smarter framework for future acquisitions.

Your financial goals deserve a strategy that's just as ambitious.

- Schedule a Consultation: Let's have a real conversation about your unique portfolio, your current holdings, and where you want to be in five, ten, or twenty years.

- Identify Key Opportunities: We'll dive into your specifics and pinpoint the biggest areas for improvement—whether it's entity structure, depreciation, or something else entirely.

- Build a Proactive Plan: Together, we’ll craft a year-round roadmap to minimize your tax liability and maximize your growth.

Take the first step toward a more profitable future. Contact the team at Blue Sage today and let's build a tax strategy that matches your ambition.

Frequently Asked Questions

When you're navigating the complexities of real estate investing, questions are bound to come up. Here are some straightforward answers to the things we hear most often from investors like you.

When Is the Best Time to Bring in a Specialist?

Honestly? The ideal time is before you even close on your first major property. Getting an expert involved from the very beginning allows us to help you set up the right ownership structure and plan the purchase in a way that can save you a tremendous amount in taxes down the road. It's about building a tax-efficient foundation from day one.

But don't worry if you're already well on your way. It's never too late to optimize. If you have an existing portfolio, we can come in, take a hard look at your current setup, and find immediate ways to improve things—whether that's through a deep dive into your depreciation schedules, a cost segregation study, or crafting a smart exit strategy for a future sale.

How Is a Real estate tax Accountant Different From My Property Manager?

This is a great question, and it's easy to get the two confused. They are both critical to your success, but their roles are completely different and, ideally, work in tandem.

A property manager is your on-the-ground operator. They live and breathe the day-to-day of a single building—collecting rent, dealing with leaky faucets, finding good tenants, and generally keeping the property running smoothly.

A real estate tax accountant takes a 10,000-foot view of your entire financial picture. We’re focused on the high-level strategy for your whole portfolio, ensuring you’re compliant but also minimizing your tax burden across all your assets. We're the ones you call to structure a complex 1031 exchange or model the financial impact of a new acquisition.

Think of it like this: your property manager is the captain keeping the ship in top shape, while we’re the navigator charting the most profitable course to your destination.

What Kind of Technology Should a Modern Firm Be Using?

In today's market, a firm's tech stack is a dead giveaway of how efficient and forward-thinking they are. The right technology automates the tedious stuff, freeing up brainpower for the high-level strategy that actually makes you money.

A firm’s commitment to technology isn't just about bells and whistles. It’s a direct reflection of their ability to give you the real-time financial clarity you need to make smart decisions. It shows they’re focused on accuracy, security, and strategic advice, not getting lost in a sea of spreadsheets.

At a minimum, you should be looking for:

- Industry-Specific Accounting Software: Deep experience with real estate platforms like Yardi, RealPage, or AppFolio.

- Sophisticated Tax Modeling Tools: The ability to forecast the precise tax consequences of a sale, purchase, or refinance before you pull the trigger.

- A Secure Client Portal: A simple, encrypted way to exchange sensitive documents and communicate instantly, without worrying about security.

Being proficient with these tools isn't a bonus anymore—it's table stakes for providing the kind of proactive advice serious investors demand.

Your portfolio's financial health is far too important to be an afterthought. At Blue Sage Tax & Accounting Inc., we bring the specialized expertise needed to turn your tax strategy into a powerful engine for growth. Schedule your strategic consultation today and let's get started.