If you're an owner or investor in a partnership, S corporation, or trust, you're likely familiar with the Schedule K-1. Forget the W-2 you get as an employee; the K-1 is its counterpart for business owners and investors, breaking down your specific slice of the entity's financial pie for the year.

What Exactly Is a Schedule K-1?

When you receive a K-1, it means you're part of a pass-through entity. These business structures don't pay income tax at the corporate level. Instead, all profits, losses, deductions, and credits are "passed through" directly to the owners to report on their personal tax returns.

Think of a real estate partnership that owns an apartment building. The partnership itself doesn't write a check to the IRS for the rental income it earned. Instead, it allocates the profits among the partners, and each partner receives a K-1 detailing their share. It's then up to you to report those figures on your own Form 1040 and pay the tax.

Why Your K-1 Is So Important

This form is far more than just another piece of tax paperwork—it's a direct link between the business's performance and your personal tax bill. The numbers on that K-1 dictate your taxable income, what deductions you can claim, and ultimately, how much you owe. For anyone involved in real estate, family offices, or closely held businesses, getting this right is non-negotiable.

Your K-1 breaks down several critical financial items you need to report, including:

- Your Share of Income or Loss: This is your cut of the entity's profits or losses from its core business activities.

- Distributions: This is the actual cash or property the business paid out to you during the year. It's not the same as income!

- Credits and Deductions: Any tax benefits generated by the business (like energy credits or depreciation) are passed on to you to reduce your tax liability.

Here's a classic trip-up: confusing income with distributions. Your K-1 might show $50,000 in taxable income, but you only received a $20,000 check. You are taxed on the full $50,000 of allocated income, regardless of the cash you actually pocketed.

The Schedule K-1 connects the dots, ensuring that the business's tax items land on the correct individual returns. For high-net-worth individuals and real estate investors, especially those dealing with multi-state operations, a deep understanding of the K-1 is crucial. For more official statistics on this type of reporting, the IRS website is a great resource.

Quick Guide to Schedule K-1 Forms

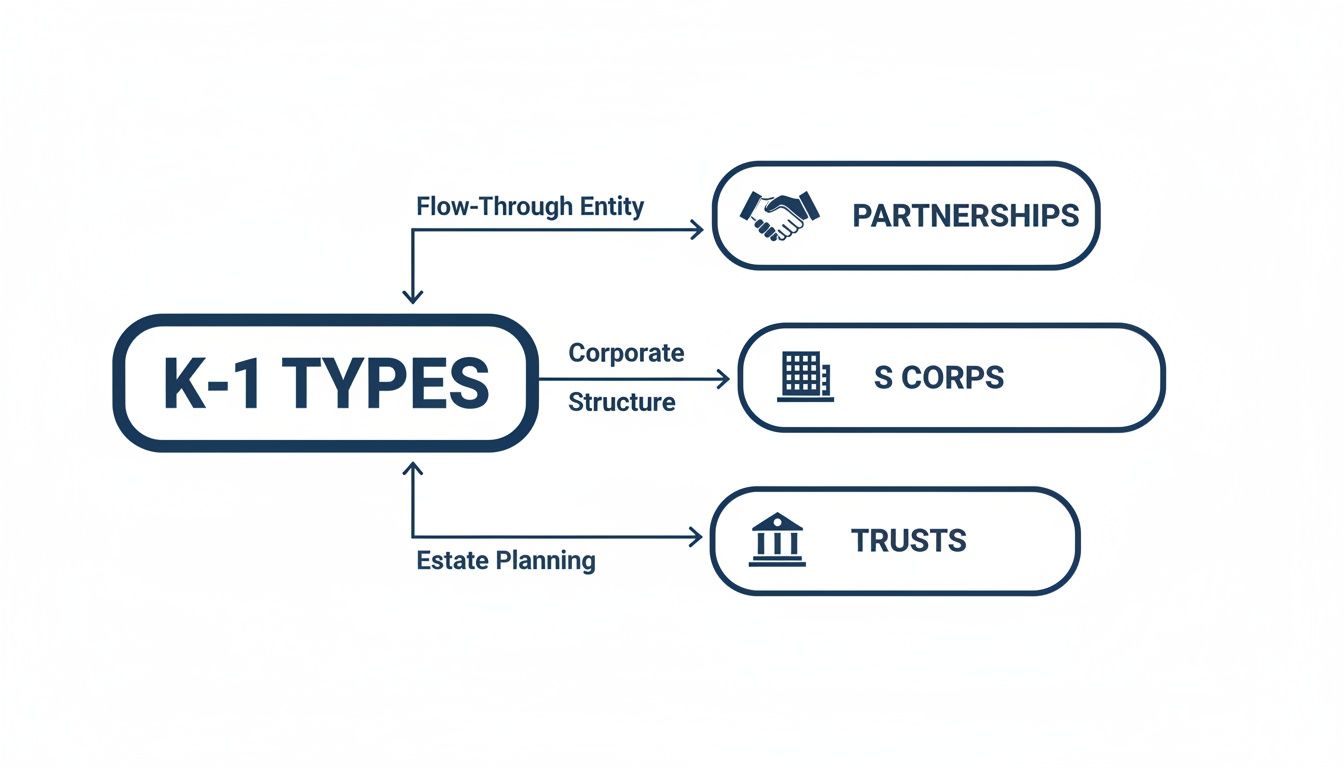

Not all K-1s are the same. The specific form you receive depends on the type of pass-through entity you're involved with. Here’s a quick breakdown to help you identify which is which.

| Form Number | Issued By | Purpose |

|---|---|---|

| Schedule K-1 (Form 1065) | Partnerships, LLCs taxed as partnerships | Reports a partner's share of income, deductions, and other items. |

| Schedule K-1 (Form 1120-S) | S Corporations | Reports a shareholder's share of income, deductions, and other items. |

| Schedule K-1 (Form 1041) | Estates and Trusts | Reports a beneficiary's share of income, deductions, and other items. |

Knowing which form you have is the first step in correctly translating its information onto your personal tax return. Each one has its own set of rules and nuances.

The Three Main Flavors of a K-1

At first glance, all Schedule K-1s look pretty similar. They all share the same basic job: to report your slice of a pass-through entity’s financial pie. But don't be fooled—they aren't interchangeable. The specific form that lands on your desk depends entirely on the legal structure of the business, fund, or trust you’re a part of. Knowing which one you're holding is the first critical step.

The sheer volume of these forms tells a story about how American business has evolved. Today, pass-through businesses represent a staggering 95% of all U.S. companies. This isn't a niche corner of the tax world; it's the mainstream. More than 50 million K-1s from partnerships and S corporations are sent to individual taxpayers every year, making them a cornerstone of modern tax reporting. You can dig into more of these IRS filing trends over on the National Archives website.

Let's break down the three primary types you'll encounter.

K-1 for Partnerships (Form 1065)

This is the workhorse of the K-1 world. If you're a partner in a business, a member of an LLC (that’s taxed as a partnership), or an investor in a private equity or real estate fund, you can expect to see a Schedule K-1 from a Form 1065.

The partnership itself doesn't pay federal income tax. Instead, it files Form 1065 as an informational return to the IRS, and the K-1 you receive breaks down your specific share of the partnership’s financial results for the year.

- Who Issues It: General partnerships, limited partnerships (LPs), and the vast majority of multi-member limited liability companies (LLCs).

- Real-World Example: Imagine you've invested in a real estate syndicate structured as a limited partnership. At the end of the year, the LP will issue you a K-1 detailing your portion of the rental income, your share of the depreciation deductions, and any capital gains from properties sold.

K-1 for S Corporations (Form 1120-S)

Shareholders of an S corporation get a slightly different version of the K-1, one that’s tied to the S corp's tax return, Form 1120-S. While S corps and partnerships both pass their income through to their owners, the underlying tax rules are quite different.

With an S corp, things are more straightforward. Profits and losses are allocated strictly based on each shareholder's stock ownership percentage. No complex, special allocations here.

Key Distinction: Income reported on a partner's K-1 is typically subject to self-employment tax. In contrast, an S corp shareholder's K-1 income generally is not. The trade-off? S corp owners who are active in the business must pay themselves a "reasonable salary," which means W-2 wages and payroll taxes.

K-1 for Estates and Trusts (Form 1041)

The third type of K-1 comes from a completely different source: trusts and estates. When a trust or estate earns income and distributes it to beneficiaries, it acts as a pass-through entity.

The trust or estate files a Form 1041 to report its total income. It then takes a deduction for the income it passed along to the beneficiaries. Those beneficiaries receive a K-1 spelling out their share of that income. It's an elegant system designed to prevent double taxation—the income is taxed just once, in the hands of the person who received it. For family offices stewarding wealth across generations, this K-1 is a fundamental part of the toolkit.

How to Read Your Schedule K-1 Box by Box

Getting a Schedule K-1 in the mail can feel like someone just handed you a complex treasure map without the legend. While every single box on the form has a purpose, you really only need to zero in on a handful of them to understand what’s going on. Learning to decode these key sections is the first step to seeing your full financial picture for the tax year.

The form itself is broken into three main parts. Part I is simple enough—it just gives you the basic details about the business, like its name, address, and Employer Identification Number (EIN). Part II is all about you, the partner or shareholder. It contains your identifying info and the specifics of your stake in the company, such as your ownership percentage.

This visual helps clarify why you might receive a K-1 in the first place, depending on the type of entity you're invested in.

Knowing whether your K-1 came from a partnership, an S corp, or a trust is crucial, as the tax rules that apply to the numbers inside can differ quite a bit.

Part III: Your Share of the Pie

This is where the action is. Part III is the heart of the K-1, detailing how the business's financial results for the year are allocated directly to you. It's the section that lists the income, deductions, and credits that will eventually find their way onto your personal tax return, the Form 1040. Don't feel like you need to memorize every box; let's just focus on the ones that have the biggest impact on your bottom line.

Box 1 – Ordinary Business Income (Loss): This is the big one. It’s your slice of the net profit or loss from the company’s main operations. This figure typically flows right over to Schedule E (Supplemental Income and Loss), Part II on your personal return.

Box 2 – Net Rental Real Estate Income (Loss): If you're a real estate investor, this box is your bread and butter. It reports your portion of the net income or loss from any rental properties the entity owns. Just like Box 1, this number also makes its way to Schedule E, Part II.

Box 5 – Interest Income & Box 6 – Dividends: Did the partnership or S corp hold investments that paid out interest or dividends? Your share gets reported here. From the K-1, you’ll carry these amounts over to Schedule B (Interest and Ordinary Dividends).

Beyond Income: Finding Deductions and Credits

The K-1 doesn't just pass through income; it also hands you your share of valuable deductions and credits that can seriously reduce what you owe in taxes. These are usually found a bit further down in Part III.

Here’s a critical point many people miss: the K-1 tells you what your share is, but it doesn't guarantee you can take the full deduction. Other tax rules, like basis limitations and passive activity rules, ultimately determine the final amount you can actually claim on your return.

Keep an eye out for these other important boxes:

Box 13 – Other Deductions: Think of this as a catch-all for important write-offs. It could include anything from your share of the entity’s charitable giving to a Section 179 deduction, which lets businesses immediately expense certain assets. A specific code in this box will tell you exactly where the deduction goes on your 1040.

Box 20 – Other Information: This box is easy to overlook, but it often contains crucial details. You might find information about your share of investment expenses, foreign tax data, or the numbers you need to calculate the powerful Qualified Business Income (QBI) deduction.

By carefully mapping these key boxes from your Schedule K-1 to the correct lines on your Form 1040, you’re essentially creating a clear, accurate path for filing your taxes.

Strategic Tax Planning with Your K-1 Information

Getting your Schedule K-1 in the mail isn't the finish line for your taxes—it's the starting gun for smart financial planning. This document is far more than a simple reporting form. Think of it as a detailed financial blueprint of your investment, offering a clear view that can help shape your entire wealth strategy.

When you move beyond just plugging these numbers into your Form 1040, you start to see the bigger picture. The K-1 gives you the raw data needed to proactively manage your income, find ways to maximize deductions, and make sure your investment portfolio is as tax-efficient as possible for the long haul.

Navigating Key Limitations on Losses

The numbers on your K-1 carry real weight and have direct financial consequences. Three of the most important concepts you’ll bump into are your tax basis, the at-risk limitations, and the passive activity loss (PAL) rules. Each of these acts as a gatekeeper, determining how much of a reported loss you can actually use to lower your tax bill.

Let's break down these hurdles, because your ability to deduct a loss passed through from a partnership or S Corp isn't guaranteed.

First up is your tax basis. This is essentially your total economic investment in the entity. You generally can't deduct losses that are greater than your basis. A good analogy is a credit card limit; you can't spend more than your available credit, and you can't deduct more in losses than you have in basis. Any loss that gets blocked here isn't gone forever—it’s suspended and carried forward to use in future years when you have enough basis.

Next, you have to clear the at-risk limitations. This rule is pretty straightforward: you can only deduct losses up to the amount you are personally "at risk" of losing. This is typically the cash you've put in plus any loans you've personally guaranteed. It’s the IRS’s way of ensuring you have real skin in the game.

Finally, we get to the passive activity loss (PAL) rules. For many high-net-worth individuals, especially those invested in real estate syndications or other ventures where they aren't involved day-to-day, the income and losses are considered "passive." The PAL rules are strict: they generally prevent you from using these passive losses to offset your active income (like your salary) or your portfolio income (like dividends and interest).

Passive Losses in Real Estate Investing

These rules hit home for real estate investors. Unless you’re a real estate professional who can prove material participation—which usually requires putting in over 500 hours a year—your rental income and losses will likely be classified as passive.

For example, say an investor has $8,000 in passive income from one rental property. If they have a $3,500 suspended passive loss from a different investment carried over from a prior year, they can use that old loss to offset the new income. Their taxable gain shrinks to just $4,500. You can find more detail on how the IRS tracks this data by exploring their official tax archives.

A classic real-world scenario involves an investor in a real estate partnership. They receive a K-1 showing a hefty passive loss of $20,000, mostly thanks to depreciation deductions. If this investor has no other passive income to offset, that entire loss gets suspended. It doesn't just vanish; it’s put on the shelf, ready to be used against passive income in future years or to reduce the taxable gain when the property is eventually sold.

Before we move on, let's look at a few common situations and how you can plan for them. This table breaks down what you might see on your K-1 and what actions you can take.

Common K-1 Tax Scenarios and Planning Points

| K-1 Scenario | Key Tax Implication | Proactive Planning Action |

|---|---|---|

| Large Passive Loss reported | The loss may be suspended if you lack passive income. | Look for opportunities to generate passive income from other sources or group activities to meet material participation standards. |

| Income allocation from multiple states | You may need to file non-resident tax returns in several states, creating a compliance headache. | Work with your CPA to identify all state filing requirements early and plan for state tax credit claims to avoid double taxation. |

| Negative Capital Account | This can signal future tax issues, potentially leading to taxable "phantom income" if you exit the partnership. | Discuss the reasons for the negative balance with your advisor and model the potential tax impact of a future sale or disposition. |

| Guaranteed Payments received | These are treated as ordinary income (and subject to self-employment tax) regardless of the partnership's profitability. | Ensure you are making adequate quarterly estimated tax payments to cover the liability from these payments. |

| At-Risk or Basis Limitation | A portion of your loss is disallowed and must be carried forward to a future year. | Consider making an additional capital contribution or increasing your amount at-risk to free up suspended losses, if the investment merits it. |

As you can see, the data on the K-1 is a starting point for conversation and strategy, not just a set of numbers for data entry.

The Challenge of Multi-State Taxation

A single K-1 can quickly pull you into a complex web of state tax obligations. If the partnership or S corporation you've invested in operates across state lines, it will likely generate income sourced to each of those locations.

As a partner or shareholder, you inherit that complexity. You are often required to file non-resident tax returns in every single state where the entity conducted business and earned income. This can turn into a significant compliance burden, demanding careful planning to ensure you properly claim credits for taxes paid to other states. Without a proactive approach, it’s easy to fall into the trap of paying tax on the same income twice.

Common K-1 Mistakes and How to Avoid Them

Working with Schedule K-1s often feels like navigating a minefield. Even seasoned investors can make small mistakes that spiral into major tax headaches. From late forms to phantom profits, a few common traps consistently catch people off guard. Knowing what to look for is the best way to keep your tax season running smoothly.

One of the most infamous problems is timing. While partnerships are supposed to get their K-1s out by March 15th, delays are the rule, not the exception. This late arrival often forces investors to amend their personal returns, which is a frustrating and time-consuming process nobody wants to deal with.

The Phantom Income Problem

Then there's the dreaded phantom income. This is a particularly frustrating situation where your K-1 shows a healthy profit, but your bank account is empty. You're on the hook for taxes on your full share of the entity's income, even if you never saw a dime in distributions.

Imagine a real estate partnership reinvests all its cash flow into a major renovation. Your K-1 might report $40,000 in taxable income, but you received zero cash. Suddenly, you owe the IRS for money you technically earned but can't spend.

Pro Tip: Before you ever invest, comb through the partnership agreement. Understand the distribution policy inside and out. This foresight helps you plan for tax liabilities on income that might not hit your wallet right away.

Overlooking the Devil in the Details

Beyond timing and cash flow, a handful of other red flags can signal trouble. Getting these details wrong can lead to an inaccurate tax bill, missed deductions, or an audit notice from the IRS. And the penalties aren't trivial—a nominee who fails to furnish a correct K-1 can be fined $340 per instance. In fiscal year 2024, the IRS closed over half a million audits and recommended $29 billion in additional taxes, with many issues stemming from K-1 reporting. The agency's annual tax statistics paint a clear picture of how seriously they take this.

Keep a sharp eye out for these common errors:

- Bad Basis Calculations: Your basis is everything. It determines how much loss you can deduct and what your gain will be when you sell. A mistake here could mean you’re paying far more tax than you should or, worse, claiming losses you aren't entitled to.

- Wrong Income Character: Not all income is created equal. Mixing up active and passive income can completely derail your tax strategy, especially when it comes to deducting passive losses.

- Forgetting State Filings: This one is a classic. A single K-1 from a business operating across the country can mean you have to file non-resident tax returns in several states. It's an easy oversight that can lead to big compliance headaches down the road.

When that K-1 arrives, don't just glance at the final number and file it away. Treat it like a critical financial document. Scrutinize every box, question anything that seems off, and always walk through it with your tax advisor to make sure it's perfect.

Building Your K-1 Action Plan

Knowing what a K-1 is doesn't help you manage it. The real key is moving from a reactive mindset—waiting for the form to arrive and then scrambling—to a proactive, year-round strategy. This shift is what separates savvy investors from those who leave money on the table.

It all starts with meticulous record-keeping. A shoebox full of papers just won’t cut it; disorganized files are a breeding ground for expensive mistakes and missed deductions. Instead, keep a dedicated, organized file for each and every partnership investment.

Key Documents to Keep on Hand

Your Schedule K-1 is really just the final chapter of a long story. To truly understand it, you need the source documents that provide the context behind the numbers. Make sure you have easy access to updated copies of these core files:

- Partnership or Operating Agreements: This is the rulebook. These legal documents spell out exactly how income, losses, and distributions are supposed to be allocated, giving you a roadmap for what to expect on your K-1.

- Basis Schedules: This is on you, not the partnership. You must actively track your investment basis throughout the year. It's absolutely critical for determining whether you can actually deduct any losses reported on the K-1.

- Prior Year K-1s: Your tax situation doesn't reset every January 1st. Keeping a historical file allows you to track things like suspended losses, changes to your capital account, and other items that carry over from one year to the next.

As soon as a K-1 hits your inbox or mailbox, forward it to your tax professional. Don't wait until you have every last document collected.

Sending it over right away gives your advisor a valuable head start. They can begin their analysis, flag any potential issues, and start fitting that piece of the puzzle into your overall financial picture. This simple habit turns the K-1 from a last-minute tax headache into a strategic planning tool.

Common K-1 Questions We Hear All the Time

Even with a good grasp of the basics, a few questions always seem to come up when investors and business owners first encounter a Schedule K-1. Let's tackle some of the most frequent ones head-on to clear up any lingering confusion before it becomes a bigger headache.

Why Did I Get a K-1 Instead of a 1099?

This is a great question because it cuts right to the core of your financial relationship with the business. Think of it this way: a Form 1099 is for people you hire—like independent contractors paid for their services. A Schedule K-1, however, is for people who own a piece of the pie.

You received a K-1 because you're a partner or shareholder with an equity stake in the entity. The form isn't reporting what you were paid for a job; it's detailing your slice of the company's overall profits, losses, and other financial activities. It confirms you're an owner, not just a vendor.

I Didn't Receive Any Cash, So Why Do I Owe Tax?

This is probably the most frustrating—and common—reality of pass-through entities. Yes, you can absolutely owe tax without ever seeing a dime in your bank account. Welcome to the world of phantom income.

Your tax bill is based on your share of the business's profits, not on the cash it actually distributes. For instance, a fast-growing real estate partnership might decide to reinvest 100% of its profits into acquiring another property. You won't get a cash distribution, but your K-1 will still show your share of that taxable income, and the IRS expects you to pay tax on it.

Always, always ask about an entity's distribution policy before you invest. Understanding this up front helps you plan for the tax liability and ensures you have enough cash set aside to cover the bill when it comes due.

What Should I Do if My K-1 Is Late or Wrong?

Late K-1s are the bane of every tax preparer's existence. If the tax deadline is looming and you're still waiting, the best and safest move is to file for an extension with Form 4868. This automatically gives you another six months to file your return correctly, saving you from the stress of a last-minute scramble.

If you get a K-1 with numbers that look off, don't just file with them. Pick up the phone and contact the partnership's manager or accountant immediately. Clearly explain what you think is wrong, provide any documents you have to back it up, and formally request a corrected K-1. Filing with information you know is incorrect is never a good idea.

Managing the complexities of a Schedule K-1 requires a proactive and strategic approach. At Blue Sage Tax & Accounting Inc., we partner with investors and business owners to transform tax compliance from a seasonal chore into a year-round advantage. Let us help you navigate your K-1s with confidence at https://bluesage.tax.