For anyone leading a nonprofit, Form 990 is far more than just another tax document. It’s your annual opportunity to tell your story—a public declaration of your mission, your financial stewardship, and the integrity of your governance.

This guide is designed to cut through the confusing IRS jargon and give you a practical, real-world roadmap for not just filing, but filing well.

More Than a Tax Form: Your Annual Transparency Report

Think of your annual Form 990 as your organization's public report card. For many donors, grantmakers, and even community members, it's the first—and sometimes only—deep dive they'll take into your operations. It’s arguably one of the most important financial documents you’ll touch all year.

A carefully prepared Form 990 does more than just check a compliance box; it builds trust. It showcases sound financial management and proves your organization is as serious about its accountability as it is about its mission. On the flip side, getting the form 990 filing requirements wrong can bring serious consequences, from hefty penalties to, in a worst-case scenario, losing your tax-exempt status altogether.

Getting the Foundation Right

The entire filing process hinges on one critical, upfront decision: choosing the right form. The IRS has a few different versions, and your choice depends almost entirely on your organization's financial size and activity. Picking the right one isn't just about making the paperwork easier; filing the wrong form is a red flag for the IRS.

Here’s what we’ll walk through to make sure you get it right:

- Choosing the Right Form: We’ll break down the financial thresholds that determine if you file a 990-N (the e-Postcard), a 990-EZ, or the full Form 990.

- Hitting Your Deadlines: You'll learn the standard due dates and, just as importantly, how to get an automatic extension when you need more time.

- Navigating the Consequences: We’ll cover the real-world penalties for filing late and the three-year rule that can lead to automatic revocation of your exempt status.

- State-Level Filings: We'll also look at why your federal return is often just the beginning, with a special focus on requirements for New York nonprofits.

Mastering your annual filing is fundamental to protecting your 501(c)(3) status and securing your organization's future. It sends a powerful signal that you are not only driven by your mission but also managed professionally and accountable to the public.

Consider this your playbook for turning an annual chore into a powerful statement about your organization’s strength and reliability.

Choosing the Right Form 990 for Your Organization

Picking the correct version of Form 990 is the very first—and most important—step in your annual compliance journey. This isn't a "one-size-fits-all" situation. The IRS has a specific form for every size and type of nonprofit, and your choice is dictated by your organization's financial footprint.

Think of it as choosing the right tax form for an individual. A student with a part-time job doesn't file the same complex return as a small business owner. In the same way, a small community garden club won't file the same Form 990 as a large national foundation. Getting this right from the get-go ensures your filing is compliant and paints an accurate picture for the IRS, funders, and the public.

The Financial Thresholds That Guide Your Decision

At its core, the decision boils down to two key numbers from your financial records: gross receipts and total assets. You'll need to look at your books for the fiscal year that just closed to determine where you stand.

- Gross Receipts: This is the total income your organization brought in from all sources during the year, before subtracting any expenses. Think donations, grants, program fees—everything.

- Total Assets: This is the total value of everything the organization owns at the end of the fiscal year, which you can find right on your balance sheet.

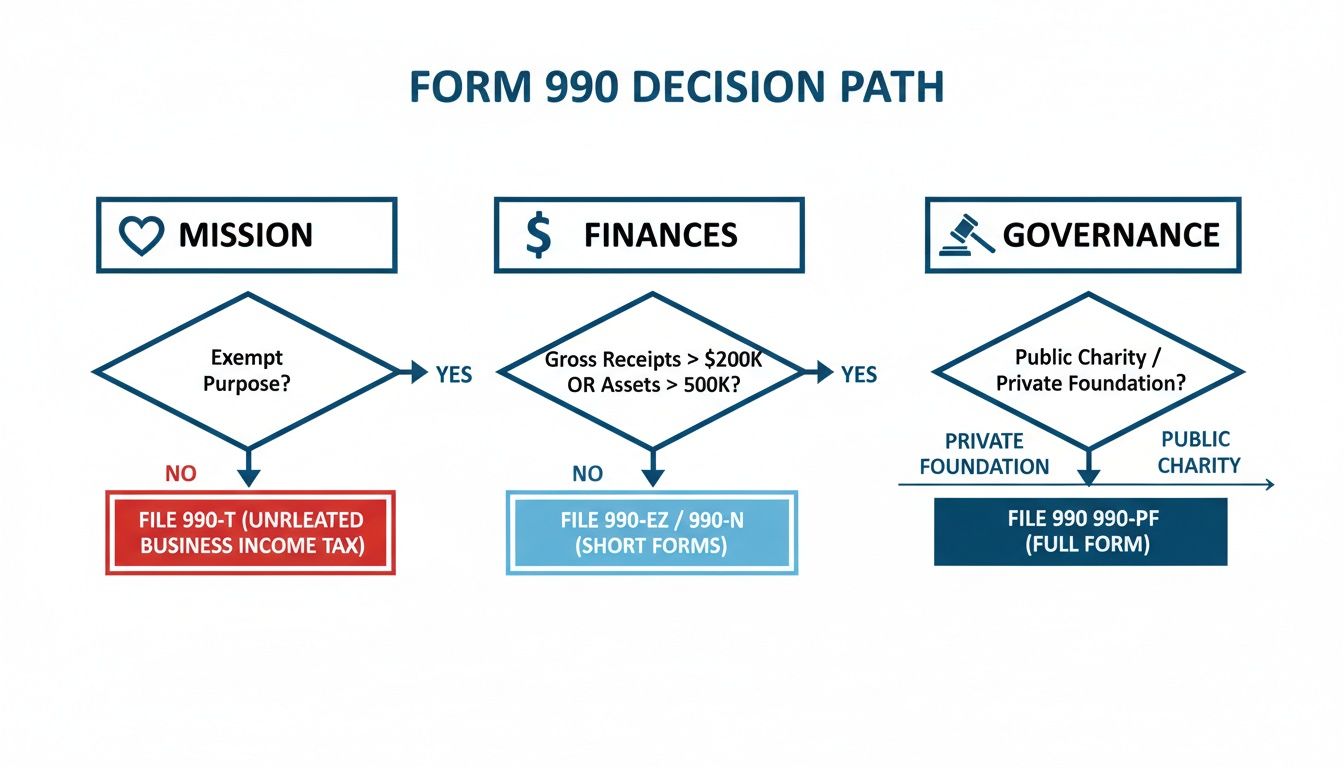

These two figures will point you directly to the correct form. This flowchart gives a great visual overview of how an organization’s mission and finances funnel it toward the right IRS form.

As you can see, those financial metrics are the primary fork in the road, setting you on the right compliance path.

A Breakdown of the Form 990 Series

Each form in the 990 family is built for a different kind of organization. Let's walk through them so you can see exactly where you fit.

Form 990-N (The e-Postcard)

This is the simplest filing of all, designed for the smallest nonprofits. If your annual gross receipts are typically $50,000 or less, you can file the 990-N. It’s a quick, online-only notice that basically tells the IRS, "Hey, we're still here and active!" It doesn't ask for any detailed financial data.

Form 990-EZ

As the name suggests, this is the "easy" or short version of the main form. It's a great option for many small to mid-sized organizations. You can file Form 990-EZ if your gross receipts are less than $200,000 and your total assets are less than $500,000. While it requires more information than the e-Postcard, it's far less intimidating than the full Form 990.

A common pitfall here is focusing only on revenue. If your organization has low annual receipts but holds significant assets—like a building or an endowment—that push you over the $500,000 asset threshold, you must file the full Form 990. Don't get tripped up by this two-part test!

Form 990

This is the comprehensive, long-form return required for larger organizations. You’re required to file the full Form 990 if your gross receipts hit $200,000 or more, or if your total assets are $500,000 or more. It's a 12-page beast that digs deep into your finances, governance policies, and program accomplishments.

Form 990-PF

This one is different. It’s exclusively for private foundations, no matter their size. All private foundations—from a small family foundation to the Bill & Melinda Gates Foundation—file Form 990-PF. This return is built differently, focusing on things like charitable distributions and compliance with strict rules against self-dealing, which are unique to private foundations. The gross receipt thresholds that apply to public charities don't apply here.

Form 990 Selection Guide Based on Financial Thresholds

To make it even clearer, here’s a quick-reference table to help you pinpoint the right form based on your nonprofit's financials.

| Form Version | Gross Receipts Threshold | Total Assets Threshold | Who Should File |

|---|---|---|---|

| Form 990-N | Typically ≤ $50,000 | Not a factor | The smallest nonprofits looking for a simple online notice. |

| Form 990-EZ | < $200,000 | < $500,000 | Small to mid-sized organizations that meet both thresholds. |

| Form 990 | ≥ $200,000 | ≥ $500,000 | Larger organizations that meet either threshold. |

| Form 990-PF | Not a factor | Not a factor | All private foundations, regardless of financial size. |

This table provides a great starting point, but always double-check the fine print in the official IRS instructions for Form 990 to confirm your choice. Getting this right is the foundation of a clean and compliant filing season.

Meeting Deadlines, Extensions, and E-Filing Rules

Getting your Form 990 prepared correctly is one thing, but getting it filed on time is another challenge entirely. The nuts and bolts of hitting deadlines, getting an extension when you need one, and navigating the e-filing system are just as important for staying compliant. Let's walk through how to manage the timeline so you can avoid headaches and penalties.

The standard due date for your Form 990 is pretty easy to remember: it’s the 15th day of the 5th month after your fiscal year closes. This gives your team a decent window to get the books in order and pull together all the details for the return.

Most nonprofits run on a standard calendar year, so their deadline is a straightforward May 15th. But if your organization’s fiscal year ends on June 30th, for instance, you’d be looking at a November 15th deadline. You just have to count it out.

Securing a Filing Extension with Form 8868

Life happens. Sometimes, no matter how well you plan, you just need more time. The IRS gets this and offers a simple, automatic six-month extension for your Form 990. All you have to do is file Form 8868, Application for Extension of Time To File an Exempt Organization Return.

The key word here is automatic. As long as you file Form 8868 properly and before your original deadline, the extension is yours. No questions asked. For a calendar-year filer, that pushes the May 15th deadline all the way to November 15th.

It's critical to know exactly what this extension covers.

- It extends the time to file your return. This is your breathing room to get the Form 990 right.

- It does NOT extend the time to pay any taxes. If your nonprofit owes tax on unrelated business income (reported on a Form 990-T), that payment is still due by the original deadline. Don't mix them up.

I hear this all the time: clients worry that filing for an extension makes them an audit target. It absolutely does not. Filing a Form 8868 is a completely normal practice that thousands of organizations use to ensure they can submit a high-quality, accurate return.

The Mandatory Shift to Electronic Filing

The era of printing out a thick Form 990 and dropping it in the mail is officially over. As part of a major push to modernize, the IRS now requires virtually all exempt organizations to file electronically. This mandate, stemming from the Taxpayer First Act, covers the whole 990 family: Form 990, Form 990-EZ, and Form 990-PF.

What does this mean for your workflow? You have to use an IRS-approved software or work with an authorized e-file provider to submit your return. Frankly, it’s a better system for everyone. E-filing cuts down on processing errors, gives you an instant confirmation that the IRS received your filing, and helps make the data available for public transparency much faster.

If your organization has been paper-filing for years, it's time to adapt. You'll need to find a tax professional or a software platform that can handle the electronic submission smoothly. The exceptions to this rule are incredibly narrow, so it’s best to operate on the assumption that you must e-file.

The Real Consequences of Non-Compliance

Missing your Form 990 filing deadline is much more than a simple paperwork blunder. It's a serious misstep that can trigger a cascade of problems, from hefty fines to the potential loss of your nonprofit's very existence. Think of it less as an administrative task and more as a fundamental pillar supporting your entire mission.

When you ignore these filing obligations, you kick off a chain reaction. It starts with financial penalties that tick up every single day, but the real danger goes far beyond the money. You risk losing the legal foundation your organization is built on.

The Immediate Sting of Financial Penalties

The IRS doesn’t wait around to penalize late or incomplete Form 990 filings. The fines are automatic and designed to get your attention—fast.

For smaller organizations with gross receipts under $1,208,500, the meter starts running at $20 per day. This daily penalty can climb to a maximum of $12,000 or 5% of your annual gross receipts, whichever is less.

If your organization is larger and brings in more than that amount, the stakes get much higher. The penalty jumps to a steep $120 per day, capping out at a maximum of $60,000. These penalties aren't just aimed at the organization; if managers knowingly fail to file after a formal request from the IRS, they can be held personally responsible.

The key thing to remember is that these penalties are relentless and require no special action from the IRS to begin. They start ticking the day after your deadline, quietly draining your resources until the issue is fixed.

The Ultimate Penalty: Automatic Revocation of Exempt Status

As painful as the fines are, they're nothing compared to the most severe consequence. The IRS has a very clear, very strict "three-strikes" rule for organizations that consistently fail to file their annual returns.

If your nonprofit fails to file its required Form 990—and yes, this includes the simple 990-N e-Postcard—for three consecutive years, your tax-exempt status is automatically revoked. It just happens. There's no hearing, no appeal, no second chance before the switch is flipped.

The IRS is serious about this. Between 2010 and 2020, about 760,000 organizations learned this lesson the hard way, losing their tax-exempt status for this very reason. To dig deeper into the data and what it means for the sector, check out this 2025 compliance guide for nonprofits from waterandshark.com.

The Devastating Impact of Revocation

Losing your 501(c)(3) status is a catastrophic event. The fallout touches every corner of your operations, effectively slamming the brakes on your ability to function as a charity.

Here’s a snapshot of what revocation really means:

- Donor Support Dries Up: You're immediately scrubbed from the IRS list of eligible charities. This means you can no longer tell donors their contributions are tax-deductible, which is often the main reason people give in the first place.

- The Tax Man Cometh: Your organization is no longer exempt from federal income tax. All that revenue you bring in could now be subject to corporate or trust income tax rates, creating a massive financial liability you never planned for.

- A Permanent Stain on Your Record: The revocation becomes a public, permanent mark against your name. Grantmakers, foundations, and major donors do their homework, and this is a giant red flag they're unlikely to ignore.

- The Long Road to Reinstatement: Getting your status back is a grueling process. You have to start from scratch with a new, full Form 1023 application, pay all the fees again, and provide a good reason for your failure to file. It’s expensive, time-consuming, and there's no guarantee you'll be approved.

The only reliable defense against these mission-ending consequences is proactive, diligent compliance with your Form 990 filing requirements.

Navigating State-Level Filing Obligations

Getting your federal Form 990 filed is a huge accomplishment, but don't close the books just yet. For many nonprofits, that IRS submission is only half the battle. A lot of leaders are caught by surprise when they learn that filing with the IRS doesn't automatically cover their obligations at the state level. This parallel compliance track is absolutely critical for staying in good standing and maintaining your legal right to operate and ask for donations.

It’s a bit like getting a driver's license. The IRS determination letter is your federal license to "drive," but you still have to register your car in the state where you actually operate—that's your state filing. Every state has its own unique rulebook, and ignoring it can lead to some serious headaches, including financial penalties, the loss of your fundraising privileges, and even having your organization shut down by the state.

Understanding the Dual Filing System

Most states that keep a close eye on nonprofits require you to file an annual report with a specific state agency. This is usually the Attorney General's office or a dedicated Charities Bureau. This isn't a substitute for your federal filing; think of it as an entirely separate, mandatory step.

What you'll often find is that states require you to attach a full copy of your federal Form 990, 990-EZ, or 990-PF to their own unique state form. This creates a two-part submission: the state’s cover sheet plus your detailed federal return. This system gives state regulators a complete picture of your organization's finances and governance without forcing them to create a brand new, complex reporting system from scratch.

State-level compliance isn't just a paperwork exercise. It's about registering for the legal authority to solicit donations from the residents of that state. Dropping the ball on these filings can put all your fundraising activities in legal jeopardy—a risk no nonprofit can afford.

A Closer Look at New York State Requirements

New York is a perfect case study in how thorough state oversight can be. The Attorney General's Charities Bureau takes its supervisory role seriously, and its annual filing requirements are notoriously strict.

In New York, most charities are required to file an annual report using Form CHAR500, the "Annual Filing for Charitable Organizations." Here's the kicker: this form is due four and a half months after your fiscal year ends. That's two weeks before the federal deadline.

Let's break down what that looks like for an organization on a calendar year:

- Federal Deadline: 15th day of the 5th month (May 15th).

- New York Deadline: Last day of the 4th month (April 30th).

This subtle difference trips up countless organizations every single year. Along with the CHAR500, you have to submit a copy of your completed federal Form 990. The state then uses all that rich data from your federal return to make sure you're playing by New York's specific rules for charities.

And it doesn't stop there. Any organization that solicits contributions in New York must also register with the Charities Bureau and renew that registration every year. While related, this is a separate obligation tied directly to your right to fundraise. Mastering these multi-layered form 990 filing requirements at the state level is non-negotiable for any nonprofit operating in a highly regulated environment like New York. It's a vital piece of the compliance puzzle that protects both your mission and your hard-earned reputation.

Your Essential Form 990 Compliance Checklist

Staying on top of your Form 990 filing doesn't have to be a scramble. With a solid system in place, you can turn this annual requirement into a smooth, manageable process. This checklist breaks it all down into a practical timeline, helping you build a stress-free habit for compliance year after year.

Think of this as your roadmap, guiding you from early prep work all the way to a confirmed, successful filing.

Following these steps isn't just about checking a box for the IRS. It’s about protecting your tax-exempt status and proving your organization’s commitment to transparency—something donors, funders, and the public truly value.

Phase 1: Pre-Year-End Planning (October – December)

The secret to a painless filing season is starting before it even begins. Getting organized in the final quarter of your fiscal year lays the groundwork for a much easier process when the pressure is on.

- Project Your Financials: Take a look at your numbers. Estimate your year-end gross receipts and total assets to get a good idea of which Form 990 you’ll need to file. This heads-up allows you to mentally prepare for the level of detail required.

- Review Governance Policies: Dust off your conflict of interest, whistleblower, and document retention policies. Are they up to date? More importantly, did you follow them? The full Form 990 asks about these directly, so it's best to be prepared.

- Compile Your Board and Officer List: Keep a running, accurate list of every board member and key officer who served during the year. Make sure you have their correct titles and terms of service ready to go.

Phase 2: Post-Year-End Data Gathering (January – March)

Once your fiscal year officially closes, it’s time to shift from planning to action. This is the heavy-lifting phase where all that good record-keeping you’ve done throughout the year really pays off.

- Finalize Your Financial Statements: First things first, close the books. Prepare your final Statement of Financial Position (your balance sheet) and Statement of Activities (your income statement).

- Gather Program Accomplishments: Get ready to tell your story. You'll need descriptions and the specific financial data for your three largest programs, based on what you spent. This is the heart of Part III on the full Form 990.

- Confirm Compensation Details: This one is crucial. Compile the exact compensation figures for all your officers, directors, trustees, and key employees. Remember to include salary, benefits, and any other reportable pay.

- List Major Donors: If you're required to file a Schedule B, you'll need a confidential list of every donor who gave $5,000 or more during the year. It's important to remember this schedule is filed with the IRS but is not made available to the public.

"A well-organized data gathering phase is the single most important factor in filing an accurate and timely Form 990. Rushing this step is where most correctable errors originate, leading to amendments and unnecessary IRS scrutiny."

Phase 3: Filing and Confirmation (April – May or During Your Extension Period)

You’ve done the prep work and gathered the data. Now it's time to bring it all home. This final phase is all about careful preparation, a thorough review, and submitting the return with confidence.

- Select the Correct Form: Using your final, official numbers for gross receipts and assets, make the definitive choice: Form 990-N, 990-EZ, or the full Form 990.

- Prepare and Review the Draft Return: Get the return prepared by a qualified professional. But don't stop there. It is absolutely critical that a key officer or a finance committee member reviews the draft before it’s finalized. A second set of eyes can catch simple mistakes.

- File Electronically Before the Deadline: Submit your return through an IRS-authorized e-file provider. Remember, the deadline is the 15th day of the 5th month after your fiscal year ends—that's May 15 for most organizations.

- Submit State Filings: Don't forget about the states! Immediately after your federal filing, submit any required state-level charity reports, like New York's CHAR500, which requires a copy of your Form 990.

- Confirm Acceptance: Your job isn't done until you get confirmation. Make sure you receive and save the acceptance receipts from both the IRS and your state charity bureau. These are important documents for your permanent tax records.

Common Questions We Hear About Form 990 Filing

Even with a solid grasp of the rules, real-world scenarios can throw a wrench in your nonprofit's filing process. Over the years, we've seen it all. From simple mix-ups to sudden windfalls, certain questions come up time and time again.

Let's walk through some of the most common issues that nonprofit leaders and board members bring to us during tax season.

"I Filed the Wrong Form. Now What?"

It’s a surprisingly common situation. You file your return, breathe a sigh of relief, and then realize your final numbers pushed you over the threshold for the form you used. Maybe you filed a 990-EZ when your gross receipts actually required the full Form 990.

Don't panic, but do act quickly. The solution is to file an amended return.

You'll need to prepare and submit the correct form for that tax year in its entirety. So, in our example, you’d complete the full Form 990 from scratch and check the "Amended return" box at the top.

Think of an amended return not as an admission of guilt, but as a mark of good governance. The IRS looks far more kindly on organizations that proactively fix their own mistakes. It’s a move that protects your standing and shows you’re committed to getting it right.

Fixing the error promptly keeps the public record accurate and sends a clear signal to funders and the IRS that your organization values transparency.

"How Much of Our Information Becomes Public?"

This is a huge concern for many board members, and understandably so. They're volunteering their time and want to know what personal details will be out there for the world to see. While Form 990 is a public document, the IRS draws a clear line between transparency and privacy.

Here’s what the public will see:

- Who's in charge: The names and titles of your current officers, directors, trustees, and key employees are listed.

- Who gets paid what: Compensation for these key individuals is disclosed. This is central to demonstrating responsible use of donor funds.

- What you do: Descriptions of your major programs, along with their associated expenses and revenues, are open for review.

What's kept private? The IRS is very protective of sensitive personal data. The home addresses of your board members and staff are not made public. Crucially, your list of major donors on Schedule B is also kept confidential by the IRS to protect donor privacy.

"We're Just a Small Volunteer Group. Do We Really Need to File?"

This might be the most dangerous myth in the nonprofit world. The belief that a small, all-volunteer group is totally off the hook for filing has led many organizations to lose their tax-exempt status.

Even if you have no paid staff and your income is tiny, a filing requirement almost certainly exists.

If your gross receipts are typically $50,000 or less, you must file Form 990-N, often called the e-Postcard. It’s a simple online notice that takes just a few minutes to complete, but it's absolutely critical. It tells the IRS you're still in existence and active.

Failing to file the 990-N for three years in a row leads to the automatic revocation of your tax-exempt status—the same penalty a multi-million dollar organization would face for not filing its Form 990. Never assume you're too small to file.

"We Just Got a Huge Grant! How Does That Affect Our Filing?"

What a great problem to have! But that one-time, game-changing grant can absolutely change your filing obligations for the year. An organization that has filed a Form 990-EZ for years could easily get a grant that pushes its gross receipts well over the $200,000 threshold.

Suddenly, you're in the big leagues and must file the full Form 990.

This isn't just a longer form; it's a whole different level of disclosure. You'll need to gather much more detailed information on governance, board policies, program accomplishments, and complex financial breakdowns. The key is to see this coming. As soon as a large grant is secured, start preparing for the more rigorous requirements of the full Form 990 so you aren't scrambling at the deadline.

Managing nonprofit compliance is a specialized field. The team at Blue Sage Tax & Accounting Inc. lives and breathes this stuff, providing dedicated tax and accounting services for nonprofits in New York and across the country. We help ensure your organization meets every federal and state requirement with confidence, so you can focus on your mission.