When your business, investments, or even your family life crosses international borders, you've stepped into the world of cross-border tax and accounting. This isn't just about filing a few extra forms; it's a completely different ballgame with its own set of rules, players, and serious financial stakes.

Simply put, it’s the specialized field that deals with the tax and financial reporting puzzles that arise when you have financial ties to more than one country. It requires a deep understanding of how different tax systems—like those in the U.S. and the UK, for example—interact with one another. The goal is to stay compliant while making sure you're not paying more tax than you legally owe.

Why International Tax Requires a Strategic Approach

Expanding your financial footprint abroad is exciting. It can unlock massive growth potential. But it also adds a thick layer of complexity that trips up even the most seasoned business owners and investors. The tax rules can change on a dime the moment your money, assets, or business activities cross a border.

Think of it like this: managing your finances in one country is like playing checkers. The rules are straightforward. Managing finances across multiple countries is like playing three-dimensional chess. You have to anticipate moves from different directions, all at once. Without a solid game plan, you're bound to make a costly mistake.

The Dangers of a Reactive Mindset

Too many people treat international tax as an afterthought—something to deal with only when a notice from the IRS or a foreign tax authority shows up. That's a reactive, and frankly, dangerous way to operate. It almost always leads to bigger problems and more financial pain down the road.

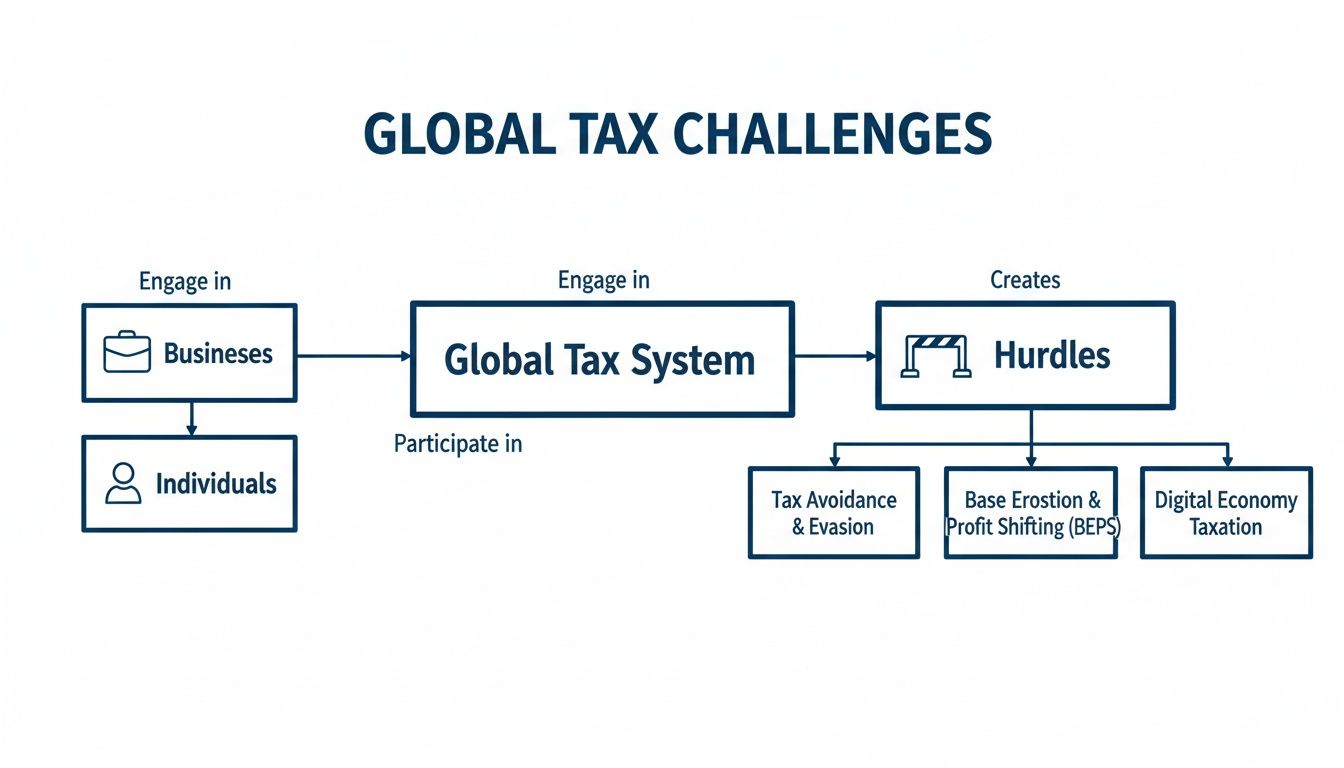

Here’s a quick look at some of the most common hurdles that catch people completely off guard.

This table provides a snapshot of the primary hurdles that individuals and businesses face when their financial interests cross international borders.

| Challenge Area | Who It Affects Most | Primary Consequence of Non-Compliance |

|---|---|---|

| Double Taxation | U.S. citizens/residents with foreign income; foreign nationals with U.S. income. | Paying tax on the same dollar twice, significantly eroding profits and investment returns. |

| Complex Reporting | Anyone with foreign bank accounts, investments, or ownership in foreign companies. | Steep penalties, sometimes exceeding the value of the unreported account or asset. |

| Conflicting Rules | Businesses operating in multiple countries; investors with diverse global portfolios. | Disallowed deductions, unexpected tax liabilities, and potential legal disputes. |

| Transfer Pricing | Multinational businesses with intercompany transactions. | Major tax adjustments and penalties if authorities believe profits are being unfairly shifted. |

Navigating these challenges effectively requires a proactive strategy, not just a reaction when problems arise.

A proactive approach to cross-border tax and accounting transforms it from a compliance headache into a genuine strategic advantage. By anticipating challenges and making smart use of international agreements, you can protect your assets, minimize your global tax bill, and keep your operations running smoothly.

Building a Foundation for Success

At the end of the day, getting this right is about more than just checking boxes on tax forms. It's about designing a resilient financial structure that can support your global ambitions for the long haul.

This guide is designed to be your roadmap. We'll start with the fundamentals, like figuring out tax residency and how income is sourced, before moving on to more advanced strategies involving tax treaties and transfer pricing. Once you grasp these core principles, you'll be in a much better position to manage the complexities of cross-border tax and accounting and turn potential obstacles into real opportunities.

Understanding the Foundations of Global Taxation

To get a real handle on cross-border tax and accounting, you have to start with the fundamental rules of the game. International tax isn’t just a random collection of laws; it’s built on a few core principles that dictate which country gets to tax your income and how much they can take. Get these concepts down, and every other strategy and compliance decision will start to make a lot more sense.

Think of it like learning the basic moves in chess. Without knowing how the pieces move, you can't even begin to think about strategy. Let's walk through these foundational pillars one by one.

Determining Your Tax Home Base

The first question every tax authority on the planet asks is, "Are you one of ours?" This is the core idea behind tax residency. It's the primary hook a country uses to claim the right to tax your worldwide income. And it’s not always about where your passport is from—it’s about where your financial and personal life is anchored.

For the U.S., it’s pretty clear-cut for citizens and green card holders. They are nearly always considered U.S. tax residents, no matter where on the globe they happen to live. For everyone else, it often comes down to a numbers game based on how much time you spend in the country (what’s known as the substantial presence test) or a more subjective look at where you have a permanent home and your closest economic ties.

Once a country pegs you as a tax resident, it generally asserts its right to tax all of your income, from any source, anywhere in the world. This is the critical starting point, because it immediately sets up the potential for double taxation if another country also wants a piece of that same income.

The flowchart below gives a sense of the common hurdles that both individuals and businesses run into when navigating these global rules.

As you can see, whether you're an individual with foreign investments or a business expanding overseas, the path is layered with complex challenges that demand a clear strategy.

Following the Money with Income Sourcing

While residency gives a country the right to tax your global income, income sourcing rules give it the right to tax money that’s generated within its borders—regardless of where you live. Think of it as a local access fee. If you make money in another country's "marketplace," that country is going to claim its right to tax those specific earnings.

Let's say you're a U.S. resident who owns a rental property in Spain. The U.S. taxes that rental income because you're a U.S. resident. But Spain will also tax that income because it was generated, or "sourced," from property physically located inside Spain.

This sourcing principle applies differently to various income types:

- Services: Income is usually sourced to where the work is physically done.

- Sales of Goods: It often depends on where legal title to the goods passes to the buyer.

- Real Estate: Rent or sale profits are sourced to the country where the property sits.

- Dividends and Interest: This typically follows the residency of the company or person paying you.

As you can imagine, sourcing rules are a major reason double taxation happens. It's easy for multiple countries to lay a legitimate claim to tax the exact same income, just based on different principles.

The core conflict in international tax comes down to the clash between residency and sourcing. Your home country wants to tax your worldwide income, while other countries want to tax any income you generate inside their borders.

Preventing Double Taxation with Foreign Tax Credits

So, what stops you from getting hammered by two different countries on the same dollar? The most important tool in the toolbox is the foreign tax credit (FTC). This is a brilliant feature built into a country's own tax code specifically to solve the double-taxation problem.

The idea is refreshingly simple: your home country gives you a dollar-for-dollar credit for the taxes you've already paid to a foreign government on your foreign-sourced income. It’s essentially a rebate.

Let's go back to our Spanish rental property. If you paid $3,000 in taxes to the Spanish government on your rental profits, the U.S. tax code allows you to claim a foreign tax credit. This can reduce your U.S. tax bill by up to $3,000 on that same slice of income. The end result is that your total tax burden ends up being close to the higher of the two countries' tax rates—not the sum of both.

Getting your head around these three pillars—residency, sourcing, and foreign tax credits—is absolutely essential. They are the logical bedrock upon which all other international tax strategies, treaties, and compliance rules are built.

Decoding Key US International Tax Laws

The United States doesn't just play in the world of international tax; it often writes the rulebook. Because of its unique citizenship-based taxation system and unmatched global financial reach, the U.S. has rolled out a series of powerful tax laws that every global citizen and business needs to understand.

These laws aren't just abstract theories found in a textbook. They have very real, tangible consequences for anyone with foreign assets or business operations. They represent a deliberate strategy by the U.S. government to demand transparency and prevent the siphoning of its tax base.

Let's unpack the most significant pieces of this legislative puzzle.

FATCA: The Global Transparency Net

The Foreign Account Tax Compliance Act (FATCA) is arguably one of the most transformative pieces of U.S. tax legislation ever passed. Think of it as a global dragnet for financial information, spun by the U.S. Treasury to catch offshore tax evasion by Americans.

How does it work? FATCA compels foreign financial institutions (FFIs)—your bank in Geneva, your brokerage in Singapore—to identify their U.S. clients and report account information directly to the IRS. If they refuse to play ball, they get hit with a crippling 30% withholding tax on certain payments coming from the U.S.

This created an offer most foreign banks couldn't refuse. For individuals, it means the era of quiet, "undiscovered" foreign accounts is over. While you're filing your FBAR (FinCEN Form 114) and Form 8938, your foreign bank is sending its own report to the IRS, making cross-referencing simple.

FATCA effectively deputized the world's financial institutions into becoming extensions of the IRS reporting system. This shift dramatically increased transparency and made proactive compliance a non-negotiable for U.S. taxpayers with global assets.

Tackling Profit Shifting with GILTI and NCTI

For decades, a massive loophole existed: U.S. multinational companies could earn profits through foreign subsidiaries and defer paying U.S. tax on them indefinitely, as long as the cash stayed offshore. This led to mountains of capital being parked in low-tax jurisdictions.

The Global Intangible Low-Taxed Income (GILTI) regime was designed to blow up that model. It created a new class of foreign income that gets taxed in the U.S. right now, whether the money is brought home or not. The main target was the profit generated from intangible assets—like patents, software, and brand royalties—which are notoriously easy to shift to tax havens.

Of course, the rules of the game are always changing. In 2025, the One Big Beautiful Bill Act (OBBBA) brought a transformative overhaul, replacing the GILTI regime with Net CFC Tested Income (NCTI). At the same time, the effective tax rate was hiked from 10.5% to 12.6%. You can explore more about these significant international tax changes and what they mean for your business.

BEAT: Preventing Base Erosion

Another heavyweight in the U.S. international tax arsenal is the Base Erosion and Anti-Abuse Tax (BEAT). This law takes aim at large corporations that slash their U.S. tax bills by making deductible payments to their own foreign affiliates.

Picture a huge U.S. company paying massive royalties or management fees to its parent company in a low-tax country. Those payments create deductions in the U.S., "eroding" the taxable income and shifting profits offshore.

BEAT functions as a backstop—a kind of minimum tax. It forces these large companies to re-do their tax math without the benefit of those base-eroding deductions. If the tax calculated under BEAT is higher than their regular tax liability, they owe the difference.

- Who is affected? Primarily U.S. corporations with average annual gross receipts of at least $500 million.

- What does it do? It imposes a minimum tax on companies making significant deductible payments to foreign affiliates.

- Why does it matter? It curbs the ability of large multinationals to strip earnings out of the U.S. and into lower-tax jurisdictions.

Together, FATCA, GILTI/NCTI, and BEAT form a complex, interlocking system. They all point in one direction: the U.S. is committed to increasing global financial transparency and ensuring its citizens and corporations pay their fair share on worldwide income. Navigating this landscape isn't for the faint of heart; it demands deep expertise and a forward-looking strategy.

Mastering Transfer Pricing and Dispute Resolution

When different parts of the same multinational company do business with each other, they have to put a price on those internal transactions. This process, called transfer pricing, is easily one of the most scrutinized areas in the entire world of cross-border tax.

Think about it this way: a U.S. parent company designs groundbreaking software, and its subsidiary in Ireland handles all international sales. The U.S. entity has to "sell" the software rights to its Irish counterpart. The price tag they put on that internal sale directly determines how much profit gets reported—and ultimately taxed—in each country.

If that price is set artificially low, more profit magically appears in lower-tax Ireland, which shrinks the U.S. tax base. As you can imagine, tax authorities from the U.S. to Europe to Asia are hyper-aware of this potential for shifting profits, and they have very strict rules to stop it.

The Arm's-Length Principle Explained

The global gold standard for transfer pricing is the arm's-length principle. The concept is straightforward, but putting it into practice is where things get tricky. It simply means that the price for a deal between related companies must be the same as it would be if the two were completely unrelated, negotiating on the open market.

At the end of the day, tax authorities are asking one question: would an independent company have actually agreed to this price? Getting the answer wrong can bring a world of hurt.

- Significant Tax Adjustments: A tax authority can just recalculate your profits using what they think the price should have been, leaving you with a much bigger tax bill.

- Steep Penalties: Non-compliance can trigger penalties that often run between 20% to 40% of the tax you owe.

- Lengthy Audits: Transfer pricing audits are notorious for being long, invasive, and incredibly resource-intensive, pulling your team’s focus away from what really matters—running the business.

To prove your pricing is fair, your business needs to keep meticulous documentation that justifies every decision and methodology. This isn't a friendly suggestion; it's a mandatory part of modern cross-border tax & accounting.

Proactive Solutions for Tax Certainty

Rather than just crossing your fingers and waiting for an audit, you can take control of the situation to get ahead of disputes. One of the most powerful tools for this is an Advance Pricing Arrangement (APA). An APA is a formal agreement between you and one or more tax authorities.

Through the APA process, you agree in advance on the exact methodology you'll use for setting transfer prices on future deals. It's a demanding process, no doubt, but the payoff is huge: as long as you stick to the agreement, your transfer prices won't be challenged. It’s the ultimate way to eliminate uncertainty and slash your audit risk.

An APA is like getting the answers to the test before you take it. It provides a clear, pre-approved roadmap for your intercompany pricing, ensuring you remain compliant and avoid costly future disputes with tax authorities.

Resolving Disputes When They Arise

Even with the best-laid plans, disputes can and do happen. When two countries' tax authorities can't agree on how a transaction should be taxed, you can get stuck in the middle with a double tax bill. The main way to resolve these treaty-related conflicts is through the Mutual Agreement Procedure (MAP).

MAP is a formal, government-to-government negotiation where the "competent authorities" (the official tax representatives) from the countries involved work to find a resolution. This process gives you a formal channel to make your case when you believe you're being taxed in a way that goes against a bilateral tax treaty.

This isn't a niche issue; it's a growing global challenge. The OECD's 2024 statistics now cover a record 141 jurisdictions, and they reported that transfer pricing cases grew by 3.9%. This trend just goes to show how critical it is to have an expert in your corner for these high-stakes negotiations. You can dive deeper into these trends by reading the OECD's latest report on MAP statistics.

Successfully navigating APAs and MAPs demands a very specific blend of international tax law, economic theory, and sharp negotiation skills. It’s a clear reminder of why having an experienced advisor who can effectively advocate for you is not a luxury, but a necessity.

Proactive Tax Planning for Global Operations

Simply hitting your filing deadlines isn’t a strategy—it’s the bare minimum. The real value in cross border tax & accounting emerges when you move past just being compliant and start thinking ahead. This is about turning your tax function from a reactive necessity into a strategic engine for building and protecting your wealth.

For anyone with a global footprint, whether an individual or a business, this forward-looking mindset isn't just a nice-to-have; it's critical for long-term financial survival. It’s about making conscious, informed decisions on how and where to structure your assets and operations to legally minimize tax leakage and keep your finances aligned with your biggest goals.

Strategies for Individuals and Family Offices

When it comes to high-net-worth individuals and family offices, smart planning usually revolves around optimizing income streams and asset structures scattered across different countries. The whole point is to make sure taxes paid in one jurisdiction don't needlessly chew away at the wealth you've generated somewhere else.

One of the most powerful tools in our arsenal is the strategic use of bilateral tax treaties. These are formal agreements between countries that can dramatically reduce or even eliminate withholding taxes on things like dividends, interest, and royalties. By thoughtfully structuring investments through jurisdictions with favorable treaties, you can stop a huge chunk of your returns from getting taxed away before they even hit your account.

Another key piece of the puzzle is getting the most out of your foreign tax credits. This isn't automatic. It requires a meticulous approach to allocating income and expenses to ensure you can claim every dollar of credit you’re entitled to, which is your primary defense against the bite of double taxation.

Planning for Closely Held Businesses

For businesses, proactive planning casts an even wider net, touching everything from the initial corporate setup to day-to-day operational decisions. A cornerstone of any solid international business strategy is intelligent entity structuring. This boils down to picking the right kind of legal entity—a corporation, a partnership, a branch—in each country where you operate to create the most tax-efficient setup.

For example, a U.S. parent company might set up a foreign subsidiary as a corporation to defer U.S. tax on its active business income. Or, it might opt for a partnership structure to let profits and losses flow through directly to the owners. Every single choice has massive, long-term implications for your global tax bill.

Timing is everything, too. Strategically timing when you recognize income and expenses across different tax years and countries can create real advantages. This could mean accelerating deductions in a high-tax country or deferring income until a more favorable tax period, all while staying squarely within the lines of local laws.

Proactive cross-border tax planning is about designing a financial architecture that supports your global ambitions. It requires looking beyond a single tax year and forecasting the impact of decisions five or ten years down the line, ensuring your structure is both efficient today and resilient tomorrow.

The Power of Financial Modeling

Making these high-stakes decisions based on guesswork is a recipe for disaster. This is where sophisticated financial modeling becomes your best friend. By building detailed projection models, we can run the numbers and simulate the tax fallout of different scenarios before you commit to a path.

- Forecast Tax Impacts: See exactly how entering a new market or reorganizing your corporate structure will affect your global effective tax rate.

- Compare Structures: Model the long-term tax cost of different entity structures side-by-side to find the most efficient route.

- Assess Policy Changes: Gauge your exposure to new legislation, like shifting international tax agreements, and plan your response.

This data-driven approach takes the ambiguity out of the equation, letting you make decisions with clarity and confidence. It's particularly vital as global tax rules become more harmonized. Take the OECD's Two-Pillar framework, which has nearly 140 countries on board to enforce a global minimum tax of 15%. This proves how governments are collaborating, which creates new compliance hurdles but also opens up unique planning opportunities. To get a better sense of this shifting ground, you can review insights on the future of international taxation.

Common Questions About Cross Border Tax & Accounting

Diving into the world of international finance can feel like learning a new language. It’s a complex field, and it’s completely normal to have questions. In fact, the small points of confusion are often what lead to the biggest headaches and most expensive mistakes down the road.

We get asked these questions all the time. Here are some clear, straightforward answers to the most common ones we hear from our clients who are living, investing, or doing business across borders.

What Is the Difference Between Tax Residency and Citizenship?

This is probably the single most important concept to get right, and it's a frequent source of confusion. Your citizenship is your legal tie to a country—where your passport is from. Tax residency, on the other hand, is all about where a country believes it has the right to tax you based on your economic and personal ties.

The United States is an outlier here; it taxes its citizens no matter where they live in the world. Most other countries don't do that. For them, tax residency is usually determined by things like:

- How many days you physically spend in the country each year.

- Whether you have a permanent home available for your use there.

- Where your "center of vital interests" lies—basically, where your personal and economic life is most centered.

You can easily be a citizen of one country and a tax resident of another. This isn't an unusual situation, but it's the exact scenario that makes careful cross-border tax planning absolutely critical.

How Can I Avoid Double Taxation?

Nobody wants to pay tax twice on the same income, and thankfully, there are well-established mechanisms to prevent this. The two primary tools in your arsenal are Foreign Tax Credits (FTCs) and tax treaties.

Think of a Foreign Tax Credit as a dollar-for-dollar reduction of your U.S. tax bill for the income taxes you've already paid to another country. A tax treaty is an agreement between two nations that lays out the rules of the road for taxes. These treaties often lower the taxes withheld on payments like dividends and interest and provide "tie-breaker" rules to decide where you’re a resident if both countries try to claim you.

The objective isn't to avoid tax altogether. It's to make sure every dollar of your income is taxed fairly—and only once. Using tax credits and treaty benefits correctly is how we make that happen.

Does My Foreign Bank Have to Report My Account to the IRS?

The short answer is yes, almost certainly. Under a U.S. law called the Foreign Account Tax Compliance Act (FATCA), the IRS has agreements with governments all over the world. These agreements require foreign banks and financial institutions to identify their U.S. clients and report their account information directly to the IRS.

The days of quiet, undisclosed offshore accounts are long gone. The IRS gets this data automatically, making it incredibly easy for them to see if it matches what you've reported on your tax return and FBAR. Full, accurate disclosure isn't just a good idea; it's a globally enforced requirement.

When Is a Transfer Pricing Study Necessary?

If your business operates in more than one country and has transactions between its related entities, you need to be thinking about transfer pricing. Imagine your U.S. headquarters provides management services to your German subsidiary. The price you charge for those services must be the same as if you were dealing with a completely unrelated company—what's known as an "arm's length" price.

A transfer pricing study is the formal documentation that proves you've done this correctly. It’s your first line of defense if a tax authority questions your pricing. Without a solid study, they can decide you've shifted profits unfairly and hit you with major adjustments and penalties. While a formal study might not be needed for a few tiny transactions, it becomes a non-negotiable part of risk management as your intercompany business grows.

Getting these details right is about more than just compliance; it’s about building a smart, proactive strategy that fits your unique situation. At Blue Sage Tax & Accounting Inc., we help you connect the dots, bringing clarity and confidence to your global finances. Discover how our expertise in cross border tax & accounting can protect your assets and support your growth.