If you want to learn how to reduce business taxes, you have to start at the very beginning—with your business structure and accounting methods. Something as fundamental as choosing to be an S-Corp instead of a sole proprietorship can create massive savings on self-employment taxes. The right entity choice is your gateway to powerful strategies like the qualified business income (QBI) deduction.

Build Your Foundation for Tax Savings

The single most important financial decision you'll make happens right at the start: choosing your legal entity. This isn't just a formality; it dictates how your profits are taxed, which deductions you can claim, and how much personal liability you carry. Getting it wrong can cost you thousands every single year, while the right choice builds a rock-solid foundation for tax efficiency.

Many new entrepreneurs default to a sole proprietorship or a single-member LLC because it's simple. While that ease is appealing, it can lead to a shockingly high tax bill. Why? Because every dollar of net income is subject to self-employment taxes (that’s Social Security and Medicare), which currently sits at a hefty 15.3% on top of your regular income tax.

This is where understanding the S Corporation election becomes an absolute game-changer for so many small businesses I've worked with.

S Corp vs. Sole Proprietorship: A Practical Example

Let's look at a real-world scenario. Imagine Sarah, a marketing consultant in NYC, is having a great year. As a sole proprietor, her business clears $120,000 in net profit. That entire $120,000 is hit with the 15.3% self-employment tax, creating an $18,360 tax bill before she even thinks about federal and state income taxes.

Now, what if Sarah had elected to be taxed as an S-Corp? She could pay herself a "reasonable salary" of $60,000. Only that salary is subject to payroll taxes (the S-Corp version of self-employment taxes). The other $60,000 in profit? That comes to her as a shareholder distribution, which is not subject to self-employment tax.

Just by changing her tax structure, she instantly saved $9,180 in taxes ($60,000 profit x 15.3%). That's a huge win from one smart decision.

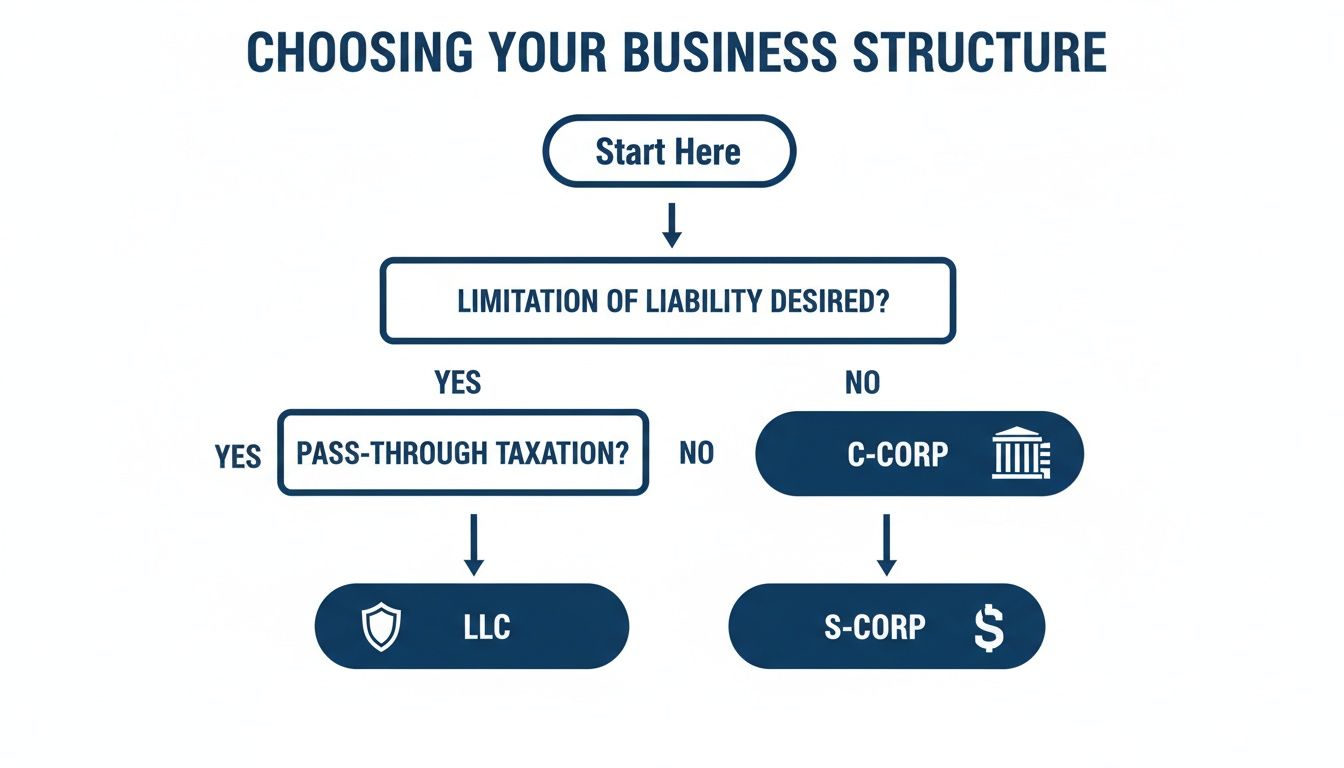

This decision tree can help you visualize how your goals for liability and taxation point toward different structures.

The flowchart makes it clear: your priorities, whether it's protecting your personal assets or optimizing for tax flexibility, should guide you to the right entity.

To make this even clearer, here's a quick rundown of how the main entity types stack up from a tax perspective.

Business Entity Tax Comparison at a Glance

| Feature | Sole Proprietorship / LLC | S Corporation | C Corporation |

|---|---|---|---|

| Taxation Level | Single Taxation | Single Taxation | Double Taxation |

| Tax Filing | Owner's Personal Return | Separate Business Return | Separate Business Return |

| Profit Distribution | Not subject to payroll tax | Not subject to payroll tax | Taxed as dividends |

| Self-Employment Tax | Applies to all net income | Applies to owner's salary | Not applicable |

| QBI Deduction | Potentially Eligible | Potentially Eligible | Not Eligible |

This table is a simplified guide, but it highlights the core differences that can have a massive impact on your bottom line.

The Power of Pass-Through Deductions

On top of the self-employment tax savings, pass-through entities like S-Corps and LLCs often qualify for another huge benefit: the qualified business income (QBI) deduction. This was a centerpiece of the Tax Cuts and Jobs Act (TCJA), which also permanently lowered the corporate tax rate to a flat 21%.

The QBI deduction allows eligible owners to deduct up to 20% of their qualified business income right off the top. This is a massive break that C Corporations simply don't get. For a deeper dive into these tax code changes, the Bipartisan Policy Center has a great breakdown.

Key Takeaway: The QBI deduction is one of the most significant tax breaks for small businesses today. It effectively lowers the top tax rate for many owners, making the choice of a pass-through entity incredibly attractive.

A word of caution, though: the QBI deduction has complex rules. There are income limits and specific qualifications depending on your industry. Service-based businesses, in particular, face much stricter income thresholds.

Why a C Corporation Might Still Make Sense

With all the talk about pass-through entities, it's easy to dismiss the C Corporation. But don't. For certain businesses, it's absolutely the right move, especially if you plan to seek venture capital or retain significant earnings to reinvest back into the company.

C-Corps are taxed separately from their owners, so that lower corporate tax rate can be a big advantage. The major downside is "double taxation"—profits are taxed once at the corporate level and then again when they’re paid out to shareholders as dividends. But a good tax advisor can help you weigh whether the benefits of a C-Corp, like the ability to offer stock options, outweigh that risk for your specific growth plans.

Turn Compensation and Benefits Into Tax Deductions

Payroll is almost always a business's biggest line item. But what if you started looking at it not just as an expense, but as one of your best opportunities for tax savings? With the right strategy, you can turn your compensation and benefits structure into a powerful tool for lowering your taxable income while rewarding yourself and your team.

How you can pull this off really depends on your business entity. For S Corporation owners, in particular, there's a delicate and highly effective dance between salary and distributions.

Balancing Salary and Distributions in an S Corp

If you own an S Corp, the IRS requires you to pay yourself a "reasonable compensation" for the work you do. That salary is hit with the usual payroll taxes—FICA and Medicare—just like any other employee. The real magic, though, comes from what's left over. Any remaining profit can be paid out to you as a shareholder distribution.

Here's the key: distributions are not subject to self-employment or payroll taxes. This single distinction is the heart of the S Corp tax advantage. By setting a reasonable salary—not too high, not too low—you can drastically cut down on the 15.3% self-employment tax bite.

So, what’s "reasonable"? The IRS is intentionally vague, but they look at a few common-sense factors:

- What are your actual duties and responsibilities?

- What do others in similar roles, in your industry and area, get paid?

- What’s your background and experience level?

Be warned: setting your salary artificially low is a huge red flag that can trigger an audit. The goal isn’t to dodge payroll taxes completely. It’s to find a defensible, compliant sweet spot that maximizes your tax savings on the distributions.

Supercharge Your Retirement Savings

Retirement plans are a classic for a reason: they work. Every dollar you contribute for yourself and your employees is a straight deduction from your business's taxable income. Plus, those funds get to grow tax-deferred until you retire. It’s a win-win.

For small business owners, a few plans are particularly powerful:

- SEP IRA (Simplified Employee Pension): This is a go-to for many sole proprietors and small businesses because it's flexible and simple to set up. You can contribute up to 25% of your compensation, with a cap of $69,000 for 2024.

- Solo 401(k): If you're self-employed with no employees (besides a spouse), this is a fantastic tool. You can contribute as both the "employee" and the "employer," which often lets you sock away more than a SEP IRA, especially at lower income levels.

- SIMPLE IRA (Savings Incentive Match Plan for Employees): This is a great choice if you have a small team. It requires either a matching or a non-elective contribution from you, the employer, both of which are fully tax-deductible.

Pro Tip: Many Solo 401(k) plans include a Roth option for your "employee" contributions. This lets you pay taxes on a portion of your savings now in exchange for completely tax-free withdrawals in retirement—a smart way to build tax diversification.

Deducting Health and Wellness Benefits

Health insurance is a hefty expense, but it also packs a major tax punch. While the specifics can change with your business structure, the savings are always there. For S Corp owners holding more than a 2% stake, you can deduct 100% of your health and dental insurance premiums as an above-the-line deduction right on your personal tax return.

Want to take it a step further? Pair a high-deductible health plan (HDHP) with a Health Savings Account (HSA).

An HSA is a triple tax-advantaged powerhouse:

- Your contributions are tax-deductible, immediately lowering your taxable income.

- The money grows tax-free inside the account.

- Withdrawals are tax-free when used for qualified medical expenses.

For 2024, you can contribute up to $4,150 to an HSA for an individual or $8,300 for a family. This gives you another powerful way to pay for healthcare with pre-tax dollars while simultaneously building a tax-free investment account for your future medical needs.

Master the Timing of Your Income and Expenses

Sometimes, the most powerful tax strategies aren't about what you buy, but when you buy it. Getting a handle on the timing of your income and expenses is a surprisingly effective way to manage your tax bill from one year to the next. It gives you a level of control that many business owners overlook.

It all starts with your accounting method.

Most small businesses I work with use the cash basis method. It’s wonderfully straightforward: you record income when the money hits your bank account and expenses when the money leaves. Simple. This simplicity is also its greatest strength for tax planning, as it gives you direct levers to pull at year-end.

The other option is the accrual basis. Here, you recognize income when you earn it (like when you send an invoice) and expenses when you incur them, regardless of when cash actually changes hands. While it can give a truer picture of your company's financial health, the cash method is usually the more flexible tool for proactive tax planning.

Making Smart Moves Before the Ball Drops

If you're on the cash method and you’re looking at a high-income year, the fourth quarter is your time to shine. The game plan is simple: legally pull forward deductions into this year and, where it makes sense, push income into next year.

Here are some classic, actionable moves to make before December 31st:

- Prepay Your Bills: Got rent due for January? An annual software subscription coming up? Pay them in December. The IRS generally allows you to prepay and deduct expenses so long as the benefit doesn't last more than 12 months.

- Stock Up on Supplies: Go on that supply run now. Whether it’s office supplies, raw materials, or inventory, buying what you know you'll need in December instead of January locks in the deduction for the current year.

- Clear Your Payables: Don’t let outstanding bills from vendors, contractors, or utilities sit until the new year. Paying them off before the calendar flips solidifies those deductions on this year's tax return.

The Art of Deferring Income

Just as you can pull expenses forward, you can also push income back. If you run a service business, you could finish a project in late December but hold off on sending the invoice until January. This effectively moves that payment—and the taxable income it represents—into the next calendar year.

Key Insight: This isn't about hiding money. It’s about legally controlling when you recognize it for tax purposes. Deferring income is a brilliant move if you anticipate being in a lower tax bracket next year or need to keep your income below certain thresholds to qualify for other tax breaks.

Of course, this requires a bit of foresight. You have to make sure you won’t create a cash flow crunch for your business. But when you get it right, the tax savings can be significant.

A Real-World Example: A Freelancer’s Year-End Hustle

Let’s see how this works in the real world. Meet Alex, a freelance graphic designer who uses cash-basis accounting. By November, Alex realizes this has been a banner year—so good, in fact, that it’s about to bump them into a much higher tax bracket.

Here’s how Alex smartly uses timing to slash their tax bill:

- Delayed Invoicing: Alex finishes a big project on December 20th, worth $10,000. Instead of invoicing right away, they wait until the first week of January. The client pays later that month, successfully shifting that $10,000 of income into the next tax year.

- Accelerated Expenses: The business needs a new high-end computer and monitor setup, which will cost $5,000. Alex buys it on December 28th and puts it on the business credit card. Even though the bill isn’t due until January, the expense was made in the current year, making it deductible now.

- Prepaid Subscriptions: Alex’s full suite of design software is up for renewal. Instead of waiting, they pay the $2,400 annual fee in December, deducting the entire amount this year.

By pushing $10,000 of income into next year and pulling $7,400 of expenses into this year, Alex just created a $17,400 swing in their taxable income. That one move could easily save them thousands in federal and state taxes for their high-profit year.

Find Hidden Savings in Tax Credits and Depreciation

Beyond the usual deductions, there’s a whole world of powerful tax-saving tools that many business owners assume aren't for them. Tax credits and aggressive depreciation strategies aren't just for the big corporations. In my experience, they are some of the most effective ways for closely held businesses to slash their tax liability and seriously boost cash flow.

Too many entrepreneurs I talk to think these incentives are out of reach. But learning how to reduce business taxes means you have to actively hunt for these opportunities. A tax credit is a dollar-for-dollar reduction of your tax bill, which makes it far more valuable than a simple deduction.

Unlocking the R&D Tax Credit

When you hear "Research and Development," you probably picture scientists in lab coats, but the IRS definition is much broader than you'd think. The R&D tax credit is designed to reward companies for developing new products, improving the ones they already have, or even creating more efficient internal processes.

Think about it this way: Have you spent time and money trying to make your software run faster? Or designing a better manufacturing process? Even testing new recipes for a food product could qualify.

The credit is for any business that tries to eliminate uncertainty through a process of experimentation. This can look like a lot of different things, including:

- Developing or improving software and internal systems.

- Engineering new product prototypes or formulations.

- Creating more efficient or environmentally friendly manufacturing processes.

- Testing new materials to improve a product's performance.

I've seen businesses in software, manufacturing, architecture, and even food production qualify without ever realizing it. The savings can be huge, giving you a powerful tool to reinvest right back into your company's growth.

Supercharge Write-Offs with Accelerated Depreciation

Depreciation is just the process of writing off the cost of an asset over its "useful life." But why wait years to get that tax benefit? Accelerated depreciation methods let you deduct a massive chunk—or even the entire cost—of an asset in the same year you buy it.

This is an absolute game-changer for managing your taxable income and improving cash flow. When you need to buy a new vehicle, machinery, or computer equipment, these rules can give you what feels like a massive, immediate tax discount on the purchase.

There are two main tools you need to know about here:

- Section 179: This rule lets you expense the full purchase price of qualifying new or used equipment. For 2024, you can deduct up to $1.22 million in qualifying purchases.

- Bonus Depreciation: This allows you to deduct a percentage of the cost of new and used assets in the first year. For 2024, the bonus rate is 60%, which is still a very significant upfront deduction.

By strategically timing your large asset purchases, you can generate enormous deductions to offset high-income years. It puts you in direct control of your tax liability.

Cost Segregation for Real Estate Investors

For property owners, one of the most powerful—and surprisingly underused—strategies is a cost segregation study. When you buy a commercial building, the IRS makes you depreciate it over a painfully long 39 years. A cost segregation study is the key to speeding that up.

The study is an engineering-based analysis that breaks a property down into its individual components. It identifies all the things that can be depreciated much faster—over 5, 7, or 15 years instead of 39. We're talking about things like carpeting, specialty lighting, landscaping, and even electrical systems tied to specific equipment.

By reclassifying these assets, you accelerate your depreciation deductions and push massive tax savings into the early years of owning the property. It's a fundamental strategy for any serious real estate investor looking to maximize returns and free up capital.

Let's look at how this plays out in a real-world scenario for an NYC property owner.

Example: A Brooklyn Office Building

Imagine you buy a small office building in Brooklyn for $2 million (after backing out the land value). Without a cost segregation study, your annual depreciation deduction is a straight line: roughly $51,282 ($2M / 39 years).

Now, let's say a cost segregation study finds that 30% of the building's cost ($600,000) can be reclassified into shorter-life assets.

- $200,000 in 5-year property (carpeting, specialty fixtures)

- $400,000 in 15-year property (site improvements like parking lots, specialized plumbing)

By front-loading the depreciation on that $600,000, your deductions in the first few years could jump by hundreds of thousands of dollars. This creates a huge immediate tax deferral, freeing up a ton of cash that you can use for renovations, other investments, or paying down debt. If you own commercial or residential rental property, a cost segregation study is a conversation you absolutely need to have.

Thinking Beyond Your State: Multi-State and International Tax Rules

Once your business starts crossing state lines, your tax world gets a lot more complicated. It's no longer just a conversation with the IRS; you're suddenly juggling a whole web of State and Local Tax (SALT) regulations. Learning how to trim your tax bill in this environment means figuring out where you owe, why you owe, and how to slice up your income fairly.

This kind of expansion, whether you’re opening a new office or just selling online to customers in another state, demands a much smarter tax strategy. If you ignore these rules, you could be hit with surprise tax bills, penalties, and interest years down the road.

Getting a Handle on State and Local Tax (SALT)

The first concept you need to get your head around is nexus. It sounds technical, but it’s just the legal term for having a connection to a state that’s strong enough for them to demand you collect and pay their taxes. Think of it as the tripwire that pulls you into a state's tax system.

A decade ago, nexus was mostly about boots on the ground—an office, a warehouse, or an employee. But the rise of e-commerce changed the game completely. The new standard is "economic nexus," which means you can trigger a tax obligation in a state just by hitting a certain threshold of sales or transactions there, even without a single physical asset in that state.

Once you have nexus, you can't just pay tax on your total income to every state. That would be a recipe for disaster, leading to crushing double taxation. Instead, you need to allocate or apportion your income.

- Allocation is generally for non-business income. You assign it to one specific state. A classic example is rental income from a property—it gets allocated to the state where the property is located.

- Apportionment is for your main business income. You use a formula to divide the profit pie among the states where you operate. Most states use a formula that looks at your proportion of sales, property, and payroll in that state.

Nailing this apportionment is crucial. If you apportion too much income to a high-tax state like New York or California, you’re just giving away money. But if you under-apportion, you’re waving a red flag for an audit.

A Real-World SALT Scenario for an NYC Business

Let's imagine a growing e-commerce business based in Manhattan that sells high-end home goods. All its people and its warehouse are in New York. But they've built a great customer base in neighboring New Jersey and Connecticut, generating over $200,000 in sales in each of those states.

Because of economic nexus rules, that business now has to file tax returns in all three states. A savvy SALT advisor would step in and apply each state's unique apportionment formula to divide the company's net income correctly. This ensures they don't overpay New York while still staying compliant with New Jersey and Connecticut.

The Bottom Line: Proactively tracking your sales on a state-by-state basis isn't just good practice anymore—it's essential. Knowing the nexus thresholds for different states can save you from a nasty surprise tax notice from a place you never even considered a business risk.

Taking Your Tax Strategy Global

For businesses operating internationally, the complexity—and the stakes—are even higher. Smart international tax planning is all about strategically managing how and where your income is recognized to lower your global effective tax rate. This often brings complex concepts like transfer pricing and intellectual property (IP) placement into play.

Transfer pricing is about the prices that related companies within the same multinational group charge each other. For example, a U.S. parent company might have an Irish subsidiary handle all European sales. The price that the Irish entity "pays" the U.S. parent for the products is the transfer price.

Regulators worldwide are cracking down on aggressive transfer pricing. From 2016 to 2021, an estimated $1.7 trillion in tax revenue was lost globally to corporate tax abuse, often from companies shifting profits to low-tax jurisdictions. A common strategy involves parking valuable IP in a country like Ireland, with its attractive 12.5% corporate tax rate, to dramatically reduce the overall tax hit. You can explore some of the fascinating data on these strategies in the findings on international tax justice.

Be warned, though: this is a high-risk game. Tax authorities insist that these internal transactions happen at "arm's length," meaning the price must be what two completely unrelated companies would agree to. Getting transfer pricing wrong can lead to severe penalties and long, draining disputes with tax agencies in multiple countries. This is definitely not a DIY project; navigating multi-state and international rules requires expert guidance to stay compliant while truly optimizing your tax position.

Answering Your Top Questions About Business Taxes

When it comes to cutting your tax bill, a lot of specific questions come up. Let's tackle some of the most common ones I hear from business owners, with straight-to-the-point answers you can actually use.

When Should I Really Be Thinking About Tax Planning?

Look, tax planning is an all-year game, but the fourth quarter—from October through December—is your Super Bowl. This is your last real chance to make moves that count for the current tax year.

Think of it as your final opportunity to prepay some key expenses, buy that piece of equipment you need to lock in depreciation, or maybe push some income into next year. For example, if you're a cash-basis business, paying your January rent in late December is a classic move to pull that deduction forward.

Staying on top of your numbers all year means you can make these decisions thoughtfully instead of scrambling in a panic. That's the difference between reactive tax filing and strategic tax planning.

I'm an S-Corp Owner. How Do I Deduct My Home Office?

Yes, you absolutely can, but it's not as simple as it is for a sole proprietor. You can't just take the deduction on your personal 1040. Instead, you need to do it the right way through an accountable plan.

It’s a formal process, but it’s straightforward:

- First, you calculate your home office costs—the business-use percentage of your mortgage interest, utilities, insurance, and so on.

- Next, you submit these expenses to your S-Corp, just like any employee would with an expense report.

- The corporation then reimburses you for these exact costs.

The beauty of this is that the S-Corp gets to deduct the reimbursement as a business expense, and that money comes to you 100% tax-free. It's the clean, IRS-approved way to handle it and keeps your business and personal finances properly separated.

What Really Catches the IRS's Eye and Triggers an Audit?

The IRS uses powerful software to flag returns that stick out from the norm for a given industry. The goal isn't to be invisible, but to have your books so well-kept that you can defend every single number if they ever ask.

Here are some of the classic red flags I see get people into trouble:

- Showing big losses year after year: If your business consistently loses money, the IRS might start to wonder if it’s a legitimate business or more of a hobby you’re trying to write off.

- Claiming unusually high deductions: If your travel and meal expenses are double what other businesses your size and in your industry are claiming, you can bet it will raise an eyebrow.

- Sloppy bookkeeping: Mixing personal and business expenses is one of the oldest mistakes in the book. A dedicated business bank account and credit card aren't optional; they're essential.

- Mismatched income reports: When the income you report doesn't line up with the 1099s that have been filed under your tax ID, it’s an easy trigger for an automated IRS notice.

- Fumbling payroll taxes: The IRS does not mess around with payroll. Any errors or late payments are seen as a serious issue and can signal deeper financial problems.

Your best defense against an audit is simple: airtight, meticulous records. When you can back up every deduction and clearly separate your business and personal spending, you’re building a fortress around your finances. Good financial hygiene isn't just about saving on taxes—it's about managing risk.

Ready to stop guessing and start building a real tax strategy for your business? At Blue Sage Tax & Accounting Inc., we specialize in helping NYC businesses and investors create proactive plans that reduce their tax burden and strengthen their bottom line. Let's start a conversation about your financial future at bluesage.tax.