For the 2025 tax year, bonus depreciation lets businesses deduct a hefty portion of an asset's cost right away—specifically, 40% for eligible new and used property placed in service during the year. This immediate write-off is a powerful tool, though it's part of a planned reduction from the 100% bonus depreciation we saw in previous years.

Understanding the Bonus Depreciation Phase-Down for 2025

Think of bonus depreciation as a government-backed incentive to get businesses spending and investing in their own growth. It’s like a massive, limited-time tax deduction sale. The discount was incredible for a few years, but now it’s getting smaller annually. For 2025, that "discount" on your taxable income is set at 40%.

This isn't some surprise tax change sprung on business owners. It's the continuation of a scheduled phase-out put in motion by the Tax Cuts and Jobs Act (TCJA) of 2017. That landmark law supercharged the deduction to 100%, allowing companies to write off the entire cost of new equipment, vehicles, or property in a single year. But, the law also built in this gradual decline.

Where We Are Now

We've been on this downward slope for a couple of years now. It started at 100% through 2022, dropped to 80% in 2023, and then to 60% for 2024. Now, for assets placed in service in 2025, the rate is 40%.

It's a significant drop, but a 40% upfront deduction is still an incredibly valuable planning tool that can dramatically lower your tax bill and free up cash flow for other investments. The key is knowing how to work with the current rules.

Key Takeaway: The timing of your asset purchases is everything. A machine you put to work in December 2024 got a 60% bonus. That same machine put to work in January 2025 only gets a 40% bonus. Planning ahead is no longer just a good idea—it's essential.

Tracking the Annual Changes

To really get a handle on this, it helps to see the numbers laid out. The TCJA created a predictable, year-by-year decline that smart businesses have been using for long-term capital planning.

Here's a look at the bonus depreciation phase-down schedule so you can see the full picture:

Bonus Depreciation Phase-Down Schedule 2022-2027

| Year Placed in Service | Bonus Depreciation Percentage |

|---|---|

| 2022 and earlier | 100% |

| 2023 | 80% |

| 2024 | 60% |

| 2025 | 40% |

| 2026 | 20% |

| 2027 and beyond | 0% |

Seeing the schedule makes the trend crystal clear. The incentive is designed to fade away completely by 2027. This provides the context for why strategic timing and understanding the rules for 2025 are so critical for your bottom line.

How the 40 Percent Bonus Depreciation Rule Works

At first glance, the tax code can seem intimidating, but the mechanics of the bonus depreciation 2025 rule are actually pretty straightforward. Think of it as a one-two punch for your tax deductions in the first year you own a new asset. You get a big, immediate write-off upfront, and then you depreciate the rest like normal.

Here's the breakdown. First, you take the asset's total cost and apply the bonus percentage for the year. For anything you put into service in 2025, that magic number is 40%. You get to deduct that chunk right away, which immediately lowers your taxable income.

So, what about the other 60%? It doesn't just vanish. That remaining value becomes the new starting point—what tax pros call the "basis"—for your regular, ongoing depreciation over the asset's useful life. This way, you still get to write off the entire cost of the asset; it just happens over a longer timeline.

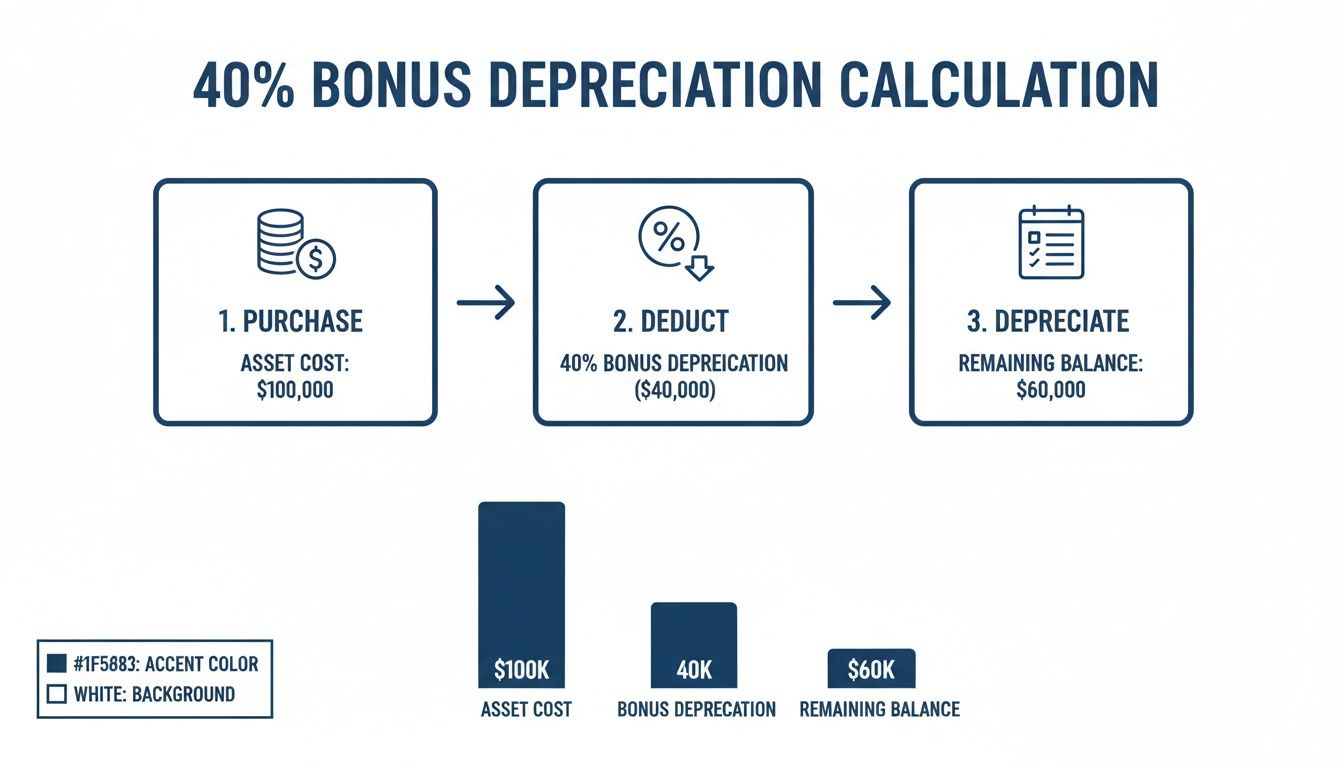

A Practical Example of the 40 Percent Rule

Let's put this into practice. Imagine your creative agency buys a new, high-end video editing suite for $100,000 in 2025.

First, we figure out the immediate bonus depreciation write-off:

- Asset Cost: $100,000

- 2025 Bonus Rate: 40%

- Bonus Depreciation Deduction: $100,000 x 0.40 = $40,000

That $40,000 is your instant tax win. You deduct it directly from your 2025 business income, which can make a huge difference in your tax bill and free up cash flow for other things.

Next, we calculate what’s left to depreciate over time:

- Original Cost: $100,000

- Less Bonus Deduction: $40,000

- Remaining Depreciable Basis: $60,000

This remaining $60,000 is then depreciated using the standard MACRS (Modified Accelerated Cost Recovery System) schedules. For tech equipment like this, that's usually a five-year schedule. So, on top of the initial $40,000 bonus, you also get to take the first year of MACRS depreciation on the remaining $60,000.

The Power of Stacking Deductions: This is where the real magic happens. By combining the 40% bonus with standard MACRS depreciation, your total first-year write-off becomes much larger than what you’d get with traditional depreciation alone. For that $100,000 editing suite, your total first-year deduction is the $40,000 bonus plus the first-year MACRS amount on the leftover $60,000.

Identifying Qualifying Property for 2025

Of course, not every purchase you make qualifies for bonus depreciation. The IRS has specific rules, but the good news is they cover a lot of common business investments. A key point is that both new and used property can qualify, as long as it's the first time you've put it to use in your business.

To claim the deduction, the asset generally needs to fall into one of these buckets:

- Property with a Recovery Period of 20 Years or Less: This is the big one. It covers most of the tangible things a business buys: machinery, equipment, company vehicles, furniture, and computer systems.

- Computer Software: This applies to "off-the-shelf" software—the kind you can buy from a store or website.

- Qualified Improvement Property (QIP): This is a huge category for real estate investors and business owners who lease space. It covers most interior, non-structural improvements to a commercial building after it's already in service. Think of renovating an office, restaurant, or retail shop. It doesn't cover elevators, the building's structural frame, or an expansion of the roof.

- Water Utility Property: A more niche category, this covers certain assets used in the business of supplying or distributing water.

Knowing these rules allows you to plan your major purchases strategically. You can time your investments to make sure they qualify for the bonus depreciation 2025 incentive, turning necessary expenses into powerful, immediate tax savings. To make sure you're checking all the right boxes, it’s always a good idea to chat with a tax professional, like the team at Blue Sage Tax & Accounting Inc., who can help you confirm eligibility and get the most out of your deductions.

Bonus Depreciation vs Section 179

When it comes to writing off asset purchases, business owners have two powerhouse deductions at their disposal: bonus depreciation and Section 179. While both can significantly slash your tax bill, they are not interchangeable. Think of them as different tools for different jobs, and knowing when to use each one is the key to a smart tax strategy.

You can think of bonus depreciation as a broad-stroke approach. It automatically applies to an entire class of qualifying assets you put into service during the year. You can’t pick and choose which assets within a class get the bonus; it’s an all-or-nothing deal unless you specifically elect out for that entire class.

Section 179, on the other hand, is all about precision. It lets you hand-select specific assets and write off their full cost in the first year, giving you granular control over your deductions. This is perfect when you want to fully expense one piece of equipment while depreciating another over its normal lifespan.

Key Differences in Application

The real distinction comes down to the rules and limitations. For bonus depreciation in 2025, there's no ceiling on how much you can spend, and it isn't limited by your business income. You could spend millions on new equipment, claim the 40% bonus, and even generate a net operating loss (NOL). That loss can then be carried forward to reduce your taxable income in more profitable years ahead.

Section 179 plays by a different set of rules. It comes with two major restrictions:

- Annual Deduction Limit: There's a cap on the total amount you can expense each year. For 2024, that limit was $1.22 million. This number is indexed for inflation, so we expect a slight adjustment for 2025.

- Taxable Income Limitation: This is a big one. Your Section 179 deduction can't be more than your business's net taxable income for the year. If your business breaks even or posts a loss, you can't use Section 179 to make that loss bigger.

This simple infographic shows how the bonus depreciation calculation works at a high level.

As you can see, you get an immediate write-off for a portion of the asset's cost, and the rest is depreciated over its useful life.

When to Choose One Over the Other

So which one is right for you? Your decision will hinge on your profitability and the size of your investments.

If your business is turning a healthy profit and your equipment purchases fall under the annual Section 179 cap, its surgical precision is fantastic. You can fully expense a new truck or a piece of machinery and get an immediate 100% deduction.

But if you're making major capital investments that blow past the Section 179 limit, bonus depreciation is your go-to. Since it has no spending cap, it's built for large-scale growth. And if you're having a lean year, bonus depreciation's ability to create a tax loss is a strategic advantage that Section 179 just can't offer.

The Best Strategy? Use Both.

Most savvy business owners don't see it as an either/or choice. A common and highly effective strategy is to first use Section 179 to fully write off specific assets up to the annual limit. Then, you apply bonus depreciation to the remaining qualified assets to maximize your total first-year deduction.

To make these differences crystal clear, let's break them down side-by-side.

Bonus Depreciation 2025 vs Section 179 at a Glance

This table provides a quick look at how the two deductions stack up against each other for the 2025 tax year.

| Feature | Bonus Depreciation | Section 179 |

|---|---|---|

| Deduction Amount | 40% of the asset's cost in 2025. | Up to 100% of the asset's cost. |

| Annual Limit | No spending or deduction limit. | Capped annually (e.g., $1.22 million for 2024). |

| Income Limitation | Can create or increase a business loss (NOL). | Cannot exceed your net taxable business income. |

| Asset Selection | Applies to entire asset classes by default. | You can pick and choose specific assets to deduct. |

| Qualifying Property | Includes new and used tangible personal property and Qualified Improvement Property (QIP). | Includes new and used tangible personal property and QIP. |

Ultimately, the right approach is a custom fit for your financial picture. Your annual income, the total cost of your asset purchases, and your long-term goals all play a critical role. A conversation with your tax advisor at Blue Sage Tax & Accounting Inc. can help you model the outcomes and build the most effective depreciation strategy for your business in 2025.

Advanced Strategies to Maximize Your Deductions

Knowing the bonus depreciation 2025 rate is just the start. The real magic happens when you move beyond the basics and start thinking like a strategic tax planner. Savvy business owners and real estate investors know how to use the tax code to their advantage, turning simple rules into powerful financial tools.

This means shifting from just keeping records to actively planning your financial future. Three of the most effective techniques you can use are mastering the placed-in-service date, leveraging cost segregation studies, and knowing precisely when to opt out of bonus depreciation altogether. Each one solves a different puzzle, and using them correctly can seriously boost your tax savings.

Master the Placed-in-Service Date

When it comes to depreciation, the date on your purchase receipt doesn't mean much. The only date that truly matters is the placed-in-service date—that’s the day an asset is fully installed, ready, and available for use in your business. This isn't just jargon; it’s the official starting pistol for all your depreciation deductions.

Let's say a piece of equipment lands in your warehouse in December, but it isn't set up and running until January. That one-month gap pushes the entire deduction into the next tax year. For year-end planning, this is absolutely critical. If you want that tax break for 2025, the asset must be ready to go by December 31, 2025.

Year-End Planning in Action: Picture this: you order a new server for your business on December 15th. If it gets delivered, installed, and powered on by December 31st, you can claim the 40% bonus depreciation on your 2025 tax return. But if a shipping delay pushes the setup to January 5th, 2026, you have to wait an entire year to claim the deduction on your 2026 return—and by then, the bonus rate will have dropped to just 20%.

The lesson? Coordinating with your vendors and planning installation timelines is a core part of tax strategy. Don't let a simple logistical hiccup cost you thousands in immediate deductions.

Unlock Hidden Value with Cost Segregation

For anyone who owns commercial property, a cost segregation study is one of the most powerful tools in the tax planning playbook. Instead of looking at your building as one big asset that depreciates slowly over 39 years, this strategy helps you see it as a collection of different components, many with much shorter recovery periods.

A proper cost segregation study, done by engineers and tax pros, literally dissects your building for tax purposes. It carves out items that can be depreciated much faster.

- Structural Components (39-year life): Things like the foundation, walls, and roof.

- Land Improvements (15-year life): Your parking lot, exterior fences, and landscaping.

- Personal Property (5- or 7-year life): This is where the gold is. Think carpeting, special lighting, custom cabinetry, and even certain types of wiring.

All those shorter-lived assets—the land improvements and personal property—are often eligible for bonus depreciation. This lets you pull deductions that would have been trickled out over decades into the very first year. On a $2 million building, a study could easily reclassify 20-30% of the cost into these faster categories, unlocking a massive upfront deduction.

Suddenly, a long-term asset becomes a source of immediate cash flow you can use for renovations, new acquisitions, or other investments.

The Strategic Choice to Elect Out

It sounds crazy, but sometimes the smartest tax move is to say "no, thanks" to a deduction. The tax code allows businesses to formally elect out of bonus depreciation for certain types of assets. But why on earth would you pass up a big, immediate write-off? It all comes down to smart, long-term thinking.

A business might elect out if it expects to jump into a much higher tax bracket in the near future. Taking a smaller, standard depreciation deduction now saves the bigger deductions for later years when they can offset income taxed at a higher rate. This is a common strategy for startups or companies that are having a down year and don't have much taxable income to offset anyway.

Imagine your business has low profits in 2025. Grabbing a huge 40% bonus depreciation deduction might just create a net operating loss (NOL) that you can't fully use. By electing out, you can spread those deductions out over the asset's normal life, using them to shield profits when you're making more money. This ensures every dollar of depreciation works for you instead of getting lost in a low-income year. This decision requires a solid financial forecast and is best made after a detailed conversation with an expert tax advisor at a firm like Blue Sage Tax & Accounting Inc. who can model the different outcomes for you.

Navigating State Tax Rules for Depreciation

It's one of the most common—and costly—mistakes I see business owners make: assuming their state tax laws just mirror what the federal government does. You might be planning your whole year around the 40% bonus depreciation for your 2025 federal return, only to find out your state has a completely different set of rules. That disconnect can land you with a surprisingly large and very unwelcome state tax bill.

This is where things get tricky.

Many states practice what’s known as “decoupling,” which is just a formal way of saying they opt out of the federal bonus depreciation rules. In these states, that powerful upfront deduction you claim on your federal Form 4562 gets added right back to your income on your state return. Poof. The benefit is gone, at least at the state level.

This forces you to maintain a completely separate depreciation schedule just for state tax purposes, adding another layer of complexity and compliance work to your plate.

Why States Decouple from Federal Rules

So, why don’t states just get on board? It boils down to one simple thing: protecting their tax revenue. Federal incentives like bonus depreciation are meant to juice the national economy by encouraging businesses to spend and invest. But this has a huge impact on tax receipts. For example, recent proposals to bring back 100% bonus depreciation were projected to cut federal tax revenues by $16 billion in 2025 alone. You can find a deeper dive into the economic impact of bonus depreciation on federal revenues in this analysis.

States, on the other hand, can’t usually afford that kind of immediate hit to their budgets. By decoupling, they keep their revenue stream more stable and predictable, even if it means their tax code is less friendly to businesses than the federal one.

Key Takeaway: Never assume your federal and state depreciation rules line up. If you operate in a decoupled state, you'll end up with two different net income figures—one for the IRS and another for your state—and you have to track them both carefully.

The Spectrum of State Conformity

To make matters more complicated, not all states handle this the same way. Their approach to federal tax law usually falls into one of three buckets, creating a messy patchwork of rules for any business operating across state lines.

- Full Conformity States: These are the easy ones. They automatically adopt the federal tax code, bonus depreciation and all. Businesses here get the same accelerated deductions on both their federal and state returns, which makes tax planning much simpler.

- Partial Conformity States: These states like to pick and choose. They might allow a certain percentage of the bonus depreciation deduction or have their own unique depreciation rules that offer some kind of accelerated write-off, but not the full federal benefit.

- Complete Decoupling States: These states say "no thanks" to bonus depreciation entirely. You have to add back the full federal bonus amount to your state income and calculate depreciation using standard methods like MACRS, without any extra kick.

For any business with a multi-state footprint, this complexity multiplies fast. Juggling different depreciation schedules for every single state you operate in isn't just a headache; it's a major compliance risk. One wrong move can lead to audits, penalties, and interest. This is exactly where getting professional guidance becomes non-negotiable to make sure you’re staying compliant everywhere you do business.

Your Top Questions About Bonus Depreciation in 2025, Answered

Once you get the hang of the basic rules, the real questions start to surface—the ones that pop up when you're trying to apply these tax strategies to actual business decisions. The world of bonus depreciation for 2025 is no exception. We’ve pulled together some of the most common questions we hear from business owners and investors, with clear, direct answers to help you make these calls with confidence.

Think of this as your field guide for those tricky scenarios that can make you second-guess your strategy. From buying used gear to weighing a lease against a purchase, these insights will sharpen your understanding and get you ready for a more productive chat with your tax advisor.

Can I Use Bonus Depreciation on Used Property?

Yes, you absolutely can. This is easily one of the most powerful—and most misunderstood—parts of the current depreciation rules. Thanks to the Tax Cuts and Jobs Act (TCJA), bonus depreciation isn't just for shiny, new-in-the-box assets anymore. You can claim it on used property, too.

But there’s one big catch: the property has to be "new to you." This just means you or your business can't have owned it before. For instance, you can't sell a machine to another company, buy it back, and claim the deduction a second time. As long as it's the first time you've acquired and used the asset, you're generally in the clear.

This rule is a true game-changer. It opens up huge tax-saving opportunities for businesses that thrive on the secondary market for machinery, vehicles, and equipment—opportunities once reserved only for brand-new purchases.

What Happens When I Sell an Asset After Taking Bonus Depreciation?

This is a critical question, and the answer hits right at the heart of long-term tax planning. When you sell an asset you've already depreciated, you’ll likely run into something called depreciation recapture. Simply put, the IRS wants to "recapture" the tax benefit you enjoyed.

Here's how to think about it: bonus depreciation gave you a big deduction right away, which drastically lowered the asset's "basis" (its value for tax purposes). When you sell that asset for more than its low basis, the profit you make is usually taxed as ordinary income, not at the more favorable capital gains rate.

A Quick Recapture Example:

Let's say you bought equipment for $50,000. You used bonus and regular depreciation to write off $30,000 over a few years. Your asset's adjusted basis is now only $20,000 ($50,000 – $30,000). If you turn around and sell it for $45,000, you have a gain of $25,000. That $25,000 gain is subject to recapture and will be taxed at your higher ordinary income rate.

This rule is in place to prevent a double-dip—getting a huge deduction upfront and getting a low tax rate on the sale. It's essential to factor in potential recapture taxes when you're thinking about selling a depreciated asset.

Should I Lease or Buy Equipment to Maximize Tax Benefits?

Ah, the classic "lease versus buy" debate. It gets a lot more interesting when bonus depreciation is on the table. The right answer really comes down to your company's cash flow, profitability, and what you’re trying to accomplish long-term.

-

Buying: When you buy equipment, you own it. That means you can claim the 40% bonus depreciation in 2025 and potentially Section 179 expensing. This creates a hefty, immediate tax deduction that can slash your taxable income. The trade-off? It requires a bigger cash investment upfront or taking on a loan.

-

Leasing: With a lease, you don't own the asset, so you can't depreciate it. Instead, you deduct your monthly lease payments as a regular business expense. This is great for preserving cash and can be much simpler from an accounting standpoint, but you miss out on that big, front-loaded tax break.

For what it's worth, some "capital leases" are structured more like a purchase and might let you claim depreciation, but they're more complex. For most standard operating leases, the deduction is just spread evenly over the lease term.

So, what’s the right call?

If your business is profitable and you have the cash, buying the asset to lock in bonus depreciation often delivers a bigger, faster tax benefit. But if preserving cash is your number one priority or you need the latest and greatest equipment every few years, leasing is probably the smarter financial move.

Can I Apply Bonus Depreciation to Real Estate?

This is where a lot of people get tripped up. Generally, you can't take bonus depreciation on an entire building. Residential and commercial buildings themselves have very long depreciable lives (27.5 and 39 years), which puts them outside the scope of bonus eligibility.

However—and this is a big however—you absolutely can use bonus depreciation on certain components inside that building. This is precisely why strategies like cost segregation are so powerful. A cost segregation study breaks a property down into its various parts, identifying components that can be depreciated much faster (over 5, 7, or 15 years), making them eligible for bonus depreciation.

Think of things like:

- Qualified Improvement Property (QIP): Interior, non-structural upgrades to a commercial building.

- Personal Property: Things like carpeting, special lighting, and dedicated electrical systems.

- Land Improvements: Assets like parking lots, fences, and professional landscaping.

By reclassifying these pieces, real estate investors can pull massive deductions forward into year one, which can dramatically boost a property’s after-tax return on investment.

Navigating the details of bonus depreciation 2025 requires thoughtful planning and a real understanding of how these rules fit your specific situation. At Blue Sage Tax & Accounting Inc., we specialize in helping businesses and investors build proactive strategies to keep their tax burden low and cash flow high. Let's build a plan that works for you. Visit us online to schedule a consultation.