Calculating your Adjusted Gross Income, or AGI, isn't as complicated as it sounds. At its core, you just take your total gross income from every source and subtract a specific list of deductions known as "above-the-line" deductions.

Think of AGI as the most influential number on your tax return. It’s the baseline the IRS uses to figure out how much you actually owe and what tax breaks you're entitled to.

What Is Adjusted Gross Income and Why It Matters

Your Adjusted Gross Income is the figure the IRS looks at before you even get to your standard or itemized deductions. It’s not just some random number on your Form 1040; it's the gatekeeper that determines your eligibility for some of the most valuable tax benefits. Honestly, a lower AGI can save you a surprising amount of money.

This single number has a ripple effect across your entire tax situation. For example, your AGI directly impacts:

- Your eligibility for tax credits: Many popular credits, from the Child Tax Credit to education credits, begin to phase out as your AGI climbs.

- Deductible IRA contributions: How much you can deduct for contributions to a traditional IRA is often limited by your AGI.

- Student loan interest deduction: Your ability to write off the interest you paid on student loans is also tied to your AGI.

In short, getting a handle on your AGI is a fundamental part of smart tax planning. When you strategically use those "above-the-line" deductions, you shrink your AGI. That, in turn, can lower your final tax bill and open the door to more savings.

A lower AGI is your best friend at tax time. It’s the key to reducing your taxable income and maximizing your eligibility for valuable tax credits and deductions that could save you thousands.

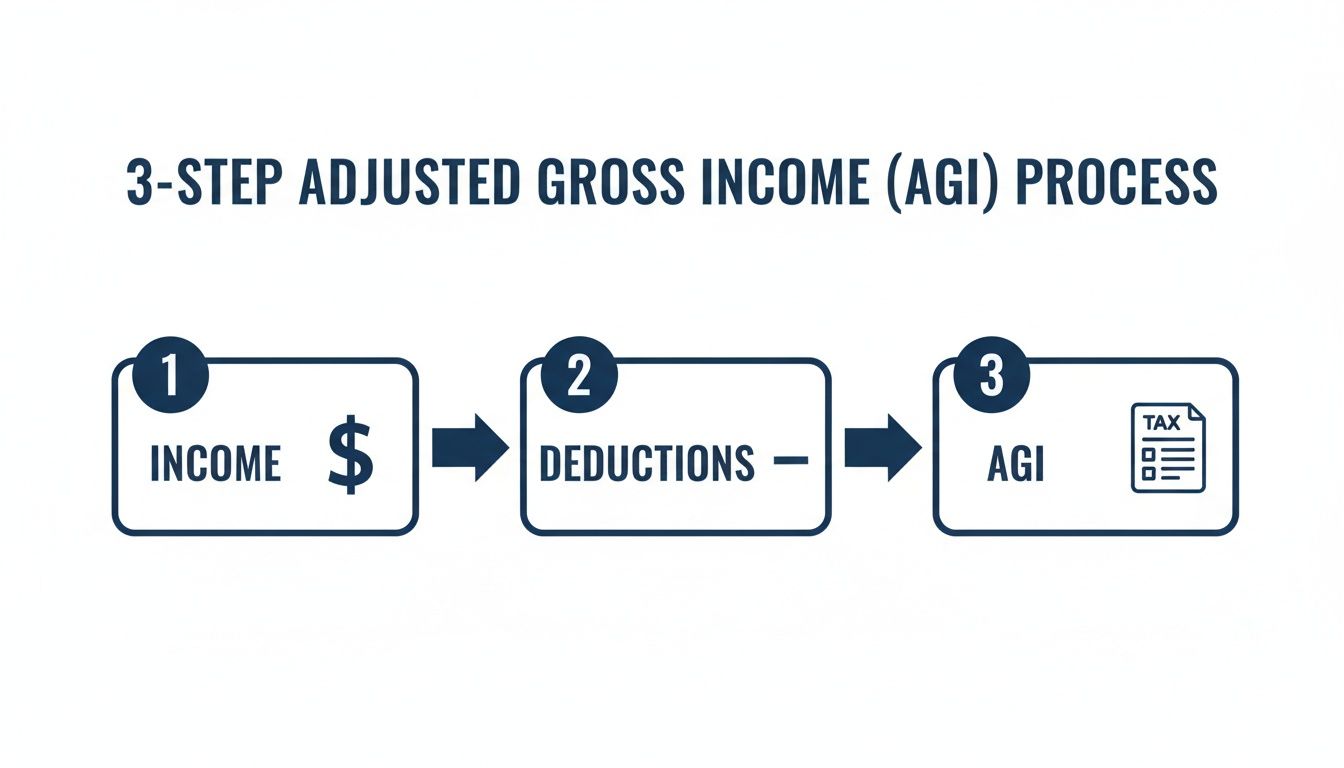

The process is pretty straightforward: add up your income, subtract the specific deductions you qualify for, and you've got your AGI.

This diagram breaks it down visually. You start with everything you earned, use deductions to bring that number down, and what's left is your Adjusted Gross Income.

To give you a clearer picture, here's a quick summary of how the formula works.

AGI Calculation at a Glance

This table breaks down the basic formula and the components that go into calculating your AGI.

| Component | Description | Example |

|---|---|---|

| Gross Income | All income received from any source before any taxes or deductions are taken out. | Wages, salaries, freelance income, investment dividends, rental income. |

| Above-the-Line Deductions | A specific list of expenses the IRS allows you to subtract from your gross income. | Educator expenses, student loan interest, HSA contributions, IRA deductions. |

| Adjusted Gross Income (AGI) | The resulting figure after subtracting all eligible above-the-line deductions from your gross income. | Gross Income minus Above-the-Line Deductions equals AGI. |

Understanding these three pieces is the first step toward mastering your tax return and finding opportunities to save.

The Modern Importance of AGI

AGI became even more critical after the Tax Cuts and Jobs Act (TCJA) of 2017. This law nearly doubled the standard deduction, which meant far fewer people found it worthwhile to itemize their deductions. As a result, AGI is now the make-or-break number for the vast majority of taxpayers.

IRS data backs this up. In 2018 alone, nearly 70% of 150 million filers chose the standard deduction, making those above-the-line adjustments more powerful than ever. Getting the AGI calculation wrong is a common mistake, delaying roughly 10% of e-filed returns each year. For a deeper dive, you can find more insights about AGI's role from the tax pros at Jackson Hewitt.

Gathering Your Total Gross Income

Before we can even think about deductions, we have to get a clear, honest picture of everything you earned. This is your total gross income, and it's the foundation for your entire tax return. It’s not just your paycheck—it's the sum of every taxable dollar that came your way throughout the year.

A lot of people think their gross income is just the salary on their W-2. That’s a common mistake, and one that can cause real problems. We need to account for all sources, big and small, to get this number right.

Core Income Sources to Track

First things first, let's round up the usual suspects. You’ll need to collect the tax forms that report your different streams of income.

Here are the most common places to start your hunt:

- W-2 Wages and Salaries: This is the big one for most people—your income from regular employment. You’ll find this number in Box 1 of your Form W-2.

- Freelance and Self-Employment Income: Got a side hustle or run your own business? This income usually shows up on a Form 1099-NEC or Form 1099-K. Remember, you have to report all your freelance income, even if you don't receive a 1099 for it.

- Investment Income: This bucket includes dividends (reported on Form 1099-DIV), interest from your savings accounts (Form 1099-INT), and capital gains when you sell assets like stocks (Form 1099-B).

- Rental Income: If you're a landlord, the rent you collect is income. You'll track this on Schedule E, where you can also deduct related expenses.

Gathering these documents gives you a solid, verifiable starting point for calculating your AGI.

Don't Overlook These Other Income Streams

It's easy to focus on the big-ticket items, but plenty of other income sources get missed. Forgetting these can lead to an inaccurate return and potential headaches with the IRS down the road.

For example, did you collect unemployment benefits last year? That’s taxable income, and it will be reported on Form 1099-G. That same form is also used for certain state tax refunds that count as taxable income.

Key Takeaway: Your total gross income is far more than your salary. It's a full accounting of every dollar you brought in—from wages and side gigs to investment returns and even unemployment. Getting this number right is the most important first step.

Here are a few other income types that often slip through the cracks:

- Alimony Received: For divorce agreements finalized before 2019, alimony payments are still considered taxable income to the person who receives them.

- Business Income: If you're a sole proprietor or have a stake in a partnership or S corporation, your share of the business profits counts toward your gross income.

- Royalties and Farm Income: Any money from creative works or agricultural activities needs to be included.

- Retirement Distributions: Money you took from a pension, annuity, IRA, or 401(k) is generally part of your gross income.

A Practical Example of Totaling Gross Income

Let's walk through a quick, real-world scenario. Imagine a marketing director in Queens who also does some freelance writing and has a modest investment portfolio.

Here's how she would add everything up:

- Salary from Main Job: $150,000 (from her Form W-2)

- Freelance Writing Income: $15,000 (total from several Forms 1099-NEC)

- Bank Account Interest: $500 (from Form 1099-INT)

- Stock Dividends: $2,500 (from Form 1099-DIV)

- Capital Gains from Selling Stock: $4,000 (from Form 1099-B)

When you add all of those up ($150,000 + $15,000 + $500 + $2,500 + $4,000), her total gross income comes to $172,000. This is our starting line. From here, we can begin subtracting adjustments to find her AGI.

Claiming Your Above-The-Line Deductions

This is where the real magic happens when you’re figuring out your taxes. Once you've tallied up your gross income, the next step is to subtract a special category of expenses called "above-the-line" deductions. They're incredibly powerful because they reduce your income before you even get to the standard vs. itemized deduction choice.

Think of these as direct discounts on your income. The best part? They're available to any taxpayer who qualifies, making them one of the most effective tools for shrinking your tax bill. You'll find the full list on Schedule 1 of your Form 1040.

Key Deductions for Individuals and Families

Plenty of common adjustments can bring your AGI down significantly. Even the smaller ones add up fast, and together, they can make a real difference in what you owe.

Let’s run through some of the most common and impactful ones I see all the time:

- Traditional IRA Contributions: If you put money into a traditional IRA, you can usually deduct the full amount you contributed, right up to the annual limit. It's a classic win-win: you save for retirement and lower your taxable income at the same time.

- Student Loan Interest Paid: Still paying off those student loans? You can deduct up to $2,500 of the interest you paid during the year. For millions of Americans, this is a much-needed break.

- Health Savings Account (HSA) Contributions: I'm a huge fan of HSAs. Your contributions are deductible, the money grows tax-free, and you can take it out tax-free for qualified medical expenses. It’s a triple tax benefit that’s tough to beat.

- Educator Expenses: For all the teachers out there, you can deduct up to $300 for the unreimbursed books, supplies, and other materials you bought for your classroom.

These deductions aren't just small change. In 2023, 4.2 million teachers took advantage of the educator expense deduction. Looking at the bigger picture, retirement and health deductions are the heavy hitters, claimed on over 75 million tax returns in 2022. You can learn more about these tax-saving adjustments and see just how much of an impact they can have.

Essential Deductions for the Self-Employed

If you're a freelancer, consultant, or small business owner in Queens or anywhere else, above-the-line deductions are more than just helpful—they're absolutely critical. They are built to help you manage cash flow and keep your tax obligations in check.

Forgetting these can be a very expensive mistake, as they directly account for the costs of being your own boss.

Here are the non-negotiables you need to know:

- One-Half of Self-Employment Tax: When you're self-employed, you're on the hook for both the employer and employee sides of Social Security and Medicare taxes. The IRS gives you a break by letting you deduct the employer half—that’s 50% of your total self-employment tax—right from your gross income.

- Self-Employed Health Insurance Premiums: This one is huge. You can deduct 100% of the premiums you pay for health, dental, and qualified long-term care insurance for yourself, your spouse, and your dependents. It makes getting quality coverage so much more affordable.

- Contributions to SEP, SIMPLE, and qualified plans: Setting up a business retirement plan like a SEP IRA or a SIMPLE IRA is a savvy move. Your contributions are fully deductible, letting you save aggressively for the future while getting a great tax break right now.

Key Insight: Above-the-line deductions are a universal advantage. It doesn’t matter if you're an employee funding an HSA or a freelancer paying for your own health insurance. These adjustments cut down your taxable income before anything else, which maximizes your savings potential across the board.

A Practical Example of Applying Deductions

Let's go back to our freelance graphic designer from Queens. We started with her gross income of $85,000. Now, let's see how these deductions chip away at that number.

During the year, she made a few key payments:

- Paid Self-Employment Tax: Her total SE tax bill was $12,001. She gets to deduct half of that, which is $6,000.

- Paid for Health Insurance: She paid $7,200 in premiums for the year.

- Contributed to a SEP IRA: She wisely stashed $10,000 in her SEP IRA for retirement.

- Paid Student Loan Interest: She knocked down her old student loans, paying $1,800 in interest.

Now, we simply subtract these from her gross income:

- Gross Income: $85,000

- Minus SE Tax Deduction: -$6,000

- Minus Health Insurance: -$7,200

- Minus SEP IRA Contribution: -$10,000

- Minus Student Loan Interest: -$1,800

After applying these deductions, her Adjusted Gross Income (AGI) is $59,000. Just like that, she lowered her taxable income by a whopping $26,000. This will have a massive effect on her final tax bill and opens the door to credits she might not have qualified for otherwise. It’s a perfect real-world example of how to calculate AGI by using every deduction you're entitled to.

Real-World Scenarios for Calculating AGI

Theory is great, but let's be honest—taxes don't really click until you see the numbers in action. Walking through a few common situations is the best way to see how all those different income streams and deductions come together to shape that all-important AGI figure. These examples will help you connect the dots between your own pay stubs, 1099s, and bank statements and the lines on your tax return.

Example 1: The W-2 Employee

First up, a pretty straightforward case. Meet Sarah, a single marketing manager in Queens. She earns a steady salary and is diligent about saving for retirement and putting money into her health savings account. Her financial picture is clean, making it a perfect starting point.

Here's a quick look at Sarah's finances for the year:

- W-2 Salary: $90,000

- Traditional IRA Contribution: $6,500

- HSA Contribution: $3,000

- Student Loan Interest Paid: $1,500

To find her AGI, we start with her gross income, which is simply her salary of $90,000.

Next, we just subtract her "above-the-line" deductions. Her contributions to her IRA and HSA, plus the student loan interest she paid, all qualify.

The math is simple:

$90,000 (Gross Income) – $6,500 (IRA) – $3,000 (HSA) – $1,500 (Student Loan Interest) = $79,000

Sarah’s Adjusted Gross Income is $79,000. Just by taking advantage of a few common deductions, she managed to lower her taxable income by a solid $11,000. Not bad at all.

Example 2: The Freelance Graphic Designer

Now, let's look at something with a few more moving parts. Meet David, a freelance graphic designer who works for himself as a sole proprietor. His income is a collection of 1099s from different clients, and he has a handful of business-related expenses that are key to calculating his AGI correctly.

Here’s what David’s year looked like:

- Total 1099-NEC Income: $120,000

- Self-Employment Taxes Paid: $16,956 (He gets to deduct half of this)

- Self-Employed Health Insurance Premiums: $8,400

- SEP IRA Contribution: $15,000

David’s gross income is $120,000. Unlike Sarah, his deductions are tied directly to his self-employment status.

Let’s run the numbers:

- Start with his gross income: $120,000

- Subtract half of his self-employment tax ($16,956 / 2): $8,478

- Subtract his health insurance premiums: $8,400

- Subtract his SEP IRA contribution: $15,000

Putting it all together:

$120,000 – $8,478 – $8,400 – $15,000 = $88,122

David’s AGI comes out to $88,122. By strategically claiming deductions available to freelancers, he knocked his income down by almost $32,000, which will make a huge difference in how much tax he ultimately owes.

AGI Scenarios W-2 Employee vs Freelancer

To really see the difference, let's put Sarah and David's situations side-by-side. While their gross incomes differ, the real story is in how they reduce that income to find their AGI.

| Calculation Step | W-2 Employee Example | Freelancer Example |

|---|---|---|

| Gross Income | $90,000 (from W-2) | $120,000 (from 1099s) |

| Adjustment 1 | -$6,500 (Traditional IRA) | -$8,478 (1/2 SE Tax) |

| Adjustment 2 | -$3,000 (HSA Contribution) | -$8,400 (SE Health Insurance) |

| Adjustment 3 | -$1,500 (Student Loan Interest) | -$15,000 (SEP IRA) |

| Total Adjustments | -$11,000 | -$31,878 |

| Final AGI | $79,000 | $88,122 |

This comparison highlights how different financial lives lead to different paths for lowering taxable income. The deductions available to a freelancer are often much larger because they encompass business-related costs that a W-2 employee doesn't have.

Example 3: The Married Couple with Investments

Finally, let’s check in with a married couple, Maria and Alex, who file their taxes jointly. They both have W-2 jobs, sold some stock this year, and are helping a child with college loans. This scenario mixes in capital gains and education deductions.

Here’s their joint financial snapshot:

- Maria's W-2 Salary: $110,000

- Alex's W-2 Salary: $95,000

- Capital Gains from Selling Stock: $8,000

- Student Loan Interest Paid (for their child): $2,500

- Contribution to Traditional IRAs (total for both): $13,000

The first step is to get their total gross income by adding everything up.

$110,000 (Maria's Salary) + $95,000 (Alex's Salary) + $8,000 (Capital Gains) = $213,000

Now, we subtract their deductions. Their combined IRA contributions and the maximum student loan interest are both eligible.

Their AGI calculation looks like this:

$213,000 (Gross Income) – $13,000 (IRAs) – $2,500 (Student Loan Interest) = $197,500

Their joint AGI is $197,500. This example is a great reminder of how to combine multiple W-2s and investment income before applying any of the available adjustments.

The core process for how to calculate adjusted gross income remains the same: sum up all income, then subtract all eligible above-the-line adjustments. This is true whether you're a single filer with one W-2 or a family with complex finances.

A lower AGI isn't just a number on a form; it has a real financial impact. IRS statistics from 2022 audits revealed that a correctly calculated AGI slashed average tax liabilities by 8-12% for middle-income households. You can discover more insights about these findings and see just how powerful these adjustments can be. By carefully tracking your income and deductions, you put yourself in the best possible position come tax season.

Common Mistakes to Avoid When Calculating AGI

Figuring out your adjusted gross income is mostly a straightforward process, but a few common slip-ups can easily throw your numbers off. Since an accurate AGI is the foundation of your entire tax return, getting it wrong can mean missing out on savings, getting a notice from the IRS, or even facing penalties.

Knowing what to watch out for is half the battle. Let's walk through the errors I see most often.

By far, the most frequent mistake is mixing up the two main types of deductions. It's an easy error to make, but it has big consequences for your tax bill.

Confusing Deduction Types

Above-the-line deductions are special—they lower your gross income before you arrive at your AGI. Itemized deductions, on the other hand, only come into play after you’ve calculated your AGI.

Here’s how to keep them straight:

- AGI Reducers (Above-the-Line): These are the adjustments we've been talking about, like contributions to a traditional IRA, student loan interest, or HSA contributions. If you're eligible, you can take them.

- Taxable Income Reducers (Itemized): This category includes things like charitable donations, mortgage interest, and state and local taxes (SALT). You only use these if their combined total is more than your standard deduction.

A classic mistake is trying to subtract a charitable donation while calculating your AGI. Always keep these two buckets separate to get your AGI right from the start.

Overlooking All Your Income

It's easy to focus on your main paycheck or primary business income, but the IRS expects you to report every dollar you earn. Forgetting to add smaller income streams is a big red flag that can get your return a second look.

Get in the habit of making a checklist. Did you sell some stock? That capital gain from your Form 1099-B is part of your gross income. Did you earn a few hundred bucks from a side gig? That's income, even if you didn't get a 1099-NEC for it.

Expert Tip: I always tell my clients to scan their bank statements for odd deposits. Small amounts from freelance work, interest payments, or other miscellaneous sources add up and must be included in your gross income before you can calculate AGI.

Miscalculating Contribution Limits

Deductions for retirement accounts and HSAs are powerful tools, but they have strict annual limits set by the IRS. Going over these limits is a surprisingly common pitfall.

For example, contributing too much to your IRA or HSA is a double whammy. Not only is the excess amount not deductible, but you could also be hit with a 6% penalty tax for every year that extra money stays in your account. The rules can get tricky, especially if you also have a retirement plan at work.

Before you make a contribution, do a quick check on the current year’s limits for your age and filing status. This simple step can save you a headache, prevent penalties, and ensure your AGI calculation is perfectly accurate.

Frequently Asked Questions About Calculating AGI

Even after you think you have the hang of it, specific questions about Adjusted Gross Income always seem to surface. That’s perfectly normal. Every tax situation is unique, and the rules can be surprisingly nuanced. Let's walk through some of the most common questions I hear to clear up any confusion.

What Is the Difference Between AGI and MAGI?

It's so easy to get "AGI" and "MAGI" mixed up, especially since they sound almost identical. The best way to think about it is that your Modified Adjusted Gross Income (MAGI) is a specific version of your AGI that's used for special purposes.

To find your MAGI, you first have to calculate your AGI. Then, you add back certain deductions you just took. The most common things you’ll add back are student loan interest, tuition and fees, and some types of foreign-earned income. The exact formula actually changes depending on which tax benefit you're checking your eligibility for.

Key Takeaway: Your AGI is the main event—it's the figure on your Form 1040 that determines your taxable income. Your MAGI is more of a background calculation the IRS uses to see if you qualify for things like contributing to a Roth IRA or getting the Premium Tax Credit for health insurance.

You won’t find a dedicated line for MAGI on your main tax form. It’s a number you figure out on the side when needed. For a lot of people, their AGI and MAGI end up being the exact same number.

Can I Deduct My Charitable Contributions to Lower My AGI?

This is a great question and probably one of the biggest points of confusion out there. The short answer is no, charitable donations do not lower your AGI.

Here’s why: charitable contributions are what’s known as an itemized deduction. These deductions are subtracted after your AGI has already been locked in.

This is a really important distinction to grasp:

- Above-the-Line Deductions: These are the special deductions (like for IRA contributions or student loan interest) that you subtract from your gross income to arrive at your AGI. Anyone who qualifies can take them.

- Itemized Deductions: These are expenses like your charitable gifts, mortgage interest, and state taxes. You only get to subtract these from your AGI if you decide not to take the simpler standard deduction.

This is exactly why those "above-the-line" deductions are so powerful. They reduce your AGI no matter what, making them a much more direct way to lower your tax bill.

Does Capital Gains Income Affect My AGI?

Yes, absolutely. Capital gains are a core component of your gross income, so they feed directly into your AGI. A capital gain is just the profit you make when you sell something—like stocks, a piece of property, or other assets—for more than you originally paid for it.

When you're adding up all your income for the year, you have to include your capital gains right alongside your wages, interest, and any freelance earnings. This happens right at the very beginning of the AGI calculation.

It works the other way, too. If you have a net capital loss for the year (meaning you lost more on asset sales than you gained), you can use that loss to reduce your gross income. The IRS allows you to deduct up to $3,000 in net capital losses from your other income each year, which in turn gives you a lower AGI.

Where Do I Find My AGI on My Tax Return?

Your AGI is arguably the most important number on your entire tax return, so the IRS makes sure it’s easy to spot.

You can find your Adjusted Gross Income on Line 11 of your IRS Form 1040.

It’s sitting right there at the bottom of the form's first page. Think of it as the grand total after all your income has been added up (Line 9) and all your above-the-line deductions have been subtracted (Line 10). If you use tax software, this is all calculated automatically, but knowing exactly where to look is crucial for double-checking everything and for future financial planning.

Trying to figure out all the complexities of AGI, from self-employment deductions to investment income, is where having a professional in your corner can make a huge difference. The team at Blue Sage Tax & Accounting Inc. specializes in proactive tax planning for individuals and businesses in Queens and beyond. We focus on making sure you're taking advantage of every single opportunity to lower your tax burden. If you're ready for clarity and confidence in your financial strategy, connect with us at Blue Sage Tax.