The Section 179 deduction is one of the most powerful tools in the tax code for businesses. It lets you write off the entire purchase price of qualifying equipment and software in the year you buy it and start using it.

Instead of chipping away at the cost over several years through depreciation, you get the full tax benefit right away. This can dramatically accelerate your tax savings and give your cash flow a serious boost.

What Is the Section 179 Deduction?

Let's cut through the tax jargon. At its heart, the Section 179 deduction is designed to do one thing: encourage businesses like yours to invest in themselves. Think of it as an immediate tax break on major business purchases, freeing up capital you can plow right back into growing your company.

This powerful provision allows you to deduct the full expense of a new asset from your gross income in the current tax year, rather than recovering the cost bit by bit over its useful life. For NYC businesses—from tech startups in Brooklyn to real estate developers in Manhattan—this means a significant cut in your taxable income and faster access to the cash you need.

To make this easier to digest, here's a quick overview of the key components.

Section 179 at a Glance

| Component | What It Means for Your Business |

|---|---|

| Immediate Expensing | Deduct 100% of the cost of qualifying equipment and software in the year of purchase. No waiting. |

| Annual Deduction Limit | There's a cap on how much you can deduct in a year ($1.22 million for 2024). |

| Spending Cap | If you spend too much on assets in a year, the deduction starts to phase out ($3.05 million for 2024). |

| "Placed in Service" Rule | The asset must be actively used for business purposes in the same year you claim the deduction. |

| Business Income Limit | Your total deduction can't be more than your net taxable business income for the year. |

This table captures the essentials, but understanding the why behind it is just as important.

Core Purpose and Key Benefits

The main goal behind Section 179 is to get the economy moving. By giving you a big tax incentive upfront, the government is motivating you to buy, finance, or lease the equipment, vehicles, and technology you need now, not later.

Taking advantage of this provides some serious perks:

- Boosted Cash Flow: A lower tax bill means more cash stays in your business. You can use it for operations, expansion, or covering unexpected costs.

- Immediate ROI: The tax savings effectively slash the real cost of your new asset, making it more affordable and shortening the time it takes to see a return on your investment.

- Simpler Record-Keeping: You get to skip the hassle of tracking complex depreciation schedules for any assets you fully expense under Section 179.

How It Differs From Standard Depreciation

Normally, when you buy a major piece of equipment, you have to "capitalize" it. This is the traditional accounting method where you deduct a small piece of the asset's cost each year over its IRS-determined "useful life." This slow-burn process is called depreciation.

For example, a $50,000 machine with a five-year lifespan might only give you a $10,000 deduction each year under standard depreciation rules. It's a long, slow process.

Section 179 flips this model on its head. It lets you take the entire $50,000 deduction in the same year you purchase and start using the machine. The financial impact is much larger and, more importantly, immediate.

This guide will walk you through exactly how it works, who qualifies, and how you can use this powerful deduction to your strategic advantage.

The Evolution of a Powerful Business Tool

To really get a feel for the strategic power of the Section 179 deduction, it helps to understand where it came from. This isn’t some static line item in the tax code; it's a living, breathing tool that’s been shaped over decades by shifts in economic policy and the real-world needs of business owners. Tracing its journey from a minor tax break to a cornerstone of investment planning shows you what it’s really all about.

When it first appeared, Section 179 was a pretty modest affair. It was designed to give small businesses a little nudge, encouraging them to invest in basic equipment. It was useful, sure, but it was a small-potatoes provision that just let you speed up your cost recovery a tiny bit. The thinking was simple: let businesses write off a small chunk of their capital spending right away to get money flowing.

From Modest Beginnings to Major Incentive

For a long time, the deduction limits were… well, limited. The real shift happened when policymakers caught on to its potential as a direct economic stimulus. They realized that instead of waiting years for the slow drip of standard depreciation, businesses could be motivated to make big purchases now if the immediate tax savings were big enough.

That realization kicked off a series of legislative tweaks that steadily pushed the deduction limits higher. Each bump was a clear signal to the business community: go out and invest in technology, machinery, and infrastructure, and we’ll make it worth your while.

The philosophy behind Section 179 is simple but powerful: when businesses invest in themselves, the entire economy benefits. By effectively lowering the price tag on new assets, the government gives companies a powerful reason to expand, hire, and become more efficient.

This change in mindset transformed Section 179 from a simple accounting rule into a serious tool for economic policy.

The Impact of Legislative Milestones

The real earthquake came with major tax reforms, especially the Tax Cuts and Jobs Act (TCJA) of 2017. This law didn’t just nudge the limits; it shot them into the stratosphere. To put it in perspective, the Omnibus Budget Reconciliation Act of 1993 was considered a big deal when it raised the maximum deduction from $10,000 to just $17,500. After TCJA, that limit exploded to $1 million for the 2018 tax year. If you're curious, you can explore a detailed timeline of these legislative changes to see the full progression.

This history isn't just trivia; it's critical for any business owner or investor. It shows that Section 179 is a reliable, consistently supported tool for smart tax planning. The government has shown a clear, long-term commitment to encouraging business investment through this deduction.

Over the years, legislative action has consistently focused on three key areas:

- Increasing the Deduction Limit: This is the headline number—the maximum amount you can expense in a single year.

- Expanding the Spending Cap: This is the total you can spend on new assets before the deduction starts to phase out, dollar-for-dollar.

- Broadening Qualifying Property: The list of what counts has also grown, now including things like off-the-shelf software and even certain improvements to real property.

When you see how these limits have climbed from a mere $10,000 to over $1.2 million today, it becomes clear just how vital this tool is for managing major capital outlays and making strategic year-end decisions.

Understanding the Federal Rules and Limits

To get the most out of Section 179, you first need to get a handle on the federal rules that govern it. Think of these as the guardrails—they define what qualifies, how much you can write off, and what happens if you go over certain spending limits. Mastering these three key limitations is your first step toward making this powerful tax incentive work for you.

At its core, the deduction applies to something the IRS calls “qualifying property.” This isn't some vague concept; it's a specific set of criteria. The good news is that the definition is quite broad, covering a huge range of assets that businesses use every single day.

What Is Qualifying Property?

For an asset to qualify for Section 179, it generally needs to be tangible personal property that you've purchased for active use in your business. One of the best parts? This includes both new and used property, which gives you a ton of flexibility when you're buying assets.

So, what kind of things are we talking about?

- Machinery and Equipment: This is a big category, covering everything from heavy manufacturing equipment to a contractor's tools.

- Business Vehicles: This is a popular one. Heavy SUVs, vans, and trucks with a gross vehicle weight rating over 6,000 pounds fall under more generous rules.

- Office Furniture and Equipment: Desks, chairs, computers, printers—all the standard stuff you need to run an office is fair game.

- Off-the-Shelf Software: If you can buy it in a store or download it online, and it wasn't custom-built for you, it likely qualifies.

There's one crucial rule you can't forget: the "placed in service" requirement. This just means you have to actually start using the asset for your business in the same tax year you claim the deduction. Buying a piece of equipment and letting it sit in the box in a warehouse won't cut it.

The Two Most Important Numbers

Every year, there are two key dollar figures you absolutely have to know for any Section 179 planning. These numbers are indexed for inflation, so they can change. It's critical to work with the current year's limits.

- The Maximum Deduction Limit: This is the absolute ceiling on what you can expense in one year. For 2024, that limit is $1,220,000.

- The Total Investment Phase-Out Threshold: Section 179 is really designed to help small and mid-sized businesses. If your company invests too heavily in new assets, the deduction starts to shrink. For 2024, that phase-out begins once you spend $3,050,000.

Here's how that phase-out works: for every dollar your business spends on qualifying property over the $3,050,000 threshold, your available deduction is reduced dollar-for-dollar. Spend $4,270,000 or more ($3,050,000 + $1,220,000), and your Section 179 deduction for the year is wiped out completely.

This mechanism effectively reserves the full power of the deduction for businesses under the spending cap, while larger enterprises will have to rely on standard depreciation. It's amazing to think that these limits have grown from just $24,000 back in 2002 to over $1 million today. To see just how much it has evolved, you can explore the history of Section 179 limits.

The Business Income Limitation

The last major rule to watch is the business income limitation. This is a simple but important backstop: you can't use the Section 179 deduction to create a business loss. Your total deduction is capped at the net taxable income from your business activities for the year.

Let’s say your business has a net income of $80,000 before taking the deduction. If you bought $100,000 worth of qualifying equipment, you can only deduct $80,000 this year. That remaining $20,000 can't be used to push your income into the red.

But that leftover $20,000 isn't gone for good. Thanks to carryover provisions, you can carry that unused portion forward to the next tax year. This allows you to apply it against future business income, ensuring you eventually get the full tax benefit from your investment.

Comparing Section 179 and Bonus Depreciation

At first glance, Section 179 and bonus depreciation seem like two sides of the same coin. Both let you write off a huge chunk of an asset's cost in the year you buy it, rather than taking small deductions over many years. But they are not the same tool, and knowing when to use each—or both—is where smart tax planning really pays off.

Think of them as two different hammers in your financial toolkit. They both drive nails, but one might be better for precision work while the other is built for heavy-duty demolition. Choosing the right one can make a massive difference to your bottom line.

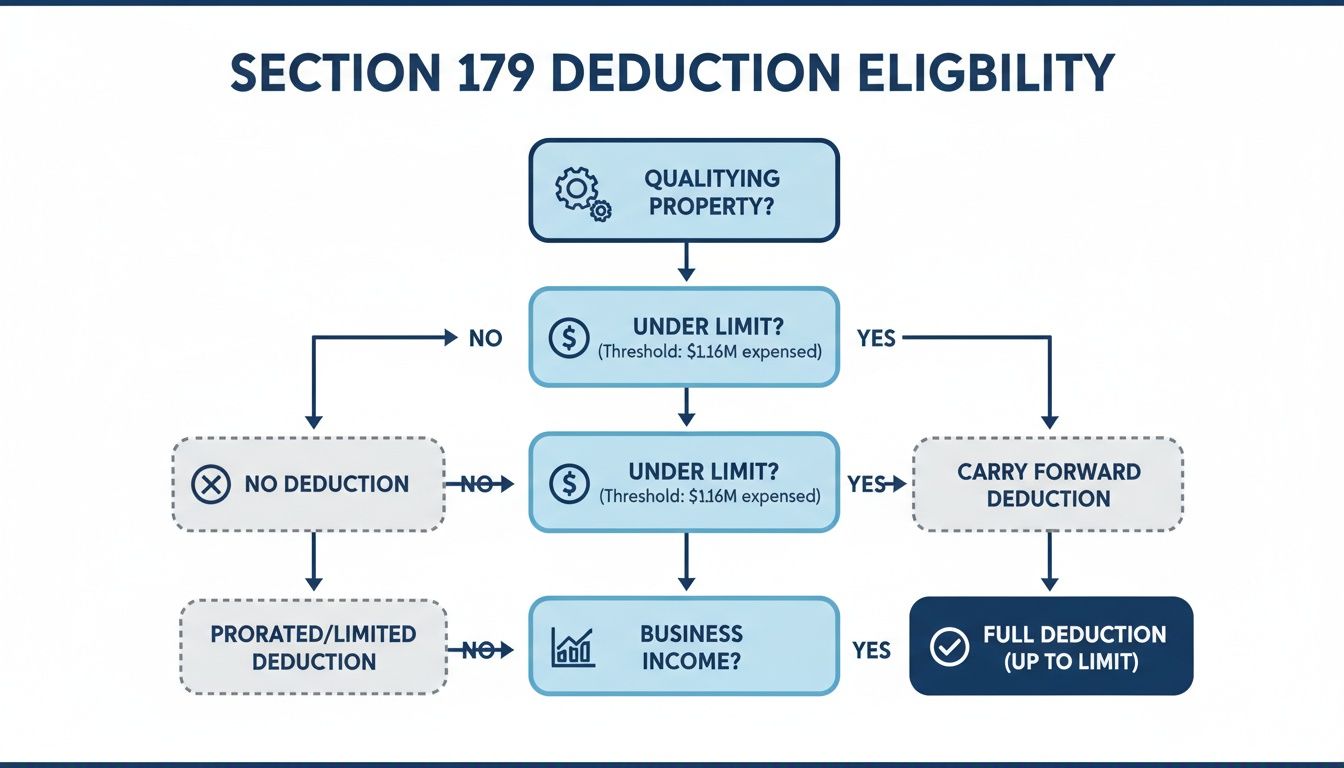

This flowchart maps out the basic logic for Section 179 eligibility, showing how you have to navigate the rules around property type, spending caps, and business income.

As you can see, you have to clear several hurdles to claim the Section 179 deduction. Bonus depreciation, on the other hand, is a bit more of a blunt instrument with fewer strings attached.

Key Differences at a Glance

The biggest divide between the two comes down to limitations. Section 179 is powerful, but it has strict guardrails: an annual deduction cap, a total investment spending limit, and an income requirement. If your business spends too much on assets in a year, the deduction starts to shrink. And you can't use it to create a business loss.

Bonus depreciation is the wilder cousin. It’s far more flexible.

- No Annual Limit: There’s no dollar cap on bonus depreciation. You can theoretically expense tens of millions in qualifying assets and write them off.

- No Income Limitation: This is a big one. Unlike Section 179, bonus depreciation can push your business into a taxable loss. This creates a net operating loss (NOL) that you can carry forward to offset profits in future years.

- Application Order: The IRS has a clear pecking order. If you're using both, you must apply the Section 179 deduction first to any assets you designate. Then, bonus depreciation comes second.

Because of its unrestricted nature, bonus depreciation is the go-to for major capital expenditures that would easily blow past the Section 179 limits.

Strategic Application: When to Use Each

So, which one should you choose? Often, the smartest move isn't choosing one or the other, but using them together.

The real power of Section 179 is that you can pick and choose which assets to apply it to. This gives you surgical control over your taxable income. A common and highly effective strategy is to apply the Section 179 deduction to specific assets until you hit the annual limit. It's particularly useful for assets that would normally have long depreciation schedules, like certain types of equipment or interior improvements.

Pro Tip: By selectively applying Section 179, you can "save" your bonus depreciation for other assets. This lets you fine-tune your income, which is a cornerstone of sophisticated tax planning for high-net-worth individuals and their businesses.

Once you've used up your Section 179 allowance, you can then apply bonus depreciation to the remaining cost of those assets and any other qualifying property. This one-two punch ensures you’re squeezing every drop of value out of your deductions, dramatically lowering your current tax bill and freeing up cash flow.

Strategic Applications for NYC Businesses

Let's move beyond the tax code jargon and see how the Section 179 deduction actually works on the ground for New York City businesses. This is where the real value lies—in tangible results. From upgrading a commercial property in the Garment District to buying a fleet of delivery vans in Queens, the opportunities to lower your tax bill are everywhere if you know where to look.

The key is to proactively connect your capital spending with the specific incentives available. It's not a passive process; it requires a smart approach to asset management and a clear understanding of how different business structures and property types interact with the deduction.

Expensing Improvements to Real Property

One of the most powerful applications for NYC real estate investors is the ability to expense certain upgrades to nonresidential buildings. We’re talking about Qualified Improvement Property (QIP), which lets you immediately write off the full cost of interior improvements instead of depreciating them over a painfully slow 39-year schedule.

Think about what this covers for a typical commercial building:

- New HVAC Systems: That brand-new, energy-efficient heating and cooling system you've been eyeing.

- Updated Security and Fire Systems: Installing modern alarms, sprinklers, and monitoring equipment.

- Interior Renovations: Redesigning an office layout, putting up new drywall, or overhauling the plumbing and electrical.

Just keep in mind, QIP doesn't cover everything. It excludes projects that enlarge the building, add an elevator or escalator, or change the internal structural framework. But for a commercial landlord, this means a $200,000 HVAC upgrade could translate directly into a $200,000 deduction this year, freeing up significant cash to reinvest elsewhere.

Navigating Vehicle Deduction Rules

Business vehicles are a classic Section 179 expense, but the rules are tricky and depend heavily on the vehicle's size and function. This is especially relevant for the thousands of NYC businesses that rely on transportation for services and deliveries.

For heavy SUVs, trucks, and vans—those with a gross vehicle weight rating (GVWR) between 6,001 and 14,000 pounds—you can typically take a massive Section 179 deduction. This category often qualifies for the full deduction limit, making it a go-to strategy for contractors, logistics companies, and other service-based businesses.

On the other hand, passenger vehicles (cars, light trucks, and vans under 6,000 pounds) fall under much stricter annual limits, often called the "luxury auto" rules. The Section 179 deduction for these lighter vehicles is capped at a much lower amount, which seriously reduces its impact.

The bottom line for business owners is simple: the type of vehicle you buy has a huge and direct impact on your upfront tax savings. A heavy-duty work truck will deliver a much bigger tax benefit in year one than a standard sedan used for business calls.

The following table breaks down how different NYC business types can strategically apply Section 179 to their common capital expenditures.

| Business Type | Common Qualifying Assets | Strategic Consideration |

|---|---|---|

| Restaurant | Ovens, refrigerators, point-of-sale (POS) systems, dining furniture, interior renovations (QIP). | A full kitchen overhaul can be expensed immediately, providing a major cash flow boost for reinvestment in marketing or expansion. |

| Medical/Dental Practice | Exam chairs, diagnostic equipment (X-ray, ultrasound), office computers, specialized software. | Investing in cutting-edge medical technology becomes more affordable with an immediate full deduction, improving patient care and practice efficiency. |

| Construction/Contractor | Heavy-duty trucks, excavators, power tools, scaffolding, project management software. | The ability to expense heavy vehicles and equipment in the year of purchase is critical for managing the high capital costs of this industry. |

| Creative Agency | High-performance computers, cameras, servers, office furniture, specialized design software. | Keeping technology current is vital. Section 179 allows agencies to write off tech upgrades immediately instead of over several years. |

| Retail Boutique | Shelving, display cases, security systems, POS terminals, interior lighting upgrades (QIP). | A store refresh can be fully deducted in the current year, helping retailers create an inviting atmosphere to attract more customers. |

Each of these scenarios highlights how Section 179 can be used not just as a tax-saving tool, but as a strategic lever for business growth and modernization.

How Partnerships and S-Corporations Handle It

If your business is a partnership or an S-corporation, the Section 179 deduction follows a slightly different path. The business entity itself doesn't claim the deduction on its tax return. Instead, the deduction is calculated at the entity level and then "passes through" to the individual partners or shareholders.

Each owner then takes their proportional share of the deduction on their personal tax return. This means the deduction is tested against limits at two levels: first at the business level (the overall spending cap) and then at the individual level (each owner’s business income limitation).

This pass-through structure is incredibly common. While states like Florida (8.1%) and California (6.5%) see the most Section 179 usage, New York claims a respectable 3.5%, often driven by real estate developers and tech startups structured as S-corps or partnerships. The number of S-corporations claiming this benefit grew from just over 724,000 in 2002 to more than 900,000 by 2007. If you want to dive deeper, you can explore the full research on state-by-state usage and business structures.

The Critical Issue of State Conformity

Finally, we have to talk about state conformity—a frequent and costly trap for the unprepared. Here’s the crucial point: New York State and New York City do not conform to the generous federal Section 179 deduction limits.

This means you’ll be doing two separate calculations: one for your federal return using the high federal limits, and another for your state and city returns using their much smaller deduction amounts. This creates a difference in the "basis" (the asset's value for tax purposes) of your property for federal vs. state tax. It’s an added layer of complexity that absolutely requires careful tracking and expert guidance to manage correctly.

Common Mistakes and How to Avoid Them

The Section 179 deduction can be a game-changer, but a few common missteps can easily turn this powerful tool into a costly liability. Understanding where taxpayers often go wrong is the best way to claim your deduction correctly and avoid future headaches with the IRS.

It's about being proactive so your business gets the full benefit it deserves.

The "Placed in Service" Trap

One of the most frequent errors boils down to timing and the "placed in service" rule. It’s not enough to simply buy qualifying equipment by December 31st. You must also start using it for its intended business purpose in that same tax year.

That new server or piece of machinery you bought on December 28th? If it’s still sitting in the box on New Year's Day, it won't qualify for the prior year's deduction.

Guessing on Business Use

Another major pitfall is failing to accurately calculate—and document—the business use for assets that pull double duty for personal life. For an asset to even qualify for Section 179, its business use must be more than 50%.

If you buy a vehicle for both client visits and family errands, you need proof. Keep meticulous records, like a detailed mileage log, to back up your business-use percentage. Just guessing won't cut it.

Failing to document this split can lead to serious consequences:

- Disallowed Deduction: If you can't substantiate your business use claim during an audit, the IRS can disallow the entire deduction.

- Recapture Risk: If that business use dips to 50% or below in a later year, you'll likely face depreciation recapture.

What is depreciation recapture? Think of it as the IRS "clawing back" the tax benefit you received. If you sell an asset too early or its business use falls below the threshold, you may have to report a portion of your initial deduction as ordinary income, effectively reversing your tax savings.

Ignoring State and Recapture Rules

A final, and surprisingly common, error is simply assuming your state plays by federal tax rules. As we've covered, New York and NYC do not conform to the generous federal Section 179 limits. Filing state taxes using federal numbers without making the required adjustments is a direct path to compliance problems.

You absolutely have to run separate calculations for your federal and state returns.

The key to sidestepping these issues is diligent record-keeping and planning. Always confirm an asset is truly placed in service before year-end and document the business-use percentage for any mixed-use property from day one. By respecting the rules around state conformity and the costly consequences of depreciation recapture, you can claim the Section 179 deduction with confidence.

Frequently Asked Questions About Section 179

The rules of Section 179 seem straightforward on the surface, but the real world always throws a few curveballs. Let's tackle some of the most common questions that pop up for business owners, getting into the practical side of how this deduction works day-to-day.

Can I Use Section 179 for a Vehicle I Use Personally?

You can, but there's a big string attached: the deduction is strictly limited to the vehicle's business use percentage. And to even get your foot in the door, that business use has to be more than 50%.

Imagine you buy a qualifying SUV and use it 80% of the time for client visits and deliveries, and 20% for personal trips. In that case, you can only write off 80% of the vehicle's cost with Section 179. This is where meticulous record-keeping becomes non-negotiable. A detailed mileage log isn't just a good idea—it's your primary defense if the IRS ever questions the deduction.

What Happens If I Sell an Asset I Expensed with Section 179?

This is where a concept called depreciation recapture comes into play. If you sell an asset you previously wrote off using Section 179, the IRS wants some of that tax benefit back.

Essentially, you have to report the sales price as ordinary income in the year you sell it, up to the amount you originally deducted. This rule stops businesses from getting a huge upfront tax break, then flipping the asset for a tax-free profit shortly after. It's a crucial piece of the puzzle to consider in your long-term strategy for buying and selling equipment.

Key Takeaway: Recapture ensures the tax break you got is earned by the asset’s continued use in your business. Selling early effectively claws back some of those initial tax savings, turning part of your sales proceeds into taxable income.

Does New York State Follow the Federal Section 179 Rules?

No, and this is a major "gotcha" for New York businesses. NYS does not conform to the generous federal Section 179 rules, and it doesn't follow the federal bonus depreciation rules either.

New York sets its own, much lower deduction limits. This mismatch means your equipment has two different values for tax purposes: one for your federal return and another for your state return. This creates an extra layer of complexity, requiring careful, separate calculations. For NYC businesses, this is a perfect example of why you can't rely on federal tax planning alone.

Navigating the gap between federal tax breaks and New York State's unique rules requires a sharp eye and careful planning. At Blue Sage Tax & Accounting Inc., we specialize in helping NYC businesses and investors turn these complexities into strategic advantages, minimizing tax burdens and boosting cash flow. Let us handle the details so you can focus on growth. Learn more about our proactive tax planning services.