If you're running your own business, working as a freelancer, or earning significant investment income, you know the IRS expects its cut throughout the year, not just on Tax Day. They call it a "pay-as-you-go" system. This means you can't just wait until April to figure out what you owe. A solid quarterly estimated tax calculator is the tool you need to get these payments right and avoid any nasty surprises.

Why You Need to Pay Quarterly Estimated Taxes

Think about a typical W-2 job. Your employer handles withholding taxes from every paycheck and sends it to the IRS for you. But when you're the boss, that responsibility falls squarely on your shoulders. You have to be your own payroll department.

This system is really about two things: ensuring the government has a steady stream of revenue to operate and, just as importantly, preventing you from facing a crippling tax bill in April. The whole idea is to pay tax as you earn your income.

If you ignore this, you'll likely face an underpayment penalty. It's basically the IRS charging you interest on the money you should have paid earlier. The rule of thumb is pretty clear: if you anticipate owing at least $1,000 in federal tax for the year (after accounting for any withholding or credits), you'll need to make estimated tax payments.

Who Is Required to Pay

This isn't just for a niche group of high-earners. The net for quarterly estimated taxes is wide, catching anyone with substantial income that isn't already subject to withholding.

You’ll most likely need to make these payments if you are a:

- Self-Employed Individual: This is the big one. Freelancers, gig workers, and independent contractors who get 1099s instead of W-2s are prime candidates.

- Business Owner: If you're a sole proprietor, a partner in a partnership, or an S corp shareholder, you're responsible for paying taxes on your slice of the business's income.

- Investor: Earning money from dividends, interest, or capital gains? If there's no withholding, you'll need to account for it.

- Landlord: The income you generate from rental properties absolutely counts toward your estimated tax liability.

The Scale of Estimated Tax Payments

Making these quarterly payments isn't some obscure corner of the tax code; it's a core component for millions of Americans. In fact, IRS data shows that over 40 million individual income tax returns reported making estimated tax payments. That gives you a sense of just how common this is. For a deeper dive into compliance trends, you can explore more historical data on the official IRS statistics page.

Key Takeaway: Don't think of quarterly estimated taxes as an extra chore. It's simply your version of paycheck withholding. Making it a regular financial habit keeps you on the right side of the IRS and helps you avoid that gut-punch feeling of a huge, unexpected tax bill.

Mark Your Calendar with These Deadlines

The easiest way to get hit with a penalty is to simply forget a due date. The IRS has four key deadlines for estimated payments each year, and it's critical to know that these "quarters" aren't spaced out evenly.

Here's a clear summary of the standard IRS deadlines for each quarterly tax payment period to help you stay on track throughout the year.

Quarterly Estimated Tax Payment Deadlines

| Payment Period | Due Date |

|---|---|

| January 1 – March 31 | April 15 |

| April 1 – May 31 | June 15 |

| June 1 – August 31 | September 15 |

| September 1 – December 31 | January 15 (of the next year) |

Keep in mind, if a due date ever lands on a weekend or a holiday, your payment is due on the next business day. There are no extensions for making these payments, so planning ahead is absolutely essential to steer clear of penalties.

Getting Your Financials in Order

Before you can even think about plugging numbers into a calculator, you need to know what those numbers are. Garbage in, garbage out—it’s true for baking and it’s especially true for taxes. If you just guess, you’ll either hand over too much money to the IRS or, worse, get hit with an underpayment penalty later.

A little prep work now saves a ton of headache. I always tell my clients to start a simple spreadsheet. It doesn't have to be fancy, but it should be your single source of truth for tracking everything you need each quarter.

Projecting Your Annual Income

This is the big one. The whole calculation starts with a solid estimate of your total income for the entire year. And I mean total—not just what you've earned so far, but what you realistically expect to bring in by December 31st.

Your projection needs to cover every stream of income, not just your main hustle. Make sure you’re including:

- Business or Freelance Earnings: Look at what you’ve made year-to-date and map out the rest of the year. Is your business seasonal? Do you expect a big project to land? Be realistic. If things are unpredictable, averaging your last few years can be a good starting point.

- Side Gigs: That weekend consulting project or the Etsy shop you run? It all adds up and the IRS wants its piece. Don't forget it.

- Investment Gains: Tally up any interest and dividends. More importantly, are you planning to sell any stocks or other assets at a profit? That’s income, too.

- Spouse's Income: If you file jointly, you absolutely have to factor in your spouse’s W-2 income and whatever taxes are already being withheld from their paychecks. This is crucial for getting a complete picture of your household tax liability.

A Quick Tip from Experience: For clients with really lumpy income—think real estate agents or freelance creatives—I often recommend the "annualized income" method. Instead of one big projection, you re-evaluate your income and recalculate your estimate each quarter based on what you’ve actually earned. It’s more work, but it prevents massive overpayments or getting blindsided by a huge bill.

Nailing Down Your Business Deductions

Okay, you’ve figured out your income. Now comes the fun part: shrinking that number. Every legitimate business expense you can claim is a dollar you’re not paying tax on, so it pays to be thorough here.

Start making a running list of all your business-related expenses. For most self-employed folks and small business owners, the usual suspects are:

- Home Office Costs: If you have a dedicated workspace at home, you can deduct a portion of your rent or mortgage, utilities, and internet.

- Software & Subscriptions: Think about all the tools you pay for to keep your business running—accounting software, project management apps, industry-specific platforms.

- Supplies & Equipment: This covers everything from printer paper to the new laptop you bought specifically for work.

- Professional Fees: Did you pay a lawyer, a consultant, or an accountant like us at Blue Sage? That’s a deduction.

- Business Travel & Meals: Keep track of work-related travel expenses and 50% of the cost of business meals.

Don't Forget Credits and Other Adjustments

Last but not least, think about tax credits and other key adjustments. These are often overlooked but can make a huge difference. Remember, deductions lower your income, but credits reduce your actual tax bill dollar-for-dollar. They're pure gold.

Jot down any credits you might be eligible for, like the Child Tax Credit or credits for making energy-efficient upgrades to your home. Also, consider any "above-the-line" deductions you plan to make, such as contributions to a traditional IRA or a SEP IRA. Having these figures ready will make your estimate as precise as possible, letting you hold onto more of your cash during the year.

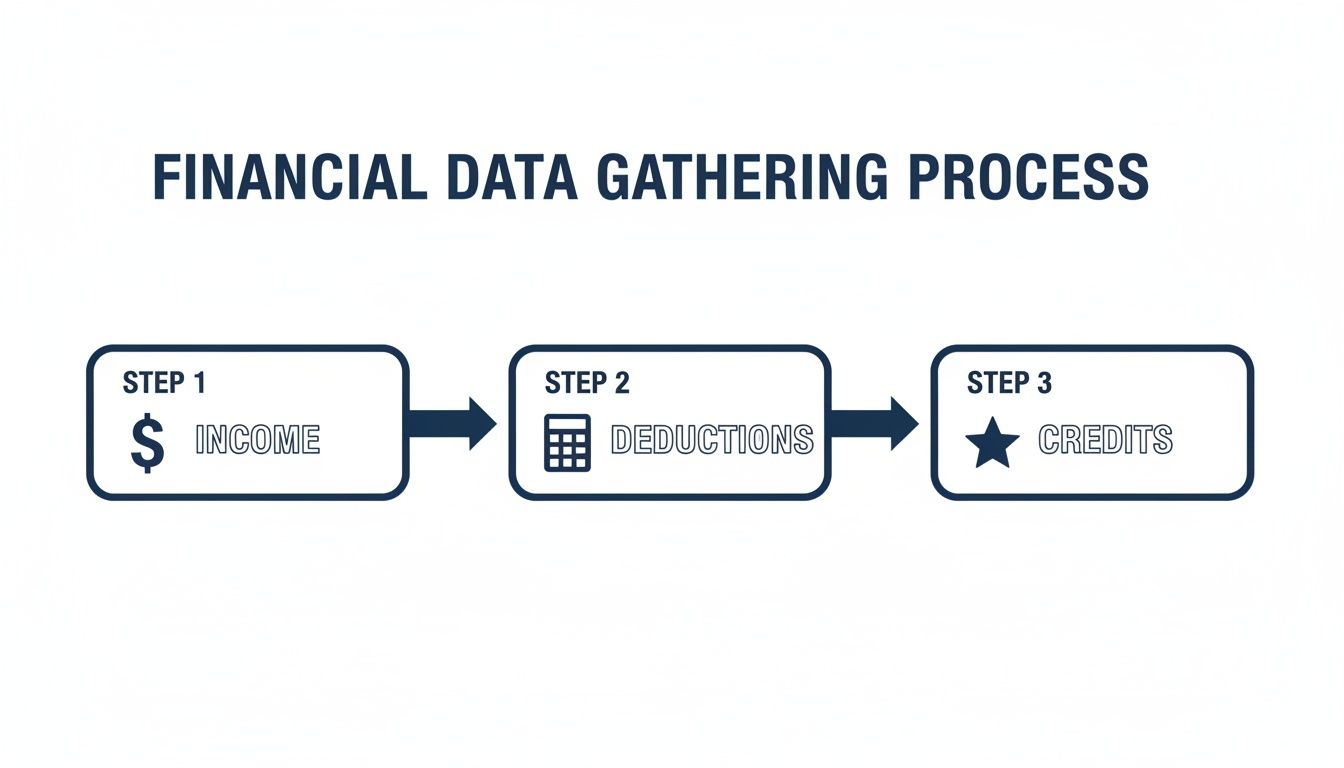

Getting a Handle on Your Estimated Tax Calculation

Using a quarterly estimated tax calculator—whether it’s a slick online tool or the IRS's own Form 1040-ES worksheet—isn't about cracking some complex code. It's really just about following a logical path. The whole point is to mimic your annual tax return, but on a smaller, predictive scale. Think of it as creating a financial forecast for the IRS so you can pay as you go.

You start with the big number: your total expected income for the year. From there, you systematically chip away at it with deductions to find the amount you're actually taxed on. After that, you figure out the tax, subtract any credits, and divide the final number by four. It’s a straightforward process of narrowing things down to find your true tax liability for the quarter.

This diagram shows that flow perfectly, moving from your broad income figures down to the specific deductions and credits you'll use.

This method ensures you get a complete picture of your earnings before you start applying all the tax breaks available to you.

Start by Pinpointing Your Adjusted Gross Income (AGI)

The first real milestone in any tax calculation is nailing down your Adjusted Gross Income (AGI). This number is absolutely critical. It’s your gross income from all sources—every last dollar—minus a specific list of "above-the-line" deductions.

These aren't your typical business expenses. Above-the-line deductions are special adjustments that are available to you whether you itemize or take the standard deduction. Some of the most common ones are:

- Contributions to a traditional IRA or SEP IRA

- One-half of your self-employment taxes (we'll circle back to this)

- Student loan interest you've paid

Subtracting these from your gross income gives you your AGI. This figure is the foundation for a lot of other calculations down the line, including limits on certain credits and other deductions, so getting it right from the start is non-negotiable.

Next, Find Your Taxable Income

With your AGI in hand, the next step is to figure out your taxable income. This is where you subtract either the standard deduction or your itemized deductions. It's an either/or situation—you can't take both. You'll want to pick whichever one is larger and gives you the biggest tax benefit.

The standard deduction is a simple, fixed dollar amount that the IRS updates annually based on your filing status (like Single or Married Filing Jointly). It's the no-fuss option.

Itemized deductions, on the other hand, require a bit more legwork and good records. These include expenses like mortgage interest, state and local taxes (SALT) up to the $10,000 cap, and charitable donations. For many high-earners, business owners, or homeowners in high-tax states, itemizing is a no-brainer because it results in a much lower taxable income.

Once you subtract your chosen deduction from your AGI, you've arrived at your taxable income. This is the number the tax brackets are actually applied to.

Calculating Your Income and Self-Employment Tax

Now you're ready to calculate the actual tax. Any decent estimated tax calculator will take your taxable income and apply the current year's tax brackets to find your projected income tax liability.

But wait, there's more—especially if you're self-employed. You also have to account for self-employment tax. This covers your Social Security and Medicare contributions, which an employer would normally split with you. The rate is 15.3% on the first 92.35% of your net self-employment earnings.

You'll add your projected income tax and your self-employment tax together to get your total estimated tax bill for the year. This combined figure is your total tax responsibility before we account for any credits or payments you've already made.

A Pro Tip: Don't forget this little tax nuance—you get to deduct one-half of what you pay in self-employment tax. It's an "above-the-line" deduction that helps lower your AGI. It feels a bit like a circular calculation, but it's a beneficial one that shaves a little off your income tax bill.

Applying Credits to Finalize Your Payment

The last step is to bring that total tax figure down. You'll subtract any tax credits you expect to qualify for, plus any federal income tax that's already been paid. This could be withholding from your (or your spouse's) W-2 job, or maybe an overpayment from last year's tax return that you chose to apply to this year's estimates.

Once you subtract those credits and prior payments, you have your net estimated tax for the year. Just divide that number by four, and that's your quarterly payment.

While many people rely on online calculators, I've seen a huge rise in clients using sophisticated spreadsheets to stay on top of these figures. They can automate income and expense tracking to give you a real-time, running tally of your tax liability. If you're curious, you can see some great examples of automated tax spreadsheets on Tiller.

Putting the Numbers to Work: Real-World Scenarios

Formulas and calculators are great, but the real "aha!" moment comes when you apply them to actual life situations. Every person's financial story is different, and seeing how a few key variables can change your tax picture makes everything click.

Let's walk through a few common scenarios to see how this plays out in the real world.

These examples move us from abstract fields in a calculator to the concrete financial decisions you might be facing yourself.

The Freelance Graphic Designer with Fluctuating Income

Meet Alex. He's a talented freelance graphic designer in Queens, NYC, and his income is the classic "feast or famine" rollercoaster. Some months are incredible, with big project payouts. Others are quiet. This makes projecting his income a bit of an art.

Alex estimates he'll bring in $95,000 in total revenue this year. He's diligent about tracking his business expenses—software like Adobe Creative Cloud, home office costs, marketing—which he projects will be around $20,000. This leaves him with $75,000 in net self-employment earnings.

Here’s how his numbers shake out:

- Self-Employment (SE) Tax: First up is the SE tax. On $75,000 of net earnings, after the standard adjustment, his SE tax comes to about $10,600. This covers his Social Security and Medicare contributions.

- Adjusted Gross Income (AGI): Alex gets to deduct half of his SE tax ($5,300) from his income. This brings his AGI down to $69,700.

- Taxable Income: He files as single and takes the standard deduction (we'll use $14,600 for this example), which makes his taxable income $55,100.

- Total Tax: His federal income tax on that amount is roughly $7,200. We add his SE tax back in ($10,600), giving him a total federal tax bill of $17,800.

To cover this, Alex needs to make quarterly payments of $4,450. But here's the key: because his income is so lumpy, he might use the annualized income method. This lets him pay more after a big project lands and less during a slow period, which is a lifesaver for managing cash flow.

The Real Estate Investor Juggling Multiple Income Streams

Now let’s look at Maria. She’s a real estate investor who also has a demanding tech job. She and her husband both have W-2s, so their financial picture is more layered, with regular withholdings, rental income, and even some capital gains from selling stock.

Here’s a snapshot of their combined annual projections:

- W-2 Salaries: $350,000

- Federal Tax Withheld from Jobs: $65,000

- Net Rental Income: $40,000

- Long-Term Capital Gains: $25,000

Maria’s goal is to figure out the tax on the income that doesn't have withholding. The calculator first needs to tally their total tax liability on all income sources.

Key Insight: The rental income gets taxed at their regular, higher income tax rate. But the long-term capital gains are taxed at the much friendlier 15% or 20% rates. A good calculator will handle these different tax treatments correctly.

Let's say their total projected tax for the year is $88,000. They subtract the $65,000 already being withheld from their paychecks, which leaves a $23,000 shortfall. To stay penalty-free, they need to cover this gap with estimated payments of $5,750 each quarter.

The Consultant in a High-Tax State Like New York

Finally, we have David, a successful management consultant living in Manhattan. As a high-earner, he’s not just dealing with the IRS; he’s also paying significant taxes to New York State and New York City. A federal-only calculation won't cut it for him.

David projects $400,000 in net self-employment income. His federal tax is complicated enough, but layering on state and city taxes can easily add another 10-12% to his total bill.

His process is a multi-step game:

- Federal Calculation: He starts by calculating his federal income and self-employment taxes, which are substantial.

- State and Local Calculation: Next, he has to run a completely separate calculation for NYS and NYC, each with its own set of rules and forms.

- The SALT Deduction Limit: Here's the kicker. When he itemizes on his federal return, David can only deduct $10,000 in state and local taxes. This cap dramatically increases his federal taxable income.

For someone like David, a comprehensive calculator must have state tax modules. Ignoring state and local obligations can lead to a whole separate set of penalties. This is exactly where working with a firm like Blue Sage becomes critical—to make sure all liabilities are projected accurately and paid on time, from the federal level right down to the city.

Using Safe Harbor Rules to Avoid Penalties

One of the biggest headaches for anyone paying estimated taxes is the fear of that dreaded underpayment penalty. It's easy to get lost in the weeds, trying to nail your quarterly numbers down to the penny. But the good news is, the IRS doesn't expect you to have a crystal ball.

That’s where the safe harbor rules come in. Think of them as your get-out-of-jail-free card for penalties.

Basically, as long as your total payments for the year hit one of two key benchmarks, you're generally off the hook for penalties—even if you end up owing more when you file your annual return. This completely changes the game. Your goal is no longer perfection; it's just about making a consistent, reasonable effort.

So, how do you stay in the "safe harbor"? You have two main options.

The 100% Rule (Based on Last Year's Tax)

This is usually the simplest and most popular route. Just look at your total tax liability from last year's tax return. If you pay 100% of that amount through your estimated payments this year (split into four equal installments), you're covered.

This method is a lifesaver if your income is relatively stable or growing predictably. It takes all the guesswork out of projecting your current year's income. You have a clear, fixed target, which makes planning your cash flow so much easier.

There's one important catch, though. If your Adjusted Gross Income (AGI) last year was over $150,000 (or $75,000 if you're married filing separately), the bar is raised. You'll need to pay 110% of last year's tax liability to qualify for this safe harbor.

The 90% Rule (Based on This Year's Tax)

Your other option is to pay at least 90% of the tax you'll owe for the current year.

This approach makes more sense if you expect your income to drop this year. Why overpay based on a great year in the past? It’s also the default method for people who are new to self-employment and don’t have a prior tax year to use as a baseline.

The obvious challenge here is that you won’t know your final tax bill until the year is over. This is where a good quarterly estimated tax calculator becomes your best friend. It helps you forecast your income and deductions as you go, allowing you to fine-tune your payments each quarter to stay on track to hit that 90% threshold.

The Goal Is Avoidance, Not Perfection: The safe harbor rules are designed to protect taxpayers who are making a genuine effort to pay their tax liability as they earn it. Choosing the right rule for your situation is a strategic decision that provides peace of mind.

Comparing Safe Harbor Rules

To make the choice clearer, here’s a quick breakdown of the two safe harbor methods. Looking at them side-by-side can help you quickly decide which path is better for your financial situation this year.

| Method | Requirement | Best For |

|---|---|---|

| Prior-Year Rule | Pay 100% of last year’s total tax (or 110% if your AGI was >$150k) | Taxpayers with stable or rising income who want a simple, fixed payment target. |

| Current-Year Rule | Pay 90% of the current year’s total tax liability. | Taxpayers with declining or unpredictable income, or those new to estimated taxes. |

Ultimately, both rules lead to the same outcome: avoiding penalties. A quick look at last year's income and a realistic forecast for this year will tell you which method is the smarter play. For more on how these rules work in practice, you can find a good visual breakdown of how these payment rules work on YouTube.

Getting Your Money to the IRS and Keeping Track of It All

You’ve done the hard part—you’ve calculated what you owe. But you’re not over the finish line until the IRS has your money and you have a clean record of the payment. Trust me, skipping this step or getting sloppy with your records can turn into a real nightmare come tax season.

Thankfully, you've got options. The IRS has made it pretty easy to pay, so you can pick whatever method works best for you. Once the payment is sent, the key is having a simple, repeatable system to track it. A little organization now saves a ton of stress later.

How to Actually Make the Payment

Forget the old-school hassle of mailing a paper check (unless you really want to). Today, digital payments are faster, safer, and give you immediate proof that you've paid.

- IRS Direct Pay: This is my go-to recommendation for most people. It's free, you can pay right from your bank account on the IRS website, and you don't even have to create an account. It's incredibly straightforward.

- EFTPS (Electronic Federal Tax Payment System): If you're running a business and making regular tax payments, EFTPS is worth a look. You do have to enroll, but once you're in, you can schedule payments up to a year in advance and see your full payment history.

- Credit/Debit Card or Digital Wallet: You can use a card or services like PayPal, but it'll go through a third-party processor. The convenience is nice, but just know they charge a fee for the service.

- The Old-Fashioned Way (Mail): You can still mail a check or money order. If you do, make sure you include the right Form 1040-ES payment voucher and get it postmarked by the deadline.

A Simple System for Perfect Records

You don’t need fancy accounting software to keep good records. You just need to be consistent. Your future self will be incredibly grateful you took two extra minutes to log everything now.

A simple spreadsheet is your best friend here. Seriously. Just create columns for the payment date, the amount, the method you used, and the confirmation number. This little habit gives you a perfect, at-a-glance summary of where you stand for the year.

Beyond that spreadsheet, I always advise clients to keep a dedicated folder—digital or physical—for all their tax documents. Toss these things in there as soon as you get them:

- Bank statements that clearly show the payment leaving your account.

- The email confirmation you get from IRS Direct Pay or EFTPS.

- A scanned copy of your mailed check and the 1040-ES voucher, if you go that route.

When you have everything organized like this, tax time stops being a frantic scavenger hunt and becomes a simple review. You can file your annual return with total confidence, knowing you have the proof to back up every single number.

Answering Your Top Estimated Tax Questions

Even with a good calculator, real life throws curveballs. Let's walk through some of the most common questions I hear from freelancers and business owners trying to navigate their quarterly tax payments.

"My Income Is All Over the Place. What Should I Do?"

This is probably the number one question I get. One month you land a huge project and your income doubles; the next, things are quiet. Don't panic. This is completely normal for business owners.

The key is to simply rerun your numbers before the next payment deadline. If you had a great quarter, your next payment will be bigger. If business was slow, it'll be smaller. You’re just adjusting as you go to make sure the total you’ve paid by the end of the year hits the mark.

The Big Picture: Your initial estimate is just that—an estimate. The IRS knows things change. What really matters is that your total payments for the year satisfy one of the safe harbor rules.

"Can I Just Pay Everything in the First Quarter and Be Done With It?"

While it might seem easier to get it all out of the way at once, the IRS system is designed for you to "pay as you go."

You can certainly pay the full year's estimated tax in the first quarter—the IRS won't complain about getting its money early! But you can't do the reverse. If you wait and try to pay the entire year's tax bill in the fourth quarter, you'll likely face underpayment penalties for the first three quarters, even if the total amount is correct.

"Do I Owe State Estimated Taxes, Too?"

Yes, almost certainly. If you live in a state with an income tax, you'll have a separate set of estimated tax obligations to your state's tax agency.

Be careful here—state rules can be very different from federal ones. The due dates, the required forms, and the payment methods might not line up with the IRS. Always check the website for your state's department of revenue to get their specific instructions.

When your situation involves multi-state complexities or you want to build a forward-looking tax plan, it’s time to call in a professional. The team at Blue Sage Tax & Accounting Inc. specializes in providing that clarity and strategic insight. Explore our tax planning services and get in touch today.