Ever wondered how some real estate investors seem to be playing a completely different game with their taxes? Chances are, they are. They’re likely using a powerful tax strategy known as the Real Estate Professional (REP) status. This isn't just some fancy title; it's a specific IRS designation that can fundamentally change how your rental property losses impact your tax bill.

The Tax Advantage That Changes Everything

For most people, rental real estate is what the IRS calls a "passive activity." In plain English, this means any losses you generate—often paper losses from things like depreciation—get stuck in a box. You can only use those losses to offset other passive income, not the active income from your day job or other businesses. It's like having a great tax deduction that you can't actually use against your biggest source of income.

But qualifying for Real Estate Professional status flips the script entirely. It allows you to treat your rental activities as non-passive, which basically tears down the wall separating your real estate losses from your other income.

Turning "Paper Losses" into Real Savings

Think about it: you could take those significant paper losses from depreciation and use them to directly slash the taxable income from your primary career. This is the heart of the REP strategy. It’s like getting a promotion from the minor leagues of tax deductions straight to the majors, where your real estate portfolio actively shields your other earnings from taxes.

This shift can have a massive financial impact, especially for high-income earners. Let's look at a quick example: a married couple brings in a combined $800,000 a year from their W-2 jobs. They also own 10 rental properties that, after depreciation, show a $100,000 loss for the year.

Without REP status, that $100,000 loss is basically useless against their salaries. But if one spouse qualifies as a real estate professional, they can deduct the full $100,000 loss against their joint income. In a 37% federal tax bracket, that’s an immediate $37,000 back in their pockets. Suddenly, a "loss" on paper becomes a powerful tool that boosts their cash flow, maybe even enough to fund the down payment on their next property. You can explore more about these tax benefits and how savvy investors make it happen.

The real magic of REP status is turning on-paper real estate losses into real-world cash savings by offsetting your primary income. It’s hands-down one of the most effective tax strategies out there for serious property investors.

Who Is This Really For?

While the tax savings are huge, REP status isn't for the casual landlord dabbling with one or two properties. It’s specifically designed for people who commit a serious amount of their professional life to real estate. You essentially have to prove to the IRS that real estate isn’t just your side hustle—it’s a primary business focus.

This guide will break down exactly what it takes to use this game-changing strategy. We'll cover:

- The two critical tests you absolutely must pass every single year.

- How to meticulously document your time to build an audit-proof case.

- Next-level strategies involving spousal planning and how to structure your entities.

- The common pitfalls and mistakes that can get you in hot water with the IRS.

The Two Critical Tests for REP Status

Qualifying for the powerful Real Estate Professional (REP) tax status isn’t about how many doors you own or the rent checks you cash. Forget all that. The IRS zeroes in on one thing and one thing only: your time.

To get this coveted designation, you have to pass two very specific, non-negotiable tests every single year. Think of them as hurdles you have to clear. Stumble on even one, and you’re stuck as a "passive" investor in the eyes of the tax code, meaning your rental losses are locked away from offsetting your other income.

The First Hurdle: The 750-Hour Rule

First up, you’ve got to prove a serious time commitment. The rule is simple: you must spend more than 750 hours during the tax year working in real property trades or businesses.

But not just any activity will do. The IRS is particular about what counts. We’re talking about hands-on, substantive work that shows you’re actively running a real estate enterprise.

Qualifying activities include things like:

- Development and redevelopment: Building from the ground up or doing major overhauls.

- Construction and reconstruction: The actual work of building or renovating.

- Acquisition and conversion: The nitty-gritty of sourcing, analyzing, and buying properties.

- Rental and leasing: Actively finding and managing tenants, handling leases, and dealing with turnover.

- Operation and management: Day-to-day oversight, coordinating maintenance, and handling the books.

- Brokerage: Working as a licensed agent or broker.

Just scanning financial statements or driving by your properties on the weekend won't cut it. The time has to be spent on legitimate, operational tasks.

The Second Hurdle: The "More Than Half Your Time" Rule

Clearing the 750-hour mark is just the first part of the equation. This second test is the one that trips up most people, especially those juggling a demanding W-2 job.

You have to prove that the time you spent on real estate was more than 50% of your total working time for the entire year. It’s a straight-up comparison. The IRS wants to see that real estate is your main gig, not just a lucrative side hustle.

Here’s a classic example:

A successful surgeon works 2,000 hours a year at the hospital. She also runs her rental portfolio like a pro, clocking an impressive 800 hours. She easily sails past the 750-hour test. But she fails the second test because her 800 real estate hours aren't more than half of her total work time (2,800 hours). She can't claim REP status.

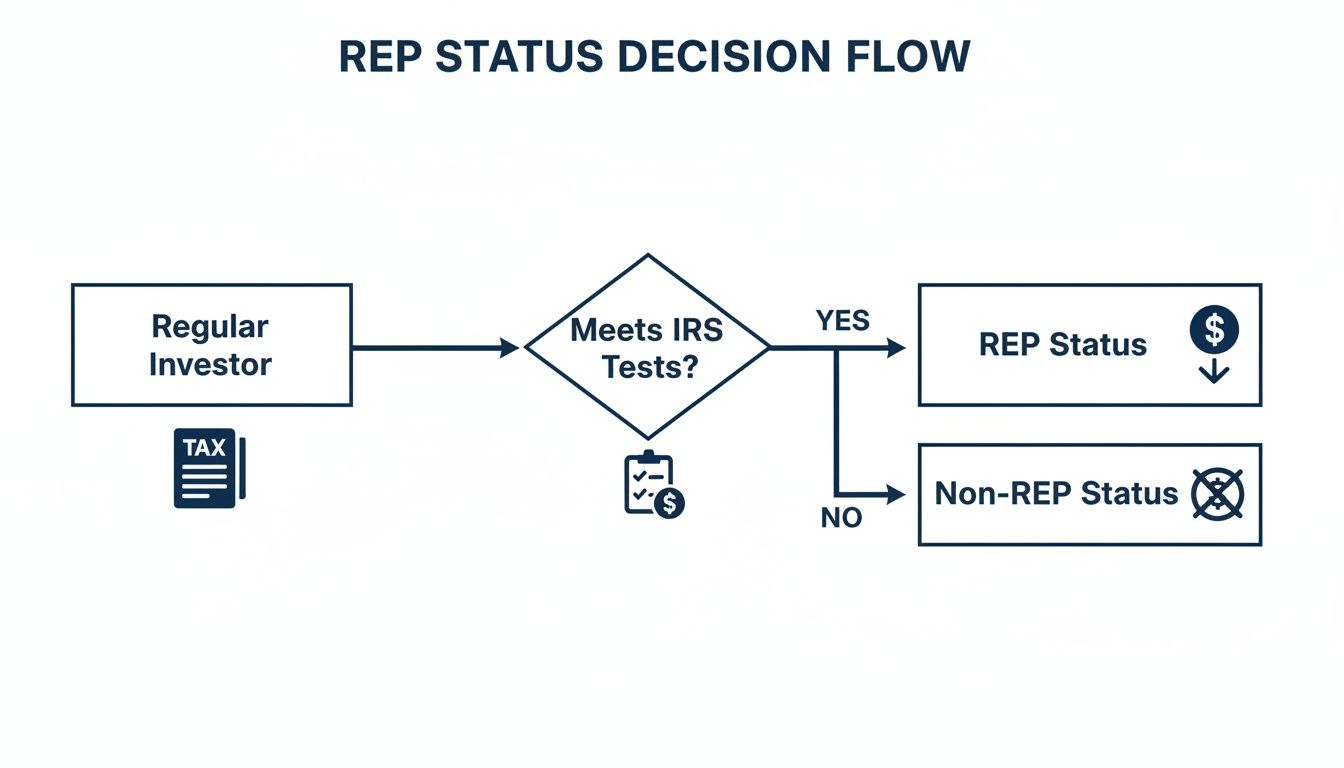

This flowchart breaks down the decision-making process perfectly.

As you can see, you have to hit both IRS tests. There's no middle ground. It's the only way to unlock those valuable tax benefits.

To help you keep track, here's a quick checklist that summarizes what the IRS is looking for.

REP Status Qualification Checklist

This table is your quick-glance guide to see if you're on the right track for meeting the two primary IRS tests for Real Estate Professional status.

| Requirement | What It Means | Common Pitfall |

|---|---|---|

| The 750-Hour Test | You must spend more than 750 hours per year on real estate trade or business activities. | Miscounting hours. Only substantive, operational tasks count—not just thinking about your properties. |

| The >50% Test | Your real estate hours must be more than half of your total personal service hours from all jobs combined. | Having a demanding full-time job. Even if you hit 750 hours, a 2,000-hour/year W-2 job makes this test impossible. |

Remember, failing even one of these puts you back in the passive investor category for the year.

These two ironclad tests have been around since the Tax Reform Act of the 1980s. They were specifically designed to draw a clear line between active professionals and passive hobbyists. It's estimated that only about 10-15% of rental property owners actually manage to qualify, but for those who do, the annual tax savings can be huge. You can read more about the history of these tax benefits and how they've shaped investment strategies.

Passing both tests is mandatory, and you have to re-qualify every single year. This is exactly why meticulous, contemporaneous time tracking isn't just a good idea—it's the absolute foundation of a defensible REP status claim.

Proving Your Hours and Material Participation

Meeting the 750-hour and 50% time tests gets you in the door for real estate professional status. But getting in and staying in are two different things. Now comes the real work: proving it.

This is where the concept of material participation becomes your day job.

Simply checking the boxes to qualify as a Real Estate Professional (REP) isn't the finish line. The IRS then requires you to also materially participate in each of your rental activities. This is their way of making sure you’re actively running a business, not just cashing rent checks from the sidelines.

The Seven Tests of Material Participation

The good news? You don't have to pass all seven of the IRS's tests for material participation. You just need to satisfy one of them for each rental activity you want to treat as non-passive.

While some of the tests are pretty obscure, most real estate investors live and breathe by these three:

- The 500-Hour Test: This is the big one. You spent more than 500 hours on the activity during the year. If you have the logs to back it up, this is the gold standard and the toughest for an auditor to challenge.

- The Substantially All Test: Your work on the property was basically all the work done by anyone. This is perfect for the DIY landlord who handles everything from tenant screening to plunging toilets.

- The 100-Hour Test (and More Than Anyone Else): You put in over 100 hours, and that was more time than any other single person (like your go-to handyman or leasing agent). It’s a great middle-ground option.

Trying to meet one of these tests for every single property can turn into an administrative nightmare. Luckily, there’s a much smarter way to play the game.

Creating an Audit-Proof Time Log

Let's be blunt: your most important tool is your time log. If you get audited, the IRS agent will ask for it, and trying to piece it together from memory a year later is a recipe for disaster.

Your log has to be contemporaneous. That’s just IRS-speak for recording your activities as they happen or soon after, not scribbled on a napkin in a panic right before your audit.

The IRS loves a paper trail. A detailed, contemporaneous time log isn't just a good idea; it's your primary line of defense. Without it, your REP claim is built on a house of cards.

Think of your log as a detailed diary of your real estate business. Every entry needs to tell a story:

- Date: The exact day you did the work.

- Hours Spent: How long it took, ideally broken down to the quarter-hour.

- Property: Which property you were working on.

- Description of Activity: Be specific! "Property management" is useless. "Screened three tenant applications for 123 Main St., called references, and ran credit checks" is perfect.

This isn't just about counting hours; it's about creating a credible, undeniable record of your hands-on involvement. A simple spreadsheet, a dedicated notebook, or a time-tracking app all work great.

The Grouping Election: A Strategic Shortcut

Juggling hours and proving participation for ten different properties sounds exhausting, because it is. That's why the tax code gives us the grouping election (under IRC Section 469(c)(7)(A)).

This is an incredibly powerful strategy that lets you formally tell the IRS you're treating all your rental properties as one single, combined activity.

Instead of hitting a material participation test for each property, you only have to meet it once for the whole portfolio. Suddenly, that 500-hour test is based on your total time across all your properties. It's a game-changer for anyone with more than a couple of doors.

Keep in mind, the IRS is cracking down. As more people claim REP status, scrutiny has ramped up. Recent guidance and a spike in audits for high-income filers show they're demanding bulletproof logs and are more critical of what counts as a qualifying activity. Vague tasks are out; core functions like development, management, and leasing are in. You can learn more about the 2025 IRS rule changes to make sure you stay on the right side of the line.

Making this election is a formal step you take on your tax return. Once you make it, it's binding for future years unless your situation changes dramatically, so it's a decision you'll want to hash out with your tax advisor.

Advanced Strategies for High-Income Earners

For anyone pulling in a high income, getting real estate professional tax status isn't just a nice little tax break—it's a cornerstone of a smart financial plan. This is the key that unlocks the holy grail for investors: using paper losses from real estate (hello, depreciation!) to shield a big chunk of your W-2 or business income from taxes.

This is more than just checking boxes to qualify. It's about weaving REP status into your bigger financial picture to seriously accelerate your wealth-building and portfolio growth. Let's get past the basics and dig into the strategies that turn this tax designation into a powerhouse for your financial life.

The Spousal Strategy: A Game-Changer for High Earners

One of the most powerful plays for high-income households is what we call the "spousal strategy." It’s the perfect solution when one spouse has a demanding, high-paying career—think doctor, lawyer, or tech exec—that makes meeting the REP tests on their own a non-starter.

Instead of both partners trying to squeeze in hours, the couple makes a strategic decision. One spouse, often the one with more schedule flexibility, becomes the designated real estate pro. Their job is to focus on the real estate activities and crush the 750-hour and 50% tests.

Because a married couple can file a joint tax return, the magic happens when that one spouse officially qualifies. Suddenly, the entire household gets the benefits. Those rental losses can be used to offset the combined income of both spouses, including the hefty W-2 salary from the other partner.

Example: The Doctor and the Investor

A surgeon earns $600,000 a year, while her husband is the one who actively manages their 15-unit rental portfolio. He's meticulous, logging over 1,200 hours a year on everything from leasing and tenant management to finding the next deal. He easily qualifies as a REP.

Thanks to depreciation, their portfolio generates a $120,000 paper loss for the year. By filing jointly, they can deduct that full $120,000 loss directly against her surgeon's salary. The result? They save over $44,000 in federal taxes. That's a huge win.

Entity Structuring and the QBI Deduction

The way you set up your real estate business can completely change your tax picture. Holding properties in an LLC or S Corp is great for liability protection, but it creates some complex interactions with tax laws, especially when it comes to the Qualified Business Income (QBI) deduction.

The QBI deduction, also known as Section 199A, lets owners of many pass-through businesses write off up to 20% of their qualified business income. While rental real estate can qualify for QBI, the devil is in the details.

Here’s where things get interesting:

- With REP Status: When you're a REP, your rental activities are non-passive. This makes it much more likely that the IRS will see it as a legitimate trade or business, making any net rental income you have eligible for the QBI deduction.

- The Trade-Off: Here's the catch. The whole point of REP status for most high-income earners is to generate a large net loss to offset other income. If you have a loss, you have no positive income to apply the 20% QBI deduction against. In most cases, the immediate benefit of deducting a huge loss against your ordinary income is far more valuable than a potential QBI deduction down the road.

Choosing the right entity and understanding how these rules play off each other is absolutely critical. This is where you need a tax advisor who lives and breathes real estate. A specialized firm like Blue Sage Tax & Accounting Inc. can help you model out the scenarios and build a strategy that fits your exact situation, ensuring you're not leaving a pile of cash on the table.

Navigating State and Local Tax Rules

Don't forget, the feds are only half the story. Your state's tax laws add a whole other layer of complexity—and opportunity.

If you live in a high-tax state like New York or California, those big federal deductions become even more powerful because they often lower your state taxable income, too. It’s a double dip on tax savings.

But be careful. Not all states follow the federal rulebook to the letter. Some might have their own quirky rules for passive loss limitations or how they handle depreciation. You have to understand the specific tax landscape where you live and invest to get a true picture of your total tax savings. This is especially crucial for investors with properties scattered across multiple states, as you'll be juggling the tax codes for each and every one.

Common Mistakes and How to Avoid Them

Claiming real estate professional status can be a game-changer for your taxes, but the path is lined with pitfalls that can easily trigger an IRS audit. Let's walk through the most common slip-ups I see investors make, so you can build a rock-solid, defensible tax position from the start.

Getting these rules right is what separates huge tax savings from a nightmare audit. Let’s dive into the frequent errors and, more importantly, how to sidestep them.

Sloppy and Inconsistent Time Logs

This is, without a doubt, the number one mistake. So many people treat their time log as a last-minute chore, scribbling down vague notes or trying to piece together a year's worth of activity from memory. An auditor will tear that apart in minutes.

- What Not to Do: Don't create a log in a mad dash before the tax deadline with generic entries like "8 hours – property management" or "4 hours – tenant calls."

- The Right Way: You absolutely must keep a contemporaneous log. This just means you record your activities as they happen or very close to it. Use a simple spreadsheet or an app to track the date, hours spent, the specific property, and a clear description of the task. For instance, instead of "landlord stuff," your log should say, "Met with plumber at 123 Main St. to fix leak, then screened two new tenant applications for 456 Oak Ave."

Misunderstanding Qualifying Activities

Here's a hard truth: not all real estate-related hours are created equal. Many investors mistakenly count time spent on what the IRS considers "investor" tasks, not the work of a professional. This can leave you with a massive shortfall in your required 750 hours.

Your time must be spent in a "real property trade or business." This means hands-on work like development, construction, acquisition, leasing, or management. Time spent merely reviewing financial statements or attending investor seminars generally does not count toward your hours.

Failing the 50 Percent Test

This is the big hurdle that trips up most high-earners with a demanding W-2 job. They might diligently log over 750 hours in real estate, but they forget that those hours must also represent more than half of their total working time for the entire year.

- Example Scenario: A marketing executive works 2,000 hours a year at their corporate job. They also manage to put in an impressive 900 hours on their rental portfolio.

- The Problem: While they cleared the 750-hour test, their 900 real estate hours are obviously not more than their 2,000 work hours. They fail the 50% test and cannot claim REP status.

- The Solution: For many in this boat, the "spousal strategy" is the key. If you have a demanding career, your spouse may be able to focus on the real estate activities to qualify for the household.

Botching the Grouping Election

The grouping election is a fantastic tool. It lets you treat all your rental properties as a single activity, which makes hitting the material participation tests much, much easier. However, it's a formal election that you have to make correctly on your tax return.

Forgetting to attach the election statement or filling it out incorrectly can blow up your whole strategy. This forces you to prove material participation for each property individually—a nearly impossible task for most. This is a critical detail that a specialized tax firm like Blue Sage Tax & Accounting Inc. can ensure is handled perfectly.

Navigating these rules can feel like a minefield. To make it clearer, here’s a quick-glance table of what to do versus what not to do.

Common REP Status Mistakes vs Best Practices

| Common Mistake | Why It's a Problem | Best Practice to Follow |

|---|---|---|

| "Guesstimating" Hours | The IRS can easily disallow a log that isn't detailed, contemporaneous, and believable. It's a huge red flag. | Keep a detailed, daily or weekly log of your activities. Note the date, hours, property, and specific task performed. |

| Counting Investor Time | Time spent researching new markets or reviewing financial statements isn't "participation." This leads to a shortfall in qualifying hours. | Focus your log on hands-on activities: repairs, tenant screening, property management, leasing, acquisition, etc. |

| Ignoring the 50% Test | It's a two-part test. Even with 1,000 real estate hours, if you worked 2,000 hours at a W-2 job, you fail. | Carefully track hours for all your personal service work, not just real estate, to ensure you meet the >50% threshold. |

| Forgetting the Grouping Election | Without a formal election, you must prove material participation for each property separately, which is incredibly difficult. | File a formal grouping election statement with your tax return the first year you want to group your properties. |

| Assuming It's "One and Done" | REP status isn't a permanent designation. Failing to requalify in a subsequent year can turn your non-passive losses back into passive ones. | Treat every year as a clean slate. You must meet all the tests and maintain documentation annually to keep the status. |

Avoiding these common errors is all about being proactive and meticulous. It's far easier to build a strong case from the beginning than to try and fix it under the pressure of an audit.

Finally, always remember the most fundamental rule: REP status is not permanent. You have to earn it and prove it all over again, every single year.

Your Top Questions About Real Estate Professional Status, Answered

Let's be honest, the rules for becoming a Real Estate Professional (REP) can feel like a maze. I get these questions all the time from clients, so let's walk through the most common ones and clear things up.

"Can I really pull this off with a full-time W-2 job?"

This is the big one, and I'll give it to you straight: for most people, it's a very, very tough sell. The math just doesn't work.

Think about it. The IRS requires that more than half your work time is spent on real estate. If you have a standard 2,000-hour-a-year day job, you'd need to log over 2,000 hours in your real estate activities. That's a second full-time job. Unless you've figured out how to skip sleeping, it's just not realistic.

This is exactly why the "spousal strategy" is such a game-changer for high-income couples. One spouse, maybe someone working part-time or with a flexible schedule, can go all-in on the real estate side. When you file a joint return, their REP status can unlock massive deductions for the entire household.

"Does hiring a property manager kill my chances?"

Not necessarily, but it definitely complicates things. Hiring a property manager doesn't disqualify you on its own, but you have to be careful. Their hours don't count for you, and the IRS will look much closer at what you're actually doing.

The time you spend managing the manager—reviewing their reports, setting strategy, approving big expenses—absolutely counts. But you have to prove you’re still the one driving the bus.

Your time logs need to show you’re deeply involved in the stuff that matters, well beyond what a typical manager handles. Things like:

- Strategic Decisions: You're the one deciding rental rates, approving major capital projects, and shaping the portfolio's direction.

- Major Repairs: When the roof needs replacing or the HVAC system dies, you're sourcing the contractors and overseeing the project.

- Tenant Relations: You might handle the final tenant interviews, negotiate complex leases, or step in for serious disputes yourself.

The key takeaway? You have to be the central decision-maker, not just a passive investor cashing checks.

Hiring help is fine, but abdicating control is not. The IRS wants to see that you are still the one substantially running the show, even if you delegate day-to-day tasks.

"What happens if I qualify one year but not the next?"

This is more common than you'd think. Real estate professional status isn't a lifetime award; you have to earn it every single year.

So, let's say you qualify in Year One. Great! You get to deduct all your rental losses against your other income. But in Year Two, life gets busy, and you don't meet the hours. Your rental activities flip back to being "passive."

Any losses you have that year are now considered suspended passive losses. They aren't gone, but they're stuck in limbo. You can't use them to offset your W-2 or business income. Instead, they get carried forward and you can use them in a couple of ways:

- To offset any passive income you have in the future (like positive cash flow from your rentals).

- To deduct them in full against any income when you eventually sell the property that created them.

It's an on-again, off-again status for many investors, and that’s perfectly okay as long as you track it correctly.

"Do I need to get a real estate license to be a REP?"

Nope! This is one of the biggest myths out there. A real estate license is not a requirement to be a Real Estate Professional in the eyes of the IRS.

The IRS cares about the activities you perform, not the licenses on your wall. Qualification is all about the time you dedicate to "real property trades or businesses," which includes things like:

- Development or redevelopment

- Construction

- Acquisition and conversion

- Rental management and operation

- Leasing or brokerage

Sure, being a full-time agent or broker makes hitting the hours a lot easier, but it's not the only path. It all comes down to your time log and proving you spent the hours doing the work. Your actions, not your credentials, are what truly matter here.

At Blue Sage Tax & Accounting Inc., we help real estate investors navigate these complex rules with confidence. Our proactive planning and deep industry expertise ensure you’re not just compliant, but are also maximizing every available tax advantage. If you’re ready to build a powerful tax strategy for your real estate portfolio, connect with us today.