Avoiding double taxation isn't about finding some obscure loophole; it’s about smart, proactive planning. It really comes down to structuring your business correctly from the start, taking full advantage of available tax credits, and understanding how international treaties can work in your favor. Once you know where the risks are, you can build a strategy to keep your income from being taxed twice.

What Is Double Taxation and Why Does It Matter?

At its core, double taxation is a simple but costly problem: the same dollar gets taxed more than once. This can seriously eat into your profits and investment returns, which is why it's such a critical issue for businesses and individuals alike. While the concept sounds technical, it usually pops up in three common situations.

The Three Faces of Double Taxation

Each type of double taxation comes with its own set of challenges, but they all lead to the same outcome—a bigger tax bill than you should be paying. Getting a handle on these scenarios is the first step to protecting your money.

Corporate Double Taxation: This is the one most people have heard of, and it’s a classic C-corporation issue. The corporation first pays federal income tax (currently at a flat 21%) on its profits. Then, when it passes those profits on to shareholders as dividends, the shareholders have to pay personal income tax on that very same money. It's a one-two punch.

Multi-State Double Taxation: If you or your business have financial ties to more than one state, you’ve likely run into this. Think of a consultant based in New York who takes on a big project for a client in New Jersey. It's not uncommon for both states to want a piece of the action, each claiming the right to tax the income from that project.

International Double Taxation: U.S. citizens and residents are taxed on their worldwide income, which sets the stage for this problem. If you earn money from another country—say, dividends from a foreign stock or rental income from a property you own overseas—that country will probably tax it first. Then, the IRS expects you to report and pay tax on it again.

Here's a quick, real-world example: Picture a real estate developer in Queens who set up their business as a C-corp. The company pulls in $500,000 in profit and pays $105,000 in corporate taxes. The owner then takes the remaining $395,000 as a dividend, only to get hit with another $140,000+ in personal income tax. That original profit got taxed twice, taking a huge bite out of what they actually get to keep.

The Financial Impact Is Significant

This layering of taxes is more than just a headache. It can stifle a company's growth, make investors think twice, and create a compliance nightmare. For a small, closely-held business, it can be the difference between reinvesting in new equipment and just scraping by. For an individual, it can make a promising international investment barely worth the effort.

The good news? You're not stuck. Every one of these scenarios has a well-established strategy to either minimize the damage or avoid it completely. From choosing a pass-through entity like an S-corp or LLC to claiming the Foreign Tax Credit, the tools are there. The trick is to get ahead of the problem before it hits your tax return.

To give you a clearer picture, here's a quick rundown of these common scenarios and the go-to solutions for each.

Common Double Taxation Scenarios and Solutions

| Type of Double Taxation | Who It Affects Most | Primary Avoidance Strategy |

|---|---|---|

| Corporate | C-corporations and their shareholders | Electing S-corp status or structuring as an LLC/partnership to allow profits to "pass through" directly to owners, taxed only once. |

| Multi-State | Individuals working or businesses operating in multiple states | Claiming a tax credit on your resident state tax return for taxes already paid to another (non-resident) state. |

| International | U.S. citizens/residents with foreign-sourced income | Claiming the U.S. Foreign Tax Credit (FTC) or using provisions within existing international tax treaties to reduce U.S. tax liability. |

This table is just a starting point, of course. The best strategy for you will always depend on the specifics of your financial situation, but it helps to see how these problems and their solutions line up.

Choosing Your Business Structure Wisely

Before you even think about complex credits or international tax treaties, your most powerful move to avoid double taxation happens right at the beginning. It's the foundational decision of choosing your business's legal entity. This is your first and, frankly, best line of defense against the classic domestic double-tax trap.

This isn't just about registering a business name; it's about dictating how the IRS will treat every dollar you earn. The critical fork in the road is the choice between a C-corporation and a "pass-through" structure. That single decision determines whether your profits get taxed once or twice.

C-Corps: The Default Double Taxation Model

When you form a corporation and don't make a special tax election, it defaults to a C-corporation. Many companies aiming for venture capital funding go this route, but it comes with a major tax headache.

First, the C-corp itself pays corporate income tax on its net profits. Then, when the company distributes those after-tax profits to you and other shareholders as dividends, you get taxed again on your personal tax return. It’s the textbook definition of the same dollar being taxed at both the corporate and individual levels.

Pass-Through Entities: The Single-Tax Solution

To sidestep that problem entirely, most entrepreneurs and investors I work with opt for a pass-through entity. These structures don't pay any corporate income tax. Instead, all profits and losses are "passed through" directly to the owners, who then report them on their personal tax returns. The income is only taxed once, period.

The most common pass-through structures are:

- S-Corporations (S-corps): An eligible domestic corporation can file an election to be treated as an S-corp. This allows profits to pass directly to shareholders, who then pay tax at their individual rates.

- Limited Liability Companies (LLCs): An LLC gives you the liability protection of a corporation but is usually taxed like a partnership or sole proprietorship by default. This blend of protection and tax simplicity makes it incredibly popular.

- Partnerships: Just like an LLC, a partnership’s income flows straight through to the partners’ personal returns.

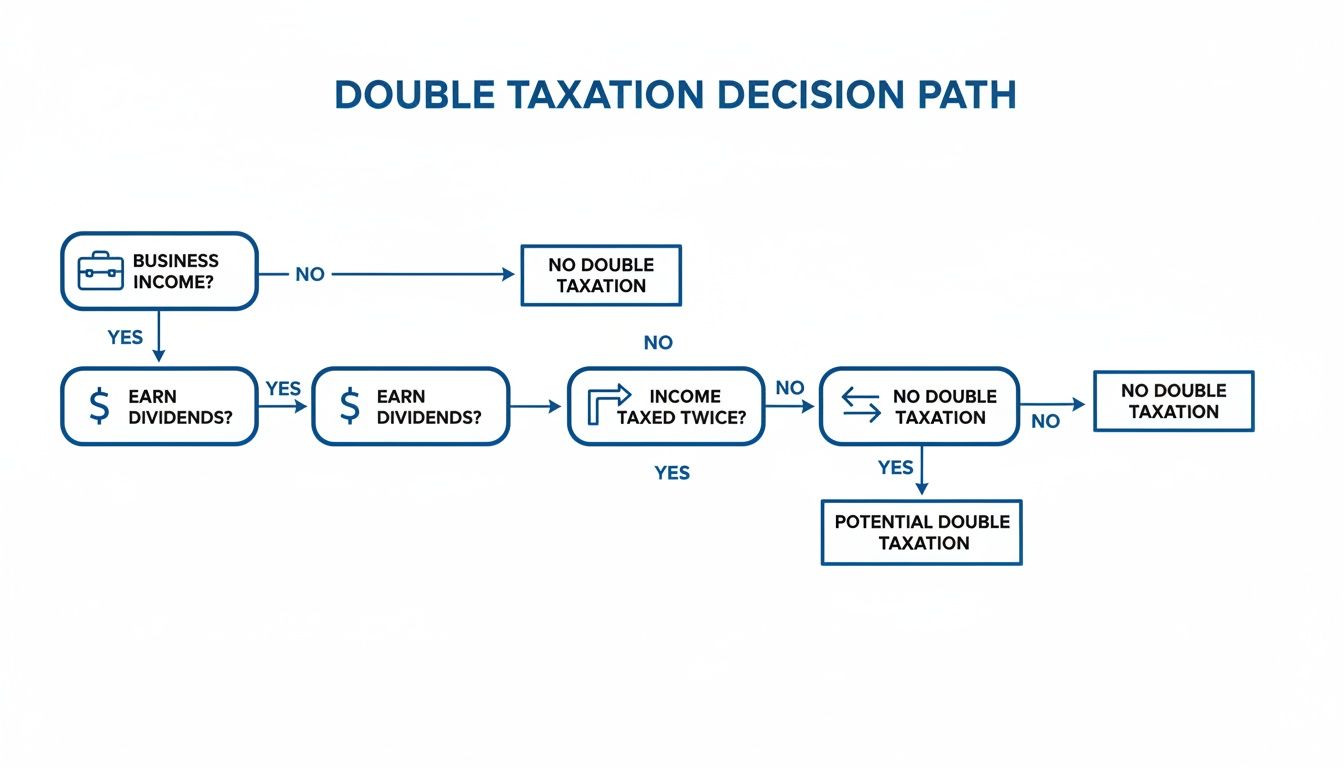

This decision tree gives you a clear visual of how business income flows and, more importantly, where that second layer of tax kicks in.

As the chart shows, it's only the C-corporation path, specifically when it distributes dividends, that leads to double taxation.

Real-World Scenarios and Entity Choice

The "best" structure is never one-size-fits-all; it depends entirely on your goals.

I've seen tech startups that need to be a C-corp to attract venture capitalists. Their strategy? They simply delay paying dividends for years, reinvesting every dollar of profit back into growth. This defers that second layer of tax until a future date.

On the other hand, a family I advised on setting up a real estate portfolio was a perfect fit for an LLC. This structure shields their personal assets from business liabilities while letting all the rental income pass through to be taxed just once on their personal returns. They completely sidestepped the C-corp tax hit.

Key Takeaway: For most small business owners, consultants, and investors, choosing a pass-through entity like an S-corp or an LLC is the most straightforward and effective way to prevent profits from being taxed at both the corporate and personal levels.

The Flexibility of a "Check-The-Box" Election

What if your business is already an LLC, but your needs have changed? The IRS offers a surprisingly powerful tool called the "check-the-box" election via Form 8832. This allows certain entities, like LLCs, to simply choose how they want to be classified for federal tax purposes.

An LLC with multiple owners can elect to be taxed as a corporation (either a C-corp or, by filing another form, an S-corp), or it can just stick with its default partnership status. This flexibility is invaluable, as it lets your business adapt its tax strategy as its financial situation and ownership evolve.

This kind of structural planning is a proven way to minimize tax burdens. For instance, in New York City, it's common for family offices to use a network of pass-through entities to manage multi-state assets. This helps them avoid the brutal combined federal and state corporate double tax hit, which can easily exceed 30% when you add New York's corporate tax to the 21% federal rate. You can even see how global companies apply similar strategies by reviewing IRS statistics on controlled foreign corporations.

Tackling Multi-State Tax Challenges

Running a business across state lines is a fantastic way to grow, but it also throws a major wrench into your tax planning: the risk of multi-state double taxation. When you have a footprint in more than one state, you can quickly find yourself paying taxes on the same income to multiple jurisdictions. This is exactly why a smart State and Local Tax (SALT) strategy isn't just a good idea—it's essential.

The whole issue boils down to a concept called nexus. In simple terms, nexus is just a connection between your business and a state that's significant enough to give that state the right to tax you. Once you establish nexus, you're on the hook for collecting sales tax and paying income tax there.

How You Create Nexus (Sometimes Without Realizing It)

For the longest time, nexus was all about physical presence. If you had an office, an employee, or a stash of inventory in a state, you had nexus. That’s still very much true, but the game has completely changed.

Thanks to the landmark 2018 Supreme Court decision in South Dakota v. Wayfair, Inc., states can now establish nexus based on your economic activity alone, even if you don’t have a single boot on the ground. This is called economic nexus.

- Physical Nexus: This is the old-school trigger. Think a physical office, a warehouse, a storefront, or even just one remote employee working from their home office in another state.

- Economic Nexus: This is the new standard, and it's based on sales volume or the number of transactions. For instance, a state might declare you have nexus if you clear $100,000 in sales or conduct 200 separate transactions with its residents in a year.

What this means for modern businesses, especially e-commerce sellers, is that you can now have tax obligations in dozens of states without ever physically going there.

Apportionment and Credits: Your Two Best Friends in SALT

So, if you have nexus in multiple states, how do you keep from paying tax on 100% of your income in every single one? Thankfully, states have mechanisms to prevent this, primarily through apportionment and tax credits.

Apportionment is the formula states use to divvy up your business income. Instead of each state taxing your entire net profit, they only get to tax their fair share—their "slice of the pie." This slice is typically calculated based on a combination of your company's property, payroll, and sales within that state.

For example, if 20% of your sales come from New Jersey and 15% of your payroll is based there, the state won't tax your total income. It will only tax a portion that reflects your business activity within its borders.

The Key Takeaway: For an individual, the most direct path to avoiding double taxation across states is by claiming a credit for taxes paid to another state. Your home state (where you're a resident) will almost always give you a credit for the income taxes you were required to pay to a non-resident state on that same income.

A Real-World Example: The Tri-State Consultant

Let's look at a marketing consultant who lives in New York City. She’s successful and has clients all over the tri-state area, earning a good portion of her income from projects in New Jersey and Connecticut.

Without proper planning, she's facing a nightmare scenario where all three states want to tax the same pool of money. Here’s how she fixes it:

First, she files non-resident tax returns in New Jersey and Connecticut. On these returns, she only reports and pays tax on the income she specifically earned from work performed in each of those states.

Next, when she files her resident tax return in New York, she claims a tax credit for the amount she already paid to New Jersey and Connecticut. This credit acts like a coupon, directly reducing her New York tax liability and ensuring her out-of-state earnings aren't taxed twice.

The Critical Difference Between Residency and Domicile

Things get particularly tricky for people who own homes or spend significant time in multiple states. You can have several residences, but you are only allowed one domicile—your true, fixed, permanent home. The state where you are domiciled has the right to tax your entire income, from all sources, worldwide.

Establishing a single, unambiguous domicile is absolutely crucial. States look at a whole host of factors to figure this out, including:

- Where you spend the most time throughout the year.

- The center of your financial and personal life (family, banks, doctors, clubs).

- Where you’re registered to vote and have your driver's license.

If you don't make your domicile crystal clear, you can end up in a drawn-out and expensive battle with two states that both claim you as a resident. It’s a double taxation trap you definitely want to avoid.

Using Foreign Tax Credits for Global Investments

Expanding your investments beyond U.S. borders opens up a world of opportunity, but it also means wading into the tricky waters of international double taxation. This is a classic problem: a foreign country taxes your investment income, and then Uncle Sam wants his share of the very same income. Thankfully, the U.S. tax code has a powerful tool designed for this exact scenario: the Foreign Tax Credit (FTC).

Let's be clear—this isn't just a deduction that chips away at your taxable income. The FTC is a dollar-for-dollar credit, meaning it directly reduces your final U.S. tax bill. It’s the primary mechanism to ensure you aren't penalized for investing globally.

How the Foreign Tax Credit Works

Think of the FTC as a shield against paying tax twice. For every dollar of eligible income tax you pay to a foreign government, you can potentially claim a one-dollar credit against your U.S. income tax on that same foreign income.

From a practical standpoint, corporations claim these credits using Form 1118, while individuals and trusts will use Form 1116. The concept sounds simple enough, but the calculations and limitations can get complex in a hurry, especially with recent tax law changes.

Navigating Recent Tax Law Changes

The landscape for international tax shifted dramatically with the Tax Cuts and Jobs Act (TCJA) of 2017. The law lowered the U.S. corporate tax rate but also changed how foreign income is treated, introducing rules around Global Intangible Low-Taxed Income (GILTI) that often came with a "haircut" on related foreign tax credits.

This change often left businesses unable to fully offset their U.S. tax liability on foreign earnings. However, tax laws are anything but static. Recent legislative proposals aim to adjust these rules, recognizing the FTC as a critical tool for U.S. businesses expanding abroad. IRS data from Form 1118 shows U.S. corporations claimed billions in foreign tax credits, and upcoming changes could make this strategy even more valuable. For a deeper dive, it's worth exploring the future of international tax policy and how these shifts might impact your strategy.

A Practical Example of the FTC in Action

Let’s see how this plays out in a real-world scenario. Imagine a U.S.-based family office holds a significant stake in a German manufacturing company.

- This year, the family office receives $200,000 in dividends from its German shares.

- Under the U.S.-Germany tax treaty, Germany withholds tax at a 15% rate. So, $30,000 in taxes is paid to the German government before the cash ever hits the U.S.

- That same $200,000 dividend is also subject to U.S. income tax. Let's assume the applicable U.S. tax rate creates a potential U.S. tax bill of $47,600 on that income.

Without the FTC, the family office would be taxed twice on the same income stream. But by filing the appropriate forms, they can claim a $30,000 credit for the taxes already paid to Germany.

This credit directly slashes their U.S. tax liability. Instead of owing $47,600 to the IRS, their final U.S. tax bill on that dividend is just $17,600. The FTC completely neutralized the double tax hit.

The Bottom Line: The FTC ensures your total tax paid on foreign income (across both countries) generally doesn't exceed the tax rate of whichever country's is higher. It turns a punishing tax outcome into a manageable one, encouraging international investment.

Key Considerations for Claiming the Credit

While powerful, the FTC isn't a free-for-all. There are rules, and the IRS watches them closely.

The most important limitation is that the credit can't exceed the U.S. tax you would have owed on that foreign income anyway. You can't use excess foreign tax credits to wipe out taxes on your U.S.-sourced income.

It's also crucial to know that not all foreign taxes qualify. The credit applies specifically to income, war profits, and excess profits taxes. It won’t cover other levies like value-added taxes (VAT), property taxes, or sales taxes. Careful planning is the only way to maximize this credit and avoid any unwelcome surprises come tax time.

How Tax Treaties Reduce Your Cross-Border Burden

While the Foreign Tax Credit is your go-to for directly offsetting U.S. taxes, it’s not the only tool in your international tax kit. Another critical layer of protection comes from tax treaties—these are formal agreements between two countries designed for one primary purpose: to keep the same dollar from being taxed twice.

Think of these treaties as the established rules of the road for cross-border business. They clearly define which country gets to tax what, sort out complex residency issues, and even provide a framework for resolving disputes. For anyone operating internationally, they create a much more predictable and fair tax environment.

The Biggest Win: Slashing Withholding Tax Rates

One of the most immediate and powerful benefits of a tax treaty is its ability to lower, or even eliminate, withholding tax rates. When you earn passive income like dividends, interest, or royalties from another country, that country’s government will typically take a bite first. This withholding can be as high as 30%, right off the top.

A tax treaty can change that picture dramatically. Depending on the specific agreement, that 30% withholding on dividends might drop to 15%, 5%, or sometimes lower. For certain types of interest and royalties, many treaties wipe out the withholding tax entirely.

This isn't just a minor tweak—it's a game-changer for your cash flow. You get more of your money upfront instead of having to wait months to claim it back as a credit on your U.S. return.

This is a cornerstone strategy for any business repatriating earnings. With over 3,000 bilateral agreements in effect globally, and the U.S. having treaties with over 60 countries, there's a good chance one can help you. For a deeper dive into how these agreements promote global tax certainty, check out the latest statistics from the OECD on resolving international tax disputes.

A Real-World Example: Licensing Software Abroad

Let's see how this works in practice. Imagine a New York-based software developer licenses her platform to a company in Ireland, a country that has a solid tax treaty with the U.S.

- Without a Treaty: Ireland's standard withholding tax on royalties might be 20%. On a $100,000 licensing fee, the Irish company would withhold $20,000 and send her only $80,000. She’d have to wait to reclaim that $20,000 via the Foreign Tax Credit.

- With the Treaty: The U.S.-Ireland tax treaty completely eliminates withholding tax on royalties. By properly claiming her treaty benefits, she gets the full $100,000. No waiting, no hassle.

That’s a massive difference. The treaty keeps her cash from being tied up with a foreign tax agency, freeing up capital she can reinvest in her U.S. business right away.

A Safety Net for Tax Disputes

But what if tax authorities in two different countries can’t agree on how to tax your income? This is where another key treaty provision, the Mutual Agreement Procedure (MAP), becomes your safety net.

MAP is basically a dispute resolution channel. It empowers the tax authorities of the two treaty countries—the "competent authorities"—to talk directly with each other to solve the problem and ensure you’re not caught in the crossfire. It’s a formal, government-to-government process for untangling complex cross-border tax conflicts.

Claiming treaty benefits isn't automatic. You have to be proactive. This usually means filing a Form W-8BEN (for individuals) or W-8BEN-E (for entities) with the foreign company paying you to certify your U.S. tax residency. If you skip this step, you’ll get hit with the higher, default withholding rates.

Tax treaties aren't just dense legal documents for tax lawyers. They are practical, powerful tools that provide certainty, reduce the immediate tax bite on your foreign income, and offer a crucial backstop when things get messy. Understanding how to use them is a non-negotiable part of any smart international tax strategy.

Common Questions on Double Taxation

Even with the best planning, a few common questions always seem to pop up when business owners and investors are trying to sidestep the double tax trap. Let's tackle some of the most frequent ones I hear from clients.

Does an S-Corp Election Solve All My Double Taxation Problems?

Making the S-corp election is a fantastic move to eliminate the classic double tax hit at the federal level for C-corps. It lets profits flow through to you, the shareholder, to be taxed just once on your personal return. It’s a game-changer.

But it’s not a magic wand. An S-corp can still get tangled up in state-level double taxation if you’re not careful with your SALT (State and Local Tax) planning. If your business has a physical presence or significant sales in multiple states, you could be facing a complicated web of state tax filings.

On top of that, some places, like New York City, hit S-corps with their own entity-level tax. So, while an S-corp election is a crucial first step, it’s just one piece of a much larger puzzle.

Can I Claim the Foreign Tax Credit for Any Tax I Pay Abroad?

This is a big one, and getting it wrong can be costly. The Foreign Tax Credit (FTC) is specifically for income, war profits, and excess profits taxes. It’s not a catch-all for every fee you pay to another government.

You can't claim a credit for things like:

- Value-Added Taxes (VAT)

- Sales taxes

- Property taxes

- Customs duties

- Other non-income-based fees

The tax also has to be a legitimate, non-refundable liability. The IRS has very strict definitions here. It’s absolutely critical to verify that a foreign tax actually qualifies before you try to claim the credit.

My Advice: Never assume a tax you paid overseas is eligible for the FTC. This is a technical area where professional confirmation isn't just helpful—it's essential for a solid international tax strategy.

Is Double Taxation Really a Concern if My Business Is Purely Domestic?

Absolutely. You don't need a passport to face a double tax burden. The most common offender right here at home is the standard C-corporation.

Think about it: the corporation’s profits get hit with the 21% federal corporate tax first. Then, when those after-tax profits are paid out to shareholders as dividends, they get taxed again on the shareholders' personal returns.

And that’s not all. Even if you only operate within the U.S., you can run into multi-state tax problems. If you have remote employees, store inventory, or just make enough sales in different states, you can create "nexus." Without smart planning, you could find yourself paying income tax on the same dollar of profit to more than one state—another painful form of domestic double taxation.

When Would a C-Corporation Be a Better Choice, Despite the Tax Risk?

It sounds counterintuitive, but sometimes the C-corp structure is the smartest strategic choice, even with the double taxation risk. The decision really comes down to your long-term vision for the business.

A C-corp often makes more sense if:

- You're chasing venture capital. Most VC funds are legally unable to invest in S-corps, making a C-corp a non-negotiable for many high-growth startups looking for that kind of funding.

- You plan to reinvest heavily. C-corps let you plow earnings back into the business at the lower corporate tax rate. This can fuel growth much faster than if you had to distribute profits and pay personal income tax on them.

- You need different classes of stock. C-corps can issue preferred stock and other complex share structures, which is vital for attracting sophisticated investors who want different rights and returns.

- You want to offer robust fringe benefits. A C-corp can often provide better tax-advantaged benefits, like health insurance, to owner-employees than pass-through entities can.

In these cases, the long-term strategic advantages can easily outweigh the potential for double taxation down the road.

Working through the maze of entity selection, state nexus rules, and international tax law is tough, but you don’t have to go it alone. The experts at Blue Sage Tax & Accounting Inc. specialize in building forward-looking strategies that minimize your tax bill and bring clarity to your finances. Schedule a consultation today to build a tax plan that protects your profits and fuels your growth.