For high-net-worth individuals, families, and business owners, tax planning is much more than just finding a few extra deductions before the April deadline. It's a comprehensive strategy for protecting your wealth—not just for one year, but for generations to come. This means looking beyond the immediate and weaving together a plan that addresses income, investments, and your eventual estate.

The goal isn't just to chip away at your tax bill. It's to build a resilient financial structure that minimizes tax erosion from every angle, using sophisticated tools like trusts, specialized investment vehicles, and well-planned charitable giving.

Building Your Financial Fortress with Proactive Tax Planning

When you have significant assets, standard tax-saving tactics just don't cut it. You have to shift your mindset from seeing taxes as an annual compliance chore to viewing tax planning as a long-term strategic mission.

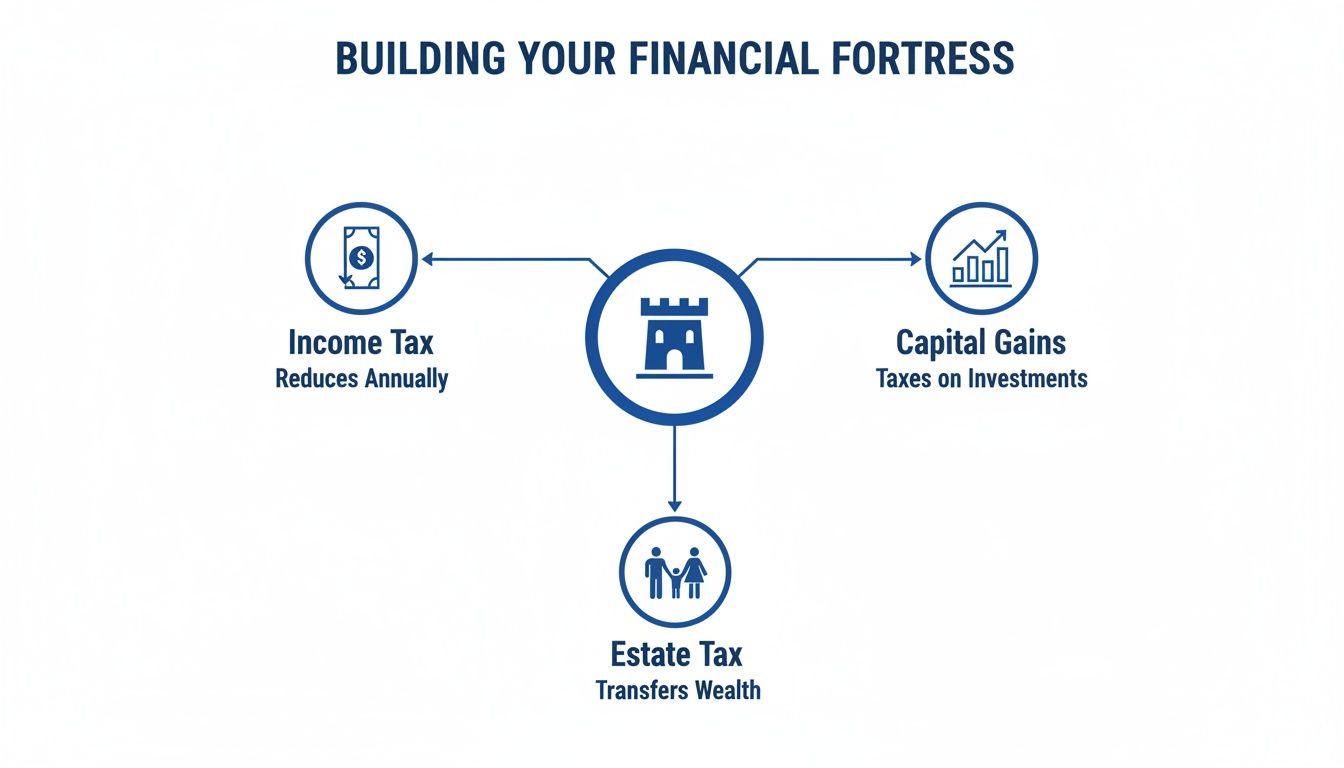

Think of it like building a financial fortress. Instead of just patching holes in the walls every year, you're designing a structure from the ground up that can withstand financial storms and protect your family's legacy for decades. This proactive approach relies on three core pillars working in unison.

The Three Pillars of High Net Worth Tax Defense

A truly robust plan doesn't treat these areas in isolation. It integrates them into a single, powerful strategy.

- Minimizing Annual Income Tax: This is your first line of defense. It’s about using every tool at your disposal to lower what you owe each year, whether that's maxing out tax-deferred retirement accounts or structuring business income in the most efficient way possible.

- Deferring Capital Gains: The real engine of wealth growth is compounding. This pillar is all about letting that engine run by delaying—and in some cases, completely eliminating—taxes on your investment growth. This keeps more of your money working for you, for longer.

- Strategically Reducing Estate Taxes: This is about legacy. The focus here is on ensuring your wealth transfers smoothly to the next generation with the least possible tax impact. This requires forward-thinking estate planning that moves assets out of your taxable estate long before they're passed on.

These three pillars aren't separate tasks; they're the interconnected foundations of your entire financial defense system.

As you can see, planning for income, capital gains, and estate taxes are not siloed activities. They are interlocking shields protecting the core of your wealth. By tackling all three, you create a comprehensive plan that truly secures your legacy. Leave one of these pillars unattended, and your entire financial structure could be vulnerable.

Optimizing Your Annual Income and Capital Gains

While grand, long-term estate plans are essential, some of the best opportunities for tax savings are right in front of you, every single year. These are the annual strategies for managing your income and investment gains. Think of them as your first line of defense—the tactics you can use year in and year out to protect a substantial part of your earnings from the taxman.

The game plan is simple, really: lower your Adjusted Gross Income (AGI). By consistently and strategically reducing your AGI, you don't just pay less tax today. You can also open the door to other tax benefits that start to disappear at higher income levels. What follows is a playbook for turning your everyday financial moves into powerful tax-saving tools.

Maximize Your Contributions to Tax-Deferred Accounts

The most straightforward way to chip away at your taxable income is to fully fund your tax-deferred retirement accounts, like a 401(k) or 403(b). Every pre-tax dollar you put in is one less dollar the IRS can tax this year. For high earners, that immediate savings is significant.

The global population of high-net-worth individuals grew by 2.6% in 2024, and with that growth comes an even greater need for smart tax planning. For 2025, U.S. 401(k) contribution limits are climbing, giving you a chance to defer taxes on a hefty sum—in some cases, over $70,000 if you include special catch-up contributions for those aged 60-63. If you’re in the 37% federal tax bracket, that move alone could cut your tax bill by more than $25,000. You can discover more insights about effective high net worth tax strategies to stay ahead.

Unlock the Triple Benefits of a Health Savings Account

A Health Savings Account (HSA) is one of the most potent tax-advantaged tools out there, offering a rare triple tax benefit. The only catch is you need to be enrolled in a high-deductible health plan (HDHP) to be eligible.

An HSA is like a supercharged IRA for healthcare. It lets you save, invest, and withdraw funds for medical expenses completely tax-free, making it a cornerstone of high net worth tax strategies for both health and retirement planning.

The advantages are stacked:

- Tax-Deductible Contributions: The money you contribute is fully deductible, which directly lowers your AGI.

- Tax-Free Growth: You can invest your HSA funds, and they grow completely tax-free.

- Tax-Free Withdrawals: You can pull money out for any qualified medical expense without paying a dime in taxes.

For 2025, an individual can contribute thousands to an HSA, with an extra catch-up amount for those 55 or older. It’s another great way to shrink your taxable income while building a dedicated, tax-free war chest for future medical needs.

Harvest Investment Losses to Offset Gains

Your investment portfolio isn’t just for generating returns; it’s also a powerful tool for generating tax savings through tax-loss harvesting. The strategy is simple: you intentionally sell investments that have lost value to "realize" the loss on paper.

You can then use these capital losses to cancel out capital gains from your winning investments. If you have more losses than gains, you can even use up to $3,000 of the excess to offset your regular income each year. Any leftover losses can be carried forward to future years.

This isn't about making bad investments. It's about being opportunistic. By systematically harvesting losses when they appear, you can rebalance your portfolio while dramatically cutting the tax bill on your investment profits. It’s how you turn a market dip into a tax asset.

Mastering Generational Wealth Transfer with Trusts

While chipping away at your annual tax bill is important, the real legacy play for high-net-worth families is mastering generational wealth transfer. This is about making sure the assets you've spent a lifetime building are passed on efficiently and on your own terms. For this, trusts are the go-to tool—they’re purpose-built vehicles for moving wealth outside of your taxable estate.

Think of your estate as a bucket. Everything left in that bucket when you pass away is subject to federal estate tax, which can run as high as 40%. The entire goal of these high net worth tax strategies is to thoughtfully move assets out of that bucket and into others—like trusts—well before they pass to your heirs. Doing this ensures your legacy goes to your family, not to Uncle Sam.

Leveraging Your Lifetime Gift and Estate Tax Exemption

Your most powerful tool for this is the federal gift and estate tax exemption. This is simply the amount of money you can give away—either during your life or at death—without triggering federal gift or estate taxes.

Fortunately, recent legislation has brought a lot of certainty here. The One, Big, Beautiful Bill (OBBBA) of 2025 permanently supercharged the federal exemption to $15 million per person, which means a married couple can now shield a combined $30 million. The law also locked in the generation-skipping transfer (GST) tax exemption at the same level, opening up incredible opportunities for multi-generational planning. You can dig into a detailed breakdown of these new planning opportunities to see the full impact.

This huge exemption isn't just for giving cash. The smartest move is to gift assets with high growth potential, like shares in the family business or a promising piece of real estate. When you gift them now, you're not just moving their current value out of your estate—you're also moving all of their future growth out of your estate, forever.

Advanced Trust Strategies for Tax-Efficient Gifting

Beyond just writing a check, certain trusts are specifically designed to amplify the value you transfer while shrinking your tax bill. Two of the most common and effective are GRATs and SLATs.

-

Grantor Retained Annuity Trust (GRAT): A GRAT is a bit like a financial boomerang. You put an asset into the trust and get a fixed annual payment back for a set number of years. If the asset inside the trust grows faster than the IRS's official interest rate, all that extra growth passes to your beneficiaries completely gift-tax-free when the term ends. It’s a "heads you win, tails you tie" strategy that works especially well with high-growth assets when interest rates are low.

-

Spousal Lifetime Access Trust (SLAT): A SLAT lets one spouse make a substantial gift into a trust for the other spouse's benefit, effectively removing those assets from their combined estate. The magic here is that the beneficiary spouse can still access the funds if needed, creating a financial safety net. It allows you to use your lifetime exemption without completely cutting off access to the wealth you've gifted away.

A well-structured trust is more than a legal document; it's a strategic vessel that sails your family's wealth across generations, navigating the turbulent waters of estate taxes to arrive safely at its destination.

The Power of Valuation Discounts

One of the most potent, and often overlooked, high net worth tax strategies involves valuation discounts. This is a game-changer for owners of family businesses and those with fractional interests in real estate.

Here’s the idea: when you gift a non-controlling piece of a private company or a partial share of a property, its value can be legally discounted for tax purposes. Why? Because a minority stake is harder to sell and comes with no real control. These discounts for lack of control and lack of marketability can often knock the taxable value of the gift down by 20% to 40%.

Let's say you gift a portion of your business that's appraised at $10 million. A 30% valuation discount means the IRS treats it as a $7 million gift. Just like that, you’ve transferred an extra $3 million of real value to your heirs tax-free, making your lifetime exemption work much harder. For families looking to keep closely-held businesses and real estate intact for the next generation, this is an absolutely critical tool.

Using Advanced Investment Structures for Tax Efficiency

While trusts are the go-to for moving wealth between generations, other specialized structures are built to do one thing exceptionally well: supercharge your investment growth by shielding it from taxes. We're not talking about your standard brokerage accounts here. These are sophisticated vehicles designed from the ground up to maximize your after-tax returns over the long haul.

Think of it like this: a typical investment portfolio is like a plant growing out in the open. It’s exposed to the elements—sun, rain, and the unpredictable "tax weather" of capital gains and income taxes that can really stunt its growth. These advanced structures are like a financial greenhouse, creating a protected, controlled environment where your assets can flourish, safe from the tax storms raging outside.

The Financial Greenhouse of PPLI

One of the most powerful tools in the high-net-worth playbook is Private Placement Life Insurance (PPLI). Don't let the name fool you; while it is life insurance, its real job for wealthy investors is to act as a tax-proof wrapper for their investments.

Inside a PPLI policy, you can hold a whole range of investments—including hedge funds and private equity—that you simply can't access in standard insurance products. Here's the magic: all those investments grow completely free from annual income or capital gains taxes. That kind of tax-deferred compounding can lead to drastically different outcomes over time.

Because it's tailored for accredited investors, a PPLI's institutional pricing can also shave 1-2% off annual fees compared to retail products, a difference that compounds into a massive savings. When you understand the full scope of PPLI in advanced tax planning, you start to see its true potential.

The benefits really stack up:

- Tax-Deferred Growth: Your money compounds year after year without getting hit with a tax bill that slows it down.

- Tax-Free Access: You can tap into the cash value through policy loans, which generally don't count as taxable income.

- Tax-Free Death Benefit: When you pass away, the proceeds go to your heirs income-tax-free and, if you set it up correctly, free of estate taxes, too.

This triple-threat of tax advantages makes PPLI an incredible tool for building and preserving wealth across generations.

Deferring and Eliminating Gains with QOFs

Another potent strategy for handling big capital gains is the Qualified Opportunity Fund (QOF). These were created to encourage investment in economically-distressed areas called Opportunity Zones, and they come with a unique package of tax incentives.

Let's say you have a large capital gain from selling stock, a business, or a piece of real estate. You can roll that gain into a QOF within 180 days. Making this move unlocks a powerful, three-part tax benefit.

First, you get to defer paying taxes on that original gain all the way until the end of 2026. This is huge because it keeps your capital working for you instead of being shipped off to the IRS. But the real prize comes later: if you hold the QOF investment for at least ten years, any new capital gains generated from the fund itself are 100% tax-free.

A Qualified Opportunity Fund is a strategic play for investors with significant capital gains. It’s a way to redirect a tax liability into a new, growth-oriented investment that comes with its own substantial tax breaks.

This one-two punch of deferral and total elimination makes QOFs a compelling option for anyone looking to redeploy capital in a highly tax-efficient way.

Comparing Investment Structures

The difference in after-tax returns between a regular taxable account and a tax-advantaged structure like PPLI can be absolutely staggering over a long enough timeline. That "tax drag" you face every year in a standard portfolio seriously erodes the power of compounding.

To see just how different these worlds are, let's put a taxable brokerage account side-by-side with a PPLI policy.

Comparing Tax Efficiency Of Investment Vehicles

| Feature | Taxable Brokerage Account | Private Placement Life Insurance (PPLI) |

|---|---|---|

| Investment Growth | Taxed annually on interest, dividends, and realized capital gains. | Grows tax-deferred; no annual tax bill on internal gains. |

| Withdrawals/Access | Gains are taxed upon withdrawal. | Can access cash value via tax-free policy loans. |

| Death Benefit | Assets receive a step-up in basis, but the estate may be taxed. | Passes to heirs income-tax-free and potentially estate-tax-free. |

As you can see, the tax treatment at every stage—growth, access, and transfer—is fundamentally different. By placing assets inside a structure engineered for tax efficiency, you create a much better environment for your wealth to grow and last. Yes, navigating the compliance rules is critical, but the long-term payoff can be immense, ensuring more of your hard-earned money stays right where it belongs: with your family.

Weaving Philanthropy into Your Tax Strategy

For many successful people, giving back isn't an afterthought—it's a core part of their legacy. Strategic philanthropy is where these two worlds meet, turning your charitable goals into a sophisticated part of your tax plan. It’s not just about writing a check; it's about giving smart to maximize both your impact and your tax benefits.

The real power move here is shifting from simple cash donations to gifting assets that have grown in value. This single change can unlock a whole new level of tax efficiency, letting you support the causes you care about while significantly improving your own financial picture.

The Two-for-One Punch of Donating Appreciated Assets

The most powerful charitable giving strategies almost always involve assets like stocks, mutual funds, or real estate that are worth much more today than when you first acquired them. Donating these assets directly to a qualified charity delivers a one-two punch of tax savings that cash just can't compete with.

Here’s the simple breakdown:

- Get a Full Deduction: You can take a charitable tax deduction for the full fair market value of the asset today, which directly cuts your taxable income for the year.

- Dodge the Capital Gains Tax: You completely sidestep the capital gains tax you would have paid if you’d sold the asset first and then donated the cash.

This is a true cornerstone of effective tax planning for high-net-worth families. You’re essentially getting a tax break on gains you never paid tax on, and the charity gets the full, pre-tax value of your gift, allowing them to put more of your money to work.

Smart Ways to Structure Your Giving for Maximum Impact

While donating assets directly is great, more structured approaches can give you far more control and long-term planning power. These tools let you separate the timing of your tax deduction from when the charities actually receive the funds.

Donor-Advised Funds (DAFs)

Think of a DAF as your personal charitable investment account. You make a contribution of cash or appreciated securities, get your tax deduction immediately, and then the funds can be invested to grow tax-free. From there, you can recommend grants to your favorite charities whenever you wish.

A Donor-Advised Fund is perfect for "bunching" multiple years of giving into one high-income year. This lets you supercharge your deduction when you need it most, without altering your actual giving schedule.

Charitable Remainder Trusts (CRTs)

A CRT is a more advanced tool that lets you turn a highly appreciated asset into an income stream for yourself or your family for a number of years. Once that period ends, whatever is left in the trust—the "remainder"—goes to the charity you designated. It's a brilliant strategy for generating retirement income, fulfilling your philanthropic vision, and locking in a substantial tax deduction upfront.

Case Study: Donating Stock vs. Cash

Let's look at a real-world example to see how this plays out. Imagine you're in the 37% federal income tax bracket and want to give $100,000 to a cause you love. You happen to own stock currently worth $100,000 that you originally bought for just $20,000.

| Action | Scenario 1: Sell Stock, Donate Cash | Scenario 2: Donate Stock Directly |

|---|---|---|

| Capital Gains Tax Due | $16,000 (20% on $80k gain) | $0 |

| Cash Available to Donate | $84,000 | N/A |

| Charitable Deduction | $100,000 | $100,000 |

| Income Tax Savings | $37,000 (37% of $100k) | $37,000 (37% of $100k) |

| Total Tax Savings | $37,000 | $53,000 ($37k + $16k) |

By donating the stock directly, you save an extra $16,000—the exact amount of capital gains tax you avoided. This makes it crystal clear: strategic giving isn't just about being generous; it's about making your generosity work as hard as it possibly can.

Assembling Your Team and Creating a Cohesive Plan

The best high net worth tax strategies aren't just a collection of clever tactics; they’re interconnected pieces of a single master plan. It helps to think of yourself as the conductor of an orchestra. Your trusts, investments, business interests, and philanthropic goals are all different instruments. For the music to sound right, they all have to be playing in harmony.

When your advisors aren't talking to each other, you get a disjointed mess. That kind of approach leads to expensive mistakes and missed opportunities. The goal is to build a single financial blueprint where every decision reinforces the others, creating a structure that’s much stronger than its individual parts.

Building Your Personal Advisory Board

Pulling off this level of coordination isn’t a one-person job. It requires a hand-picked team of specialists who bring different skills to the table. This core team essentially becomes your personal advisory board, all working together to protect and grow your wealth.

At a minimum, your team needs these key players:

- A Certified Public Accountant (CPA): This is your tax guru. They handle the compliance, spot opportunities for savings each year, and make sure every move you make is aligned with the latest tax code.

- An Estate Planning Attorney: Think of them as the architect of your legacy. They’re the ones drafting the trusts, wills, and other legal documents that ensure your wealth passes to the next generation exactly as you intend, with the smallest possible tax bite.

- A Wealth Manager or Financial Advisor: This is your investment strategist. Their job is to structure your portfolio for tax-efficient growth and make sure it lines up perfectly with your long-term goals.

A siloed strategy is a vulnerable strategy. True financial security comes from an integrated plan where your CPA, attorney, and wealth manager are all working from the same playbook—yours.

This collaborative model turns financial planning from something you do once a year into a proactive, ongoing system. It ensures your investment decisions don't accidentally trigger a huge tax bill and that your estate plan is funded in the most efficient way possible.

With the right team in place, you can stop reacting and start planning with confidence. You’re building a resilient financial future that not only protects your wealth but secures your legacy for generations to come.

Frequently Asked Questions

Diving into sophisticated tax planning always sparks a few questions. Below, I’ve answered some of the most common ones I hear from clients to give you a clearer picture.

When Is The Best Time to Implement These Tax Strategies?

Honestly, the best strategies aren't a last-minute scramble before a tax deadline. They're part of a proactive, year-round game plan.

Think of it this way: complex tools like trusts or Private Placement Life Insurance (PPLI) are not off-the-shelf products. They can take months to set up correctly, so it's absolutely vital to sit down with your advisory team early in the year to map everything out.

That said, some moves are still very effective later in the year. You can absolutely use tax-loss harvesting or make a contribution to a Donor-Advised Fund in the fourth quarter. These tactics are great for offsetting income and gains that have built up over the previous months.

The most successful high-net-worth tax planning is done by looking ahead, not reacting to what's already happened. Starting the conversation in January or February gives you the time needed to put sophisticated plans in place well before the year ends.

The bottom line? While some opportunities are time-sensitive, the best time to start planning is always right now.

What Is The Biggest Mistake HNWIs Make in Tax Planning?

The single most common—and most expensive—mistake I see is procrastination. Too many people wait until a major financial event, like selling their business, is already underway. By that point, it’s often too late to use the most powerful tax-saving tools that could have saved them millions.

Another huge misstep is treating tax planning like an isolated task. For your plan to actually work, it has to be woven into your investment, financial, and estate planning goals. Without that synergy, you can have different parts of your financial life working against each other. A unified team of advisors is the only way to prevent this.

How Much Can I Realistically Save with These Strategies?

The potential savings are genuinely massive, but it all depends on your specific situation—your net worth, where your income comes from, and even the state you live in.

For example, simply using trusts to move assets outside of your taxable estate can shield your heirs from the 40% federal estate tax. That's a huge piece of your legacy preserved right there.

Likewise, letting investments grow for decades inside a tax-free vehicle like a PPLI can lead to a radically larger inheritance for your family. A well-designed plan that layers several of these strategies together can easily add multiple percentage points to your net returns over time. This isn't about saving a little here and there; it's about fundamentally changing your family's financial future.

At Blue Sage Tax & Accounting Inc., we specialize in creating cohesive, year-round plans that integrate seamlessly with your financial goals. Schedule a consultation to build your proactive tax strategy today.