For many investors, the direct answer to whether their investment expenses are tax-deductible has become surprisingly complicated. For individuals, the answer is often no. However, for business entities, trusts, and estates, many of these exact same costs can still be deducted, which opens up a critical area for smart tax planning.

Decoding Tax-Deductible Investment Expenses

Think of it this way: the IRS now treats investment costs differently depending on whether they're for a personal endeavor or a formal business. For an individual investor, things like wealth management fees are now largely seen as personal expenses—and therefore, not deductible.

But when that same investment portfolio is held inside a corporation, partnership, or trust, those fees are often treated as necessary costs of doing business. They become just like any other operational expense, such as rent or payroll. This is the fundamental distinction that now drives the entire strategy around deducting investment-related costs.

This major shift came from the Tax Cuts and Jobs Act (TCJA) of 2017. The law suspended a whole category of write-offs called "miscellaneous itemized deductions," which was the bucket where most individual investors used to claim these expenses. For now, that suspension is set to last through 2025.

The Taxpayer Hierarchy for Deductions

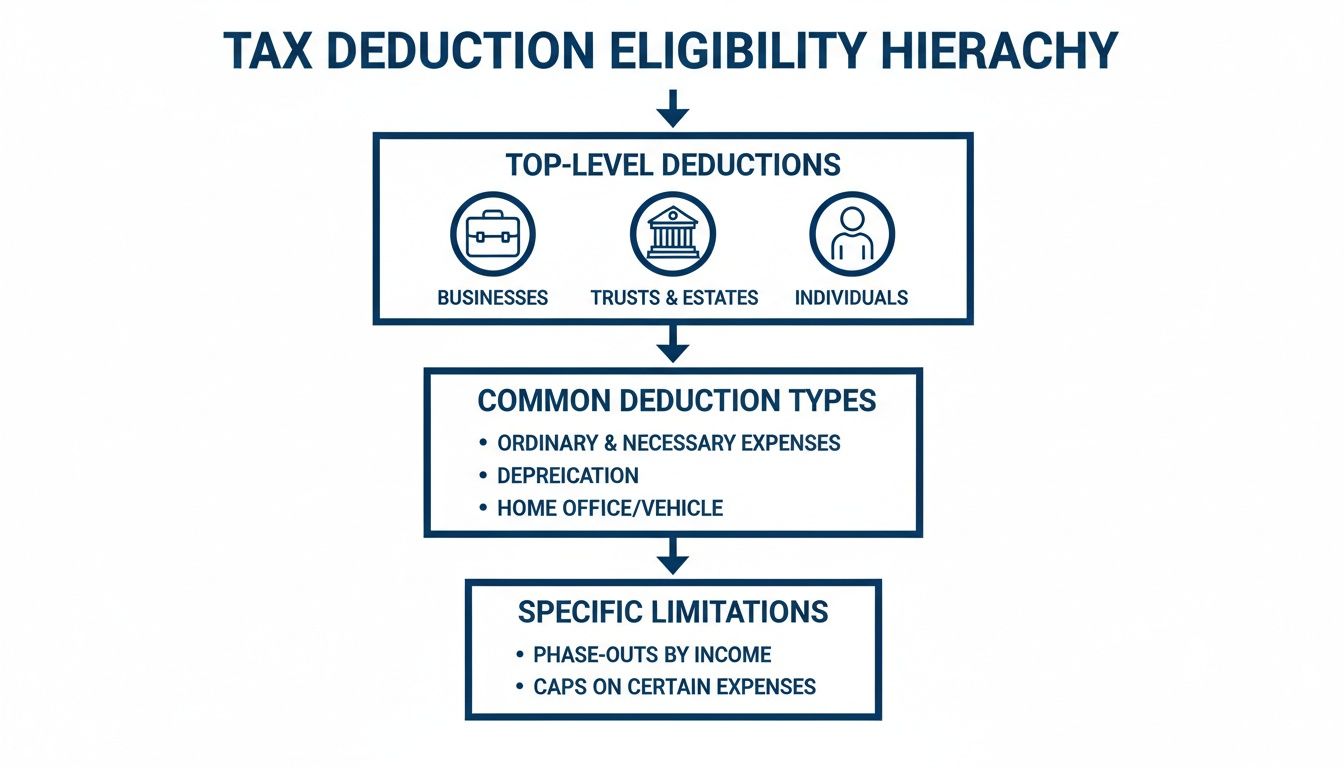

Who gets to deduct these expenses really comes down to the taxpayer's legal structure. There's a clear hierarchy, and it shows exactly who has the most flexibility.

This flowchart breaks down the different levels of deductibility available to businesses, trusts, estates, and individuals.

As you can see, business entities sit at the top with the broadest ability to claim these costs, while individuals face the tightest restrictions. This is precisely why strategic entity structuring has become such a central part of tax planning for serious investors and family offices.

For a quick reference, here's a high-level summary of how common expenses are treated across different taxpayer types.

Deductible Investment Expenses at a Glance

| Expense Type | Individual Investors | Trusts and Estates | Business Entities |

|---|---|---|---|

| Advisory & Management Fees | Generally Not Deductible (suspended misc. itemized deduction) | Deductible (as administration costs) | Deductible (as ordinary and necessary business expense) |

| Investment Interest Expense | Deductible (up to net investment income) | Deductible (subject to limitations) | Deductible (as a business interest expense) |

| Custodial & Account Fees | Generally Not Deductible | Deductible | Deductible |

| Tax Prep & Advice Fees | Not Deductible (if related to investment income on Sch. A) | Deductible | Deductible |

This table highlights the stark contrast in tax treatment and underscores why simply being an individual investor can be the least tax-efficient way to manage a substantial portfolio.

What This Means for Your Strategy

Getting a handle on this new landscape is the first step toward building a more tax-efficient investment plan. The focus has shifted. It's no longer just about what you spend, but who is doing the spending.

The key takeaways are straightforward:

- Individuals Face Major Hurdles: Direct deductions for common costs like advisory fees, custodian fees, and safe deposit box rentals are off the table for now.

- Entities Have a Clear Advantage: Corporations, partnerships, and trusts can often write off these very same expenses as standard operational costs.

- Proactive Planning is a Must: The difference in tax treatment makes it essential to evaluate your financial structure to see if you can optimize it.

The TCJA's suspension of miscellaneous itemized deductions effectively reclassified many legitimate investment costs as non-deductible personal expenses for individuals. This demands a change in mindset from simply tracking costs to proactively structuring how your investments are held.

In the sections that follow, we'll dig into the specific deductions that are still on the table—like the crucial investment interest expense deduction—and explore how business entities and trusts can unlock write-offs that are no longer available to individuals. Understanding these rules is the only way to make informed decisions that directly boost your after-tax returns.

The New Reality for Individual Investor Deductions

If you're an individual investor, the way you handle investment-related expenses on your tax return changed dramatically with the Tax Cuts and Jobs Act (TCJA) of 2017. The law put a freeze on a whole category of write-offs known as miscellaneous itemized deductions, and it's a change that directly hits your wallet.

Before the TCJA, you could often deduct many of the costs of managing your portfolio. Think about your financial advisor's fees, custodial fees for holding your stocks, or even the cost of a safe deposit box for your investment documents. You could write these off, but only the portion that exceeded 2% of your adjusted gross income (AGI).

That deduction is now gone—at least for a while. The suspension is slated to run through the end of 2025. This means that for federal tax purposes, all those legitimate costs of generating investment income are currently treated as non-deductible personal expenses.

A Tale of Two Tax Returns

To see the real-world difference, let's walk through an example. Meet Alex, a hypothetical NYC-based investor with an AGI of $500,000. We'll compare how things would shake out for Alex before and after this major tax law change.

Before TCJA (Pre-2018):

Let's say Alex paid the following investment-related costs for the year:

- Investment Advisory Fees: $8,000

- Custodial Fees: $1,500

- Tax Preparation Fees (Investment Portion): $500

- Total Investment Expenses: $10,000

First, Alex had to clear the 2% AGI hurdle:

- $500,000 (AGI) x 2% = $10,000

In this case, Alex's expenses are right at the threshold. Any amount above this $10,000 floor would have been deductible. So, if Alex's expenses were $12,000, a $2,000 deduction would have been available.

After TCJA (2018-2025):

Now, let's look at the exact same situation today. Alex still has the same AGI and the same $10,000 in investment expenses.

Under current law, the entire category of miscellaneous itemized deductions is suspended. This means Alex's deduction for these investment expenses is $0.

That's it. The law simply doesn't allow for the deduction, no matter how high the expenses climb. This single change can easily result in thousands of dollars in extra taxes over several years, taking a direct bite out of your net returns.

What's Off the Table for Individuals?

The TCJA’s suspension effectively wiped out a whole list of common expenses that investors once claimed. Knowing what you can no longer deduct is the first step in rethinking your tax strategy.

Here are the big ones:

- Investment Advisory and Management Fees: This is often the most significant loss. Fees you pay to financial planners, wealth managers, and even robo-advisors are no longer deductible on your personal return.

- Custodial and Account Maintenance Fees: Those charges from brokerages or banks for safeguarding your assets? You can't write them off.

- Safe Deposit Box Rental Fees: If you rent a safe deposit box to store stock certificates or other investment paperwork, that cost is no longer deductible.

- Investment-Related Professional Fees: This includes the portion of your tax preparation fees that you can specifically attribute to managing your investments and reporting that income.

This new reality makes it more crucial than ever to look for smarter strategies. While these specific investment expenses are not tax deductible for individuals right now, they often remain fully deductible for other entities.

This is a key reason many savvy investors now explore different structures, like partnerships or trusts, to hold their investments. By doing so, they can often convert these non-deductible personal costs into legitimate, deductible business or administrative expenses—a strategy we'll dig into later.

Using Investment Interest Expense as a Key Deduction

While the Tax Cuts and Jobs Act (TCJA) put a stop to many deductions for individual investors, the investment interest expense deduction remains a powerful tool in the right hands. If you strategically use leverage—that is, borrow money to buy investment assets—this deduction can significantly lower your taxable income. It's one of the few major investment-related write-offs still standing for individuals who itemize.

So, what does it cover? This deduction lets you write off the interest you pay on money borrowed specifically to purchase investment property. The classic example is the interest on a margin loan from your brokerage, where you borrow against your portfolio to buy more stocks or bonds. The key is that the loan proceeds must be directly traceable to buying an investment intended to produce income, like dividends, interest, or royalties.

But it's not a free-for-all. You can't just take out a personal loan, buy some stock with it, and expect to deduct the interest. The same goes for loans used to purchase tax-exempt securities, like municipal bonds. That interest is not deductible. The IRS won't let you "double-dip" by earning tax-free income while also getting a tax break on the cost to generate it.

Understanding the Net Investment Income Limit

Here’s the most important rule you need to know: your deduction is capped. The amount of investment interest you can deduct in any given year cannot be more than your net investment income for that same year. Think of it as a matching game—the tax code only lets you deduct borrowing costs up to the amount of investment income you actually brought in.

So, what counts as net investment income? It's the sum of your various investment income streams, minus any deductible investment expenses (which, for individuals, are few and far between these days).

Generally, your investment income includes things like:

- Interest Income: From bonds, CDs, and savings accounts.

- Non-Qualified Dividends: The kind that are taxed at your regular income tax rate.

- Annuity Income: The taxable portion of payments you receive.

- Royalties: As long as they don't come from a trade or business.

- Net Short-Term Capital Gains: Profits you make on assets you've held for a year or less.

You might notice a couple of big items missing from that list: qualified dividends and long-term capital gains. These aren't automatically included. You can elect to count them toward your net investment income, but it comes with a catch. Any amount you include will be taxed at your higher, ordinary income tax rate instead of the lower, preferential capital gains rate.

Key Takeaway: The core principle is that your deduction is capped by your earnings. You can only deduct interest expense against the investment income you generate, preventing you from using investment losses to offset other types of income like your salary.

The Carryforward Provision: A Planning Opportunity

What happens if your investment interest expense is more than your net investment income? Let's say you paid $15,000 in margin interest but only generated $10,000 in net investment income. Is that extra $5,000 deduction lost forever?

Thankfully, no. The IRS allows you to carry forward any disallowed investment interest expense indefinitely. You can use this carried-forward amount in future tax years when you have enough net investment income to absorb it. This makes tracking your carryforward amount a critical part of your long-term tax planning—it's a valuable future deduction just waiting to be claimed.

A Practical Example of the Calculation

Let's walk through an example to see how this works in practice. Below is a breakdown of how an investor would calculate their deductible limit.

Calculating Your Investment Interest Deduction Limit

Here’s a step-by-step example showing how to calculate net investment income and determine the maximum deductible investment interest expense.

| Financial Item | Example Amount | Included in Net Investment Income? |

|---|---|---|

| Margin Loan Interest Paid | $12,000 | This is the expense to be deducted |

| Interest Income from Bonds | $5,000 | Yes |

| Non-Qualified Dividends | $3,000 | Yes |

| Net Short-Term Capital Gains | $4,000 | Yes |

| Qualified Dividends | $6,000 | No (by choice, to keep lower tax rate) |

| Total Net Investment Income | $12,000 | This is the deduction limit |

In this scenario, the investor’s net investment income is $12,000. Since their margin interest expense was also $12,000, they can deduct the full amount.

If their margin interest had been $15,000, their deduction would be capped at $12,000 for the current year. The remaining $3,000 isn't lost—it gets carried forward to the next year. This is a perfect illustration of how the rules for tax-deductible investment expenses apply to this specific write-off. For expert guidance on optimizing this and other complex deductions, consider connecting with a tax professional at Blue Sage Tax & Accounting Inc..

Unlocking Deductions Through Business Entities and Trusts

For individual investors, the door to deducting many investment-related costs slammed shut with recent tax law changes. But for those with significant portfolios, there's another door. By strategically moving investment activities out of your personal name and into a formal business entity or trust, you can completely change the tax game and reopen the path to valuable deductions.

This isn't just a paperwork shuffle; it fundamentally recharacterizes your expenses in the eyes of the IRS. What was once an off-limits personal cost can become a legitimate business expense, directly lowering your taxable income.

Turning Personal Costs into Business Deductions

When you house your investment activities within a C corporation, S corporation, or a partnership (like an LLC), that entity is now officially in the "trade or business" of investing. This simple but powerful distinction is the key.

With this structure in place, the costs of managing those investments are no longer considered miscellaneous itemized deductions. Instead, they qualify as ordinary and necessary business expenses under IRC Section 162.

Suddenly, a wide range of costs can become deductible:

- Investment Advisory Fees: Payments to your wealth manager are now professional service fees essential to running the business.

- Management and Custodial Fees: The costs to maintain brokerage accounts or safeguard assets are simply operational expenses.

- Professional Services: Fees for lawyers, accountants, and tax preparers related to the entity’s investment work are fully deductible.

- Home Office and Administrative Costs: If you have a dedicated space and tools for managing the entity's portfolio, a portion of your home office, software, and other overhead can also qualify.

By forming an entity, you transform what would be a non-deductible personal expense into a tax-deductible business expense that directly improves your bottom line.

Special Advantages for Trusts and Estates

Trusts and estates play by a slightly different set of rules, offering their own unique advantages. While they were also impacted by the recent tax law changes, a critical exception survived for costs that exist only because the assets are held in a trust or estate.

In plain English, if an expense is unique to the administration of the trust—like specialized investment advisory fees needed to meet a trustee's fiduciary duties—it can often be deducted without the limitations individuals face.

This makes trusts a powerful tool for preserving the deductibility of essential management costs, particularly for family offices and multi-generational wealth planning. Fees paid to a trustee or an advisor to manage the trust's assets are often considered a necessary cost of administration, making them fully deductible at the trust level.

For instance, fees for fiduciary accountings or investment advice tailored to a trust’s complex legal obligations are generally deductible. This allows the trust to lower its taxable income, preserving more capital for its beneficiaries. It’s a perfect example of how the right structure dictates the tax outcome.

The Corporate Advantage for Global Investors

For corporations that invest internationally, the benefits get even bigger. The Foreign-Derived Intangible Income (FDII) deduction, for example, allows U.S. C corporations to deduct 37.5% of their foreign-derived income.

This can slash the effective tax rate on that income from the standard 21% all the way down to 13.125%. For companies with global IP or investment portfolios, that's a massive tax savings. It's worth exploring the full details of this and other corporate tax provisions to see the whole picture.

Is Creating an Entity Right for You?

Making the move to a formal business entity is a major decision. It’s a powerful strategy, but it comes with its own set of complexities that aren't for everyone.

Key Considerations Before Creating an Entity:

- Scale of Investment Activity: This approach makes the most sense for investors with substantial portfolios, where the tax savings from deducting fees will easily outweigh the costs of setting up and maintaining the entity.

- Administrative Burden: Running a corporation or partnership means ongoing compliance. You’re looking at separate tax filings, proper bookkeeping, and potentially state franchise taxes or annual fees.

- Legal and Tax Advice: This is non-negotiable. You must consult with qualified legal and tax professionals who can help you choose the right structure (LLC, S-Corp, C-Corp) and ensure you follow all the rules to be seen as a legitimate business.

For the serious investor, choosing the right entity is a cornerstone of smart tax planning. It’s one of the most effective ways to reclaim the ability to write off the real costs of managing your wealth.

A Closer Look at New York State and City Tax Rules

While federal tax law sets the stage for your investment expense strategy, that's just the first act for anyone in a high-tax state like New York. State and local rules add another critical layer, and you can't afford to ignore them. For the most part, New York conforms to the federal tax code, which means the suspension of miscellaneous itemized deductions under the TCJA also hits your state return.

In plain English, this means individual investors can't deduct common costs like investment advisory fees on their New York State income tax returns, just like on their federal Form 1040. But what about the deductions that did survive the federal chopping block, like the investment interest expense deduction? Those face their own set of hurdles at the state level.

The High-Income Earner Limitation

New York has a unique challenge for high-income taxpayers that can significantly water down the value of their itemized deductions. If your New York adjusted gross income (NYAGI) climbs above specific thresholds, the state starts clawing back the total amount of itemized deductions you're allowed to claim.

For 2024, this phase-out kicks in for taxpayers with a NYAGI over $100,000. The limitation gets progressively tighter as your income climbs, with deductions potentially being slashed by up to 50% for those earning over $10 million. This means even a perfectly valid federal deduction for margin interest could be a fraction of its original value on your New York return.

This state-level haircut is a perfect example of why you can't just look at federal rules. For New York investors, a deduction's existence on your federal return is only half the story; you have to see what's left after the state's own limitations are applied.

NYC Unincorporated Business Tax: A Trap for the Unwary

For investment partnerships, hedge funds, and other unincorporated businesses operating in New York City, there's another major tax to contend with: the NYC Unincorporated Business Tax (UBT). This is a flat 4% tax on the net income of any unincorporated business operating within the five boroughs.

What does it mean to be "carrying on" a business in NYC? The definition is surprisingly broad. If your fund has an office in the city or even just regularly and systematically buys and sells securities for its own account within city limits, you could be on the hook. This can easily ensnare investment partnerships and family limited partnerships that might not even think of themselves as a traditional "business."

Here's what investment entities need to know about the UBT:

- A Wide Net: NYC's definition is expansive. In some cases, merely executing trades through a broker based in the city could be enough to trigger a taxable presence.

- A Tax on Net Income: The tax is applied to the entity's net income. While your investment expenses (like management fees) are deductible against the UBT, the profit that remains is still subject to this extra city tax.

- No Credit for Individuals: This is a big one. Unlike some other taxes, NYC residents typically don't get a credit on their personal income tax returns for the UBT paid by a partnership they've invested in.

This local tax makes your entity structure and physical footprint incredibly important. A family office set up as a partnership with a desk in Manhattan could easily find itself subject to the UBT, adding a significant tax drag that has to be managed. It's why careful planning around how and where your entity conducts its investment activities is absolutely critical.

Building Your Year-Round Tax Planning Strategy

Smart tax management isn't a mad dash in April. The real pros know it's a year-round discipline, a constant process of planning and organizing that pays dividends. It's about shifting your mindset from simply reacting to a tax bill to proactively shaping your financial outcome.

The key is building a solid system. A well-oiled machine ensures you’re capturing every deduction you’re entitled to and setting up your portfolio for tax-efficient growth. And the cornerstone of that entire system? Flawless record-keeping. Without it, the best strategies in the world are just theory.

Maintain Impeccable Records

Your ability to claim deductions for investment expenses comes down to one thing: proof. You need clear, contemporaneous documentation. A vague memory isn't going to cut it with the IRS; you need a paper trail that tells the complete story.

The best approach is to create a dedicated system—digital or physical—to file records as they arrive. Don't let a mountain of paperwork build up for a frantic year-end scramble.

Your Essential Documentation Checklist:

- Brokerage Statements: Hang on to those year-end summaries. They detail margin interest paid (Form 1099-INT) and sale proceeds (Form 1099-B), which are absolutely essential for calculating your investment interest deduction and capital gains.

- Advisory Fee Invoices: If your investments are held in a business or trust, the invoices from your financial planner or wealth manager are your proof for claiming those ordinary business expenses.

- Loan Agreements: For any loan you took out to invest, keep the original agreement handy. It proves the funds were specifically intended for acquiring investment property.

- Capital Improvement Records: If you own investment real estate, keep meticulous receipts for any improvements. These costs increase your property's basis, which directly reduces the taxable capital gain when you decide to sell.

Keeping organized records is more than just good housekeeping; it's an active strategy. It provides the raw data needed to make timely, informed decisions that can directly lower your tax liability throughout the year.

Adopt Proactive Tax Strategies

With your record-keeping in order, you can start playing offense. This means looking ahead and making strategic moves to optimize your tax position, not just adding up the numbers after the year is over.

One of the most powerful techniques is timing your capital gains. Let’s say you have a large amount of investment interest expense that looks like it will exceed your net investment income for the year. You could consider selling some assets to realize short-term capital gains before December 31. Doing this intentionally boosts your net investment income, allowing you to deduct more of that interest expense right now instead of carrying it forward.

It's also smart to regularly evaluate your entity structure. The setup that worked when you started might not be the most tax-efficient structure for you today. As your portfolio grows and your strategy evolves, a periodic review with your tax advisor can reveal whether moving assets into a partnership or trust could open up new deductions. This is especially critical for investors whose investment expenses are tax deductible only when managed through a formal business entity.

Frequently Asked Questions

It's easy to get tangled up in the rules for deducting investment expenses. Let's clear up some of the most common questions investors ask, so you can get a better handle on what you can—and can't—claim.

Can I Deduct Fees Paid to My Financial Advisor or Robo-Advisor?

For individual investors, the short answer is no, not right now. The Tax Cuts and Jobs Act (TCJA) hit the pause button on all miscellaneous itemized deductions, and that’s exactly where fees for financial planners, wealth managers, and even robo-advisors fall. This suspension is in effect through 2025.

But here's where it gets interesting. If a trust, an estate, or a business entity like an LLC or corporation pays those same fees, the story changes. For them, these costs can often be deducted as a necessary expense of running the business or administering the trust. This is a perfect example of how your legal structure can be the deciding factor in whether investment expenses are tax deductible.

Is the Interest on a Loan to Buy Municipal Bonds Tax-Deductible?

No, you can't deduct the interest on money you borrow to buy or hold tax-exempt securities, like most municipal bonds. The logic from the IRS is pretty simple: since the income you're earning from the bonds isn't taxed at the federal level, they won't let you get a second tax break by deducting the cost of financing that income.

It's a foundational tax principle—you can't deduct expenses you incurred to generate tax-free income.

Important Reminder: Tracing your loan money is crucial. If you borrow to invest, you have to be able to prove those specific funds were used to buy taxable investments. Only then can you potentially qualify for the investment interest expense deduction.

What Happens If My Investment Interest Expense Is More Than My Net Investment Income?

This is a common scenario. If your deductible investment interest for the year exceeds your net investment income, you can only deduct up to the amount of your income. For instance, if you paid $15,000 in margin interest but only generated $10,000 in net investment income, your deduction for this year is capped at $10,000.

The good news? That extra $5,000 isn't gone for good. You can carry it forward to future tax years, and there's no time limit. This carryforward amount becomes a valuable tool you can use to offset investment income in a future, more profitable year.

At Blue Sage Tax & Accounting Inc., we live and breathe these complex rules to help investors, family offices, and businesses across NYC. Our goal is to move beyond simple tax prep with proactive, year-round planning that minimizes your tax bill and boosts your after-tax returns. Ready to build a smarter tax strategy? Contact us today.